Walgreens Boots Alliance Inc. ($WBA) delivered a standout performance last week, with its stock surging over 20%, fueled by a combination of strong earnings results, and speculation of a private equity buyout. The company reported fiscal Q1 2025 results that exceeded expectations, with adjusted earnings per share of $0.51 beating the consensus estimate of $0.38 and revenue climbing 7.5% year-over-year to $39.5 billion. This performance was underpinned by increased prescription volumes, bolstered by seasonal demand for respiratory treatments, and strong retail sales driven by a successful Black Friday campaign. The results reflected early signs of progress under CEO Tim Wentworth’s turnaround strategy, which focuses on optimizing the store footprint, improving cost efficiencies, and stabilizing cash flows.

Adding to the optimism, reports surfaced of Walgreens entering discussions with Sycamore Partners, a private equity firm, about a potential acquisition. While details remain speculative, the possibility of a buyout amplified market enthusiasm.

The buyout speculation surrounding Walgreens Boots Alliance Inc. (WBA) gained significant traction last week, driven by reports of potential discussions with Sycamore Partners, a private equity firm known for its focus on retail and consumer-facing businesses. While the details of the rumored talks remain sparse, the possibility of such a deal is notable for several reasons:

Why the Buyout Matters

Strategic Rationale for Privatization:

Walgreens has faced significant scrutiny from public markets over the past few years due to declining margins, competition from online retailers like Amazon Pharmacy, and operational missteps. A privatization could provide the company with a much-needed reset, allowing management to implement long-term strategies without the pressure of quarterly earnings reports or shareholder activism.

Sycamore Partners could use its expertise in operational restructuring to streamline costs, optimize the retail footprint, and position Walgreens for a more profitable future.

Valuation Considerations:

Walgreens has been trading at a significant discount compared to its peers, in part due to lingering operational challenges and market skepticism about its turnaround plan. A buyout would likely come at a premium to its current stock price, providing shareholders with an attractive exit opportunity.

Sycamore Partners’ Profile:

Sycamore has a history of acquiring and restructuring retail-focused businesses, including Staples and Belk. Its interest in Walgreens would align with its strategy of taking undervalued, operationally challenged companies private, enhancing profitability, and potentially returning them to the public markets at a higher valuation.

Walgreens' mix of retail and healthcare assets could be particularly appealing, offering Sycamore both a stable cash flow base (pharmacies) and growth potential in the healthcare services sector.

Walgreens Boots Alliance Overview

WBA is a leading global pharmacy retailer and wholesaler, operating over 12,000 stores across 25 countries. The company is organized into three primary segments:

U.S. Retail Pharmacy: Manages retail drugstores and health services across the United States.

International: Oversees pharmacy-led health and beauty retail businesses outside the U.S.

U.S. Healthcare: Focuses on healthcare services, including primary care and specialty pharmacy operations.

Key Bets:

Expansion of Healthcare Services: WBA is investing in its U.S. Healthcare segment, aiming to integrate primary care services and enhance patient engagement.

Digital Transformation: The company is enhancing its online presence and digital offerings to meet the growing demand for e-commerce and telehealth services.

Global Market Penetration: Through strategic partnerships and acquisitions, WBA seeks to expand its footprint in emerging markets, increasing its total addressable market (TAM).

Key Risks:

Competitive Pressure: Intense competition from other retail pharmacies and online retailers could impact market share and profitability.

Regulatory Challenges: Changes in healthcare regulations and reimbursement models may affect revenue streams and operational costs.

Debt Levels: High debt from aggressive acquisitions could strain financial flexibility, especially if operating income does not improve.

Financial Metrics:

Leadership Overview:

CEO: Tim Wentworth, appointed in October 2023, brings extensive experience in healthcare services, previously serving as CEO of Express Scripts.

CFO: James Kehoe, serving since June 2018, has a strong background in financial management within the consumer goods sector.

Chief Legal Officer (CLO): Danielle Gray, appointed in August 2021, has a robust legal background with experience in both the public and private sectors.

Chief Technology Officer (CTO): Mike Maresca, joined in May 2022, previously held senior technology roles at major retail corporations, focusing on digital transformation.

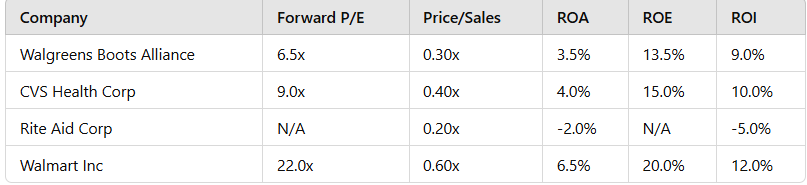

Peer Comparison:

WBA is trading at a discount compared to peers like CVS and Walmart, reflecting market concerns over its growth prospects and profitability.

In summary, WBA is focusing on expanding its healthcare services and digital capabilities to drive growth. It faces significant challenges, including competitive pressures, regulatory uncertainties, and financial constraints due to its debt levels.