Deep Dive: Applied Materials (AMAT)

In early 2026 (literally first two trading days of the year), I have lightened up NVDA 0.00%↑ and AMD 0.00%↑ positions that I held in the fund since inception to get exposure to semicap stocks. Yesterday I shared a deep dive on KLAC 0.00%↑ - today it is AMAT 0.00%↑. I have one more that I will do a deep dive on. Below is a link to the KLAC 0.00%↑ deep dive.

The AI infrastructure boom has thrust semiconductor equipment into the spotlight. Applied Materials (“AMAT”) sits at the nexus of this trend: hyperscalers and chipmakers are pouring capital into advanced logic nodes and high-bandwidth memory (HBM) to train and deploy AI models[1][2].

These cutting-edge chips demand more complex manufacturing steps, new materials (e.g. gate-all-around transistors, backside power planes), and advanced packaging techniques (chiplets, 3D stacking) to boost performance. Each added layer of complexity effectively acts as a “tax” on fabrication – requiring more deposition, etch, and metrology equipment per wafer[3]. At the same time, geopolitics are reshaping the industry’s landscape: U.S. export controls are curbing China’s access to leading-edge tools, even as China remains one of the largest consumers of chip equipment[4][5]. In short, AMAT matters now because it is squarely in the path of both the AI-driven capex surge and the policy-driven supply-chain reordering – for better or worse.

Can the world’s top semiconductor “arms dealer” keep cashing in on the AI gold rush, or is it quietly hitting a cyclical ceiling? The next 18–24 months will test whether Applied Materials is a structural complexity-compounder – profiting from ever-rising chipmaking difficulty – or just a high-quality cyclical stock peaking at an above-normal valuation.

What They Do

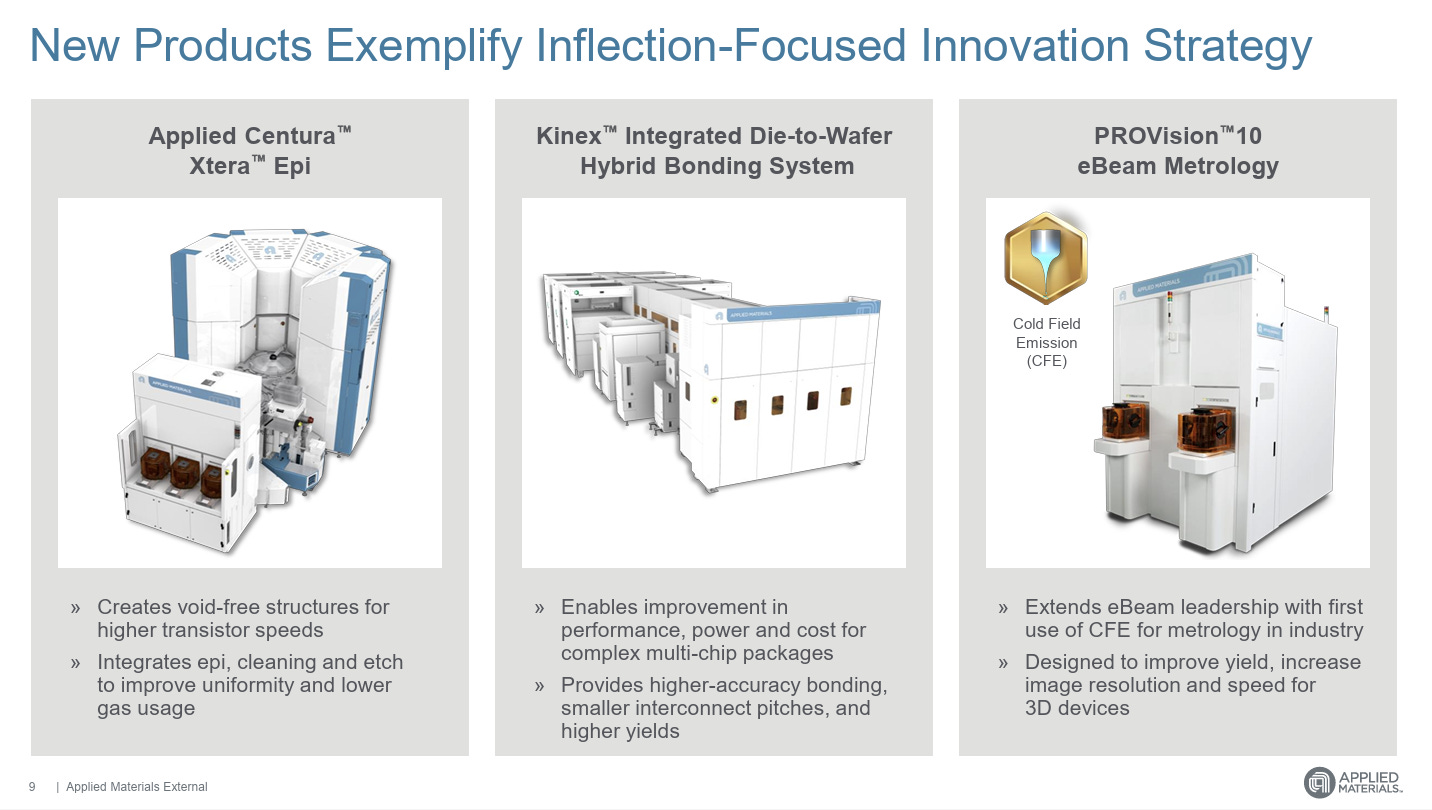

Applied Materials is the leading provider of materials engineering equipment used to produce semiconductors[6]. In simple terms, AMAT sells the machines that make computer chips. Its tools help deposit ultra-thin films of specialized materials onto silicon wafers (like coating layers in a wafer “cake”), etch microscopic patterns into those layers (like carving out circuits), and then measure/inspect the results to ensure each chip meets specs. These products span thin-film deposition systems (chemical vapor deposition, physical vapor deposition, epitaxy, ALD), plasma etch systems, ion implanters, and associated metrology/inspection tools. AMAT also has a large services division that maintains and optimizes the thousands of its machines running in customer fabs worldwide (providing spare parts, upgrades, and process support). In short, if making a modern chip requires 1,000+ process steps[7], Applied Materials likely provides the equipment (or service) for a significant share of those steps.

The Thesis

Is AMAT an unavoidable “complexity tax” on advanced chip production, or a cyclical capital equipment vendor nearing its peak?

The bullish thesis is that AMAT is becoming a structural compounder: every new generation of chips is harder to manufacture, with more process steps and new materials – and AMAT’s broad tool portfolio lets it monetize that complexity at multiple points[3]. Under this view, secular drivers (AI accelerators, explosive data demand, rising device layer counts, advanced memory like HBM, and the shift to 3D packaging) create a long runway of growth across cycles. Meanwhile, services and parts form a growing annuity as the installed base expands, dampening cyclicality.

The bearish thesis sees AMAT as still fundamentally cyclical: a supplier to a boom-bust industry now enjoying a boom (foundry/logic at 3nm, an impending memory capex recovery) and a hype-driven multiple. In this view, export restrictions and geopolitical risk cap its accessible market (e.g. China was ~30% of sales in FY2025[8] but faces new U.S. curbs), and any downturn in chip demand or digestion of capacity could mean reversion to a lower earnings multiple.

Our stance is that AMAT is evolving into more of a secular growth story (“complexity tax” collector), but it cannot fully escape the cyclicality of its end markets – an identity somewhere between a stable compounder and a high-beta industrial, with the next few years (2026–2028) likely determining which narrative prevails.

Underwriting a position in AMAT today means believing the bullish structural story outweighs the cyclical risks – while rigorously defining what would prove that wrong. At ~$296/share, the stock already discounts an optimistic scenario (25× forward earnings), so we need high conviction that AMAT’s earnings power will compound through 2026–2028 with only shallow dips. The thesis to underwrite is that AI-driven demand for leading-edge logic and memory will keep wafer fab equipment (WFE) spending elevated (or growing), even as legacy headwinds (memory oversupply, China limitations) are mitigated by new inflections (gate-all-around transistors, chiplet packaging, rising service intensity).

In practice, this means we expect AMAT to deliver above-peer growth and resilient margins over the next 2–3 years, forcing investors to treat it less like a cyclical and more like a pseudo-“tech” compounder – which could merit multiple expansion. Conversely, we acknowledge that if industry fundamentals or AMAT-specific execution falter, the stock’s rich valuation leaves no margin for error.

Financials

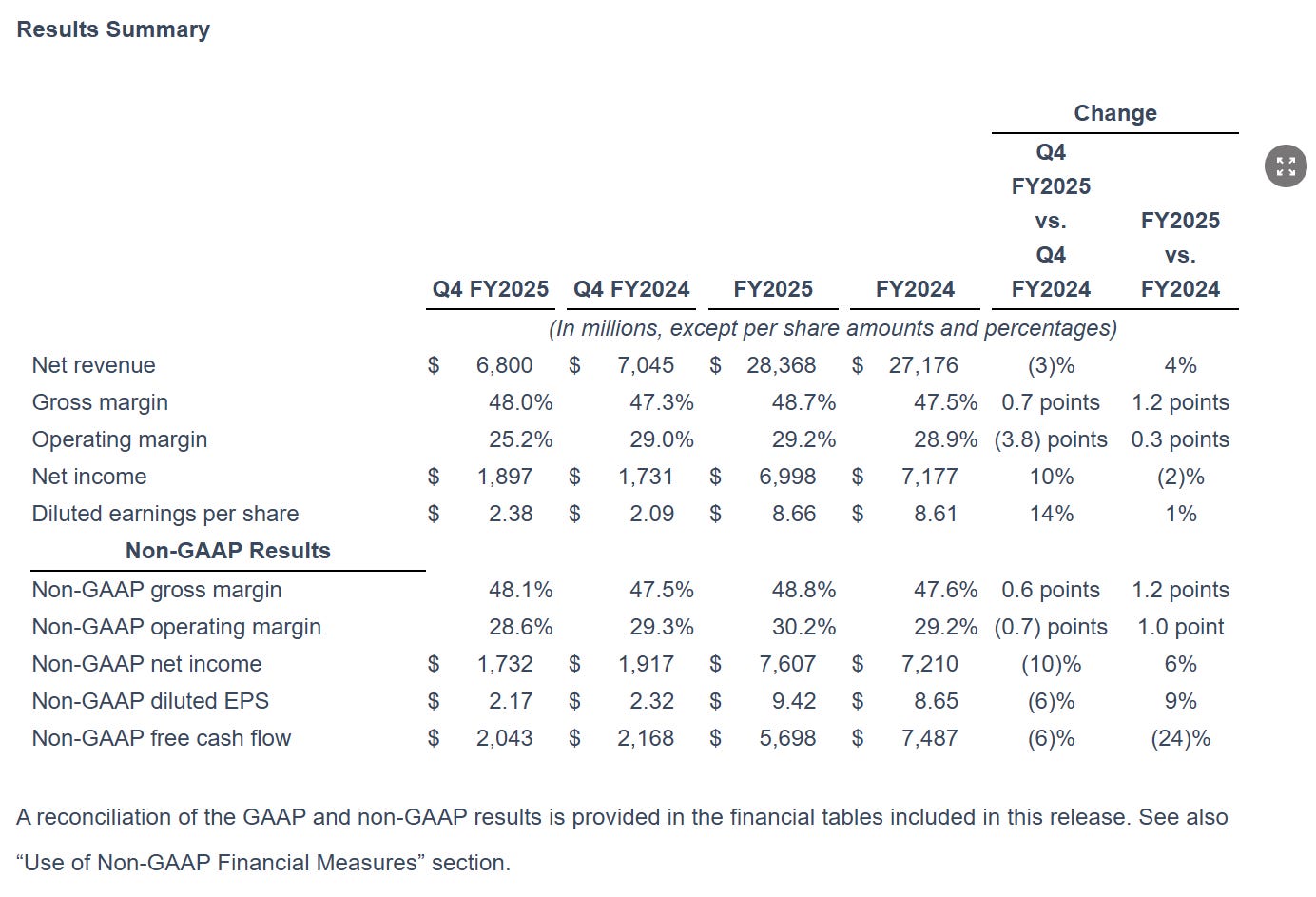

Revenue (LTM): $28.37 billion for FY2025 (trailing 12M, record high, +4% YoY as of Oct 2025)[9]. FY2024 was $27.18 B, so even amid a memory downturn, AMAT grew top-line.

Profitability: GAAP gross margin ~48.8% (FY2025, improved +120 bps YoY)[10]; GAAP operating margin 29.2% (FY2025)[10] with non-GAAP op margin ~30.2%. Net income was $7.0 B (24.7% net margin)[11]. ROE is ~35.5% and ROIC ~25.7% (TTM as of Jan 6 2026)[12], indicative of strong incremental returns on capital.

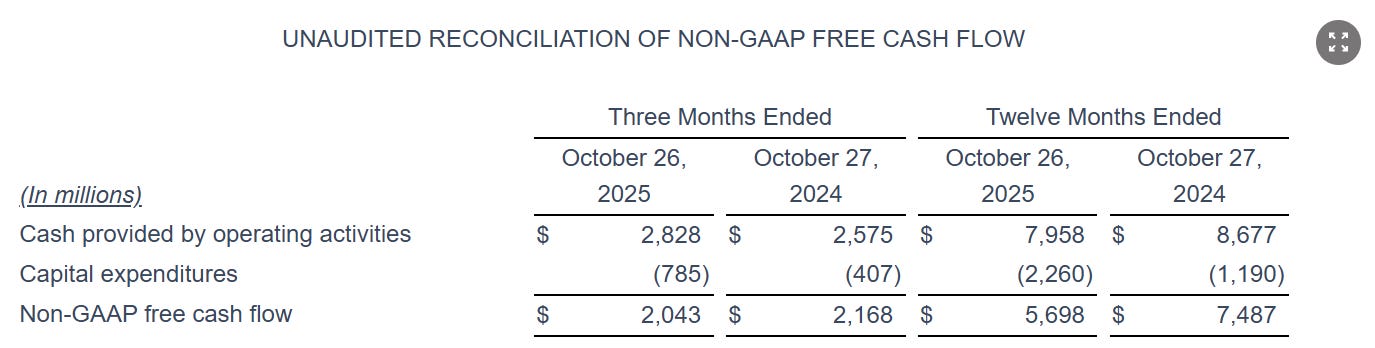

Cash Flow: LTM operating cash flow $7.96 B and capex $2.26 B, yielding Free Cash Flow ≈ $5.70 B (FY2025)[13]. This was down from an exceptionally strong $7.49 B FCF in FY2024[14], due partly to higher capex (investing in internal capacity/R&D) and working capital. The current FCF yield is ~2.4% on the market cap, reflecting the stock’s high valuation[15].

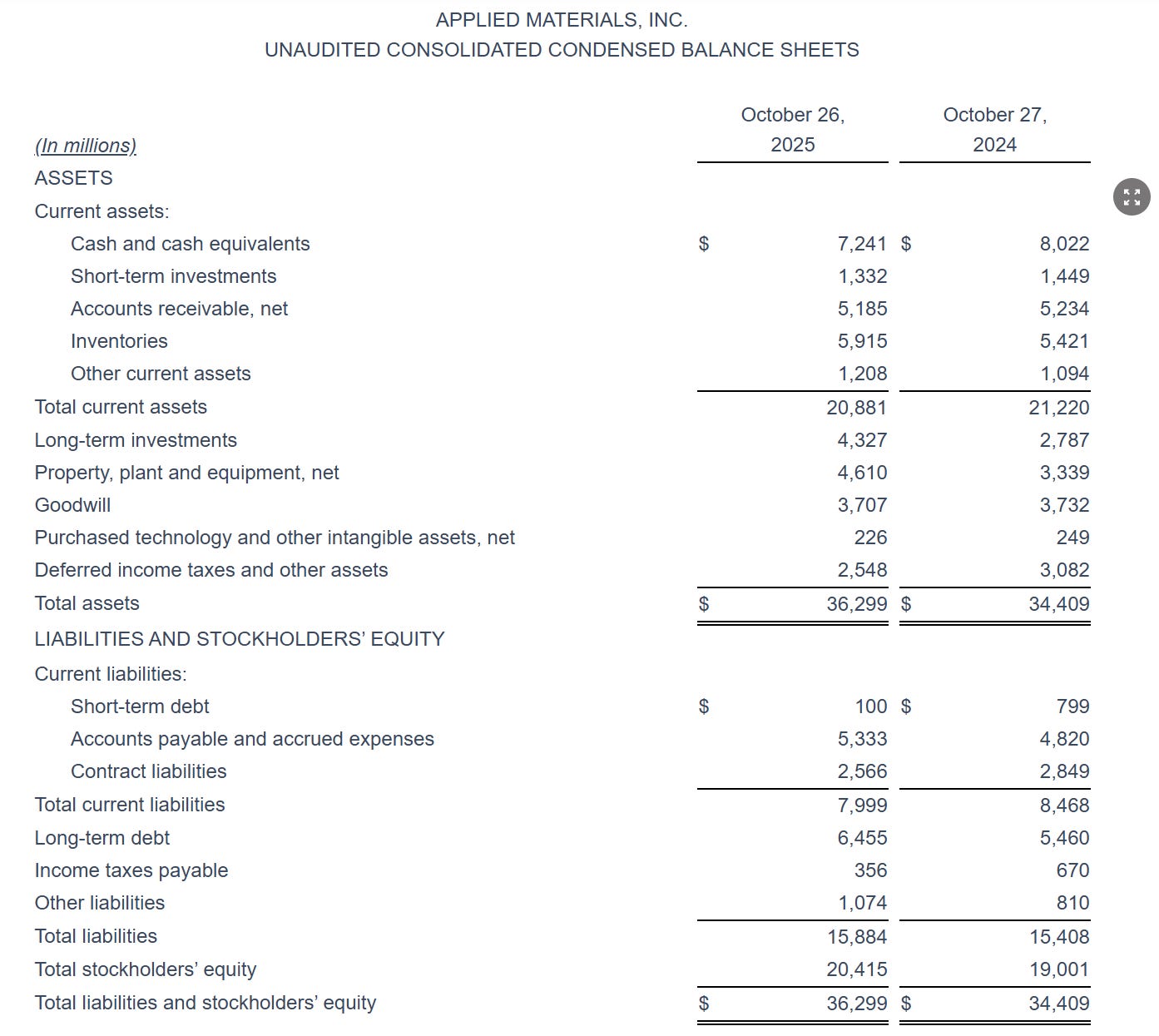

Capital Structure: Net cash position. Cash and short-term investments were $8.57 B vs. total debt of $6.56 B as of Oct 26 2025[16][17]. Including long-term investments, cash/investments exceed $12 B. Balance sheet strength gives flexibility for R&D and buybacks.

Operational/Other: R&D spend runs about 13–14% of sales (critical for new product development). Headcount ~36,500[23]. No major acquisitions pending (the attempted Kokusai Electric acquisition fell through in 2021; AMAT has since focused on organic R&D and smaller tuck-ins).

Product Mental Model

Think of chip fabrication as a high-tech assembly line for nanoscale structures: Applied Materials provides many of the essential stations on that line. The process of building a chip involves repeatedly adding material layers and sculpting them into circuits. AMAT’s deposition tools are like ultra-precise “atomic paint sprayers” that coat the wafer with conductive or insulating films just a few atoms thick. Its etching tools are like microscopic “lasers” or chisels that carve the desired patterns into those films after lithography prints the blueprint. These deposition/etch steps are repeated dozens of times to create the multi-layer architecture of modern chips. AMAT also sells inspection and metrology tools (though this is a smaller segment for them) that act as the wafer’s quality control scanners, detecting defects or measuring thickness at the nanometer scale. Finally, once a fab is full of AMAT equipment, the company’s service engineers and software keep those tools running 24/7 at peak performance – akin to providing “maintenance and upgrades for a factory’s key machines” on a subscription/contract basis. In essence, AMAT profits from the intensity of the manufacturing process: more complexity and more layers = more steps = more of its equipment and know-how needed.

Business Model

Segments: AMAT reports three segments – Semiconductor Systems, Applied Global Services (AGS), and Display & Adjacent Markets.

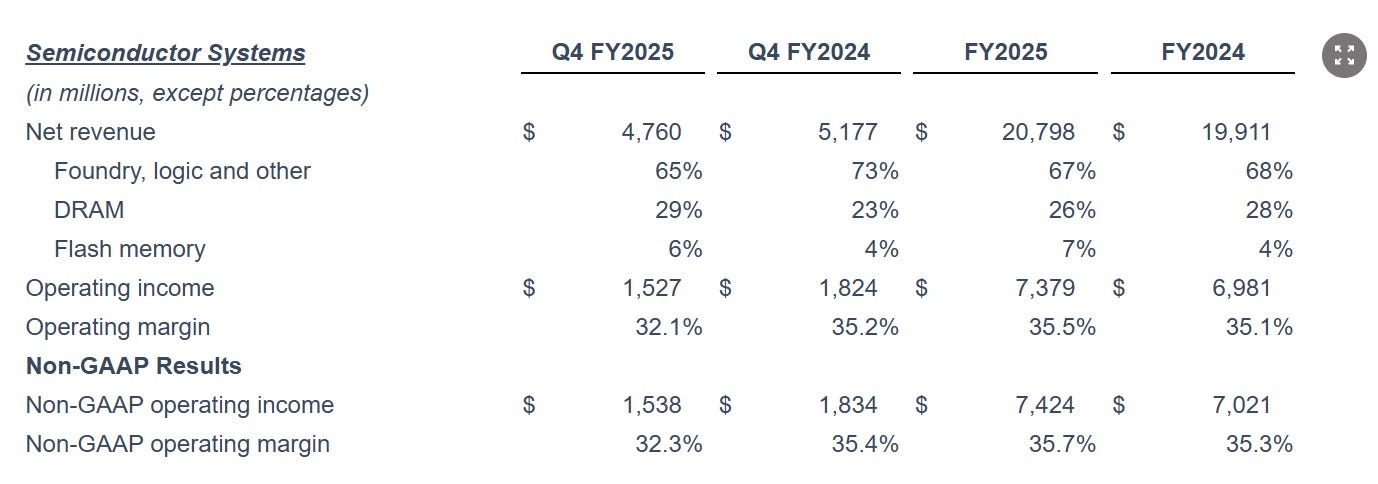

Semiconductor Systems is by far the largest, comprising the sale of wafer fab equipment (WFE) for chip manufacturing (deposition, etch, implant, etc.). In FY2025 Semiconductor Systems revenue was $20.80 B (73% of sales)[10][24] with a ~35.5% GAAP operating margin[25].

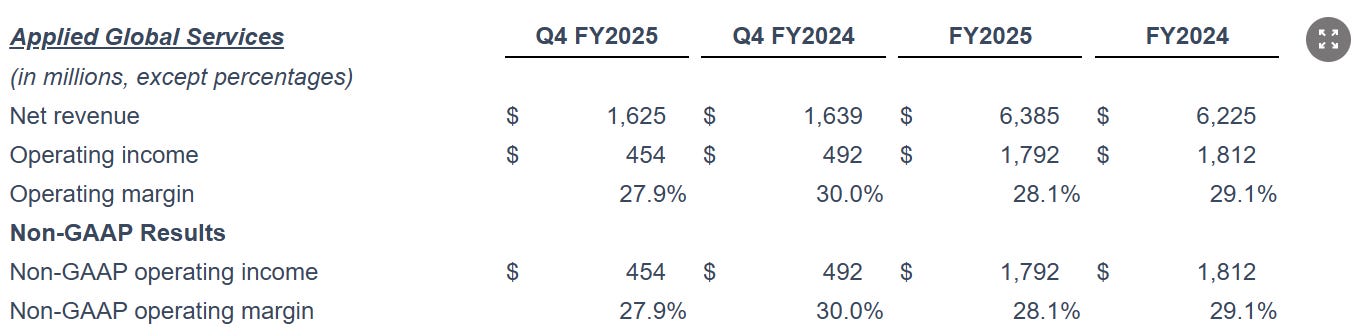

Applied Global Services contributed $6.39 B (22% of sales)[10][26] at ~28% op margin – this includes spares, equipment maintenance, refurbishments, and now software/analytics for fab optimization.

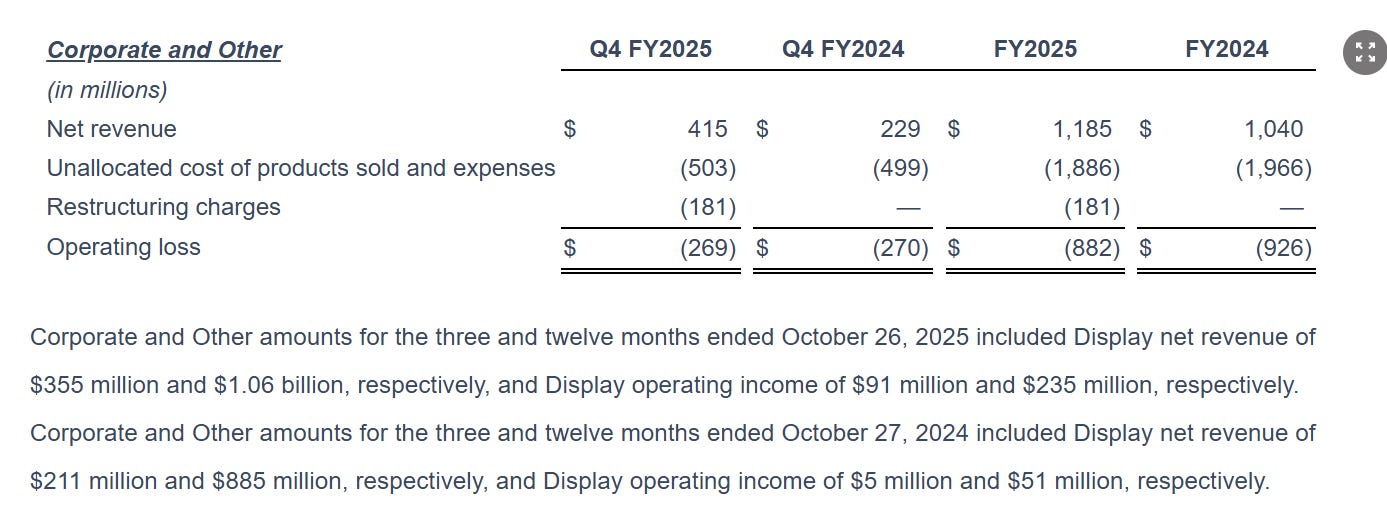

The much smaller Display/Adjacent Markets segment (e.g. equipment for LCD/OLED panel fabrication) had about $1.06 B revenue in FY2025 (≈4% of sales)[27] and was roughly breakeven (display is currently sluggish, and AMAT has deemphasized it).

Notably, starting in Q1 FY2026, AMAT will reclassify its 200mm equipment business out of AGS into Semi Systems, making AGS purely a recurring service business going forward[28] – a move that should improve transparency into the true services gross and operating margins (and highlight their stability).

Revenue Mix and Shifts: By end market, AMAT’s WFE sales are diversified across logic/foundry and memory. In FY2025, ~67% of Semi Systems revenue came from foundry/logic (e.g. TSMC, Samsung logic, Intel, etc.), ~26% from DRAM, and ~7% from NAND flash[29]. This represented a slight shift back toward memory versus the prior year (memory was ~32% in FY2024) as certain memory investments – particularly for AI-centric memory like HBM – picked up steam. In fact, in the latest quarter Q4 FY2025, DRAM-related sales jumped to 29% of Semi revenue[29] (from 23% a year prior) as memory makers began investing in high-bandwidth DRAM capacity to support AI demand. Logic spending, however, remains the largest driver, tied to leading-edge node transitions (e.g. 5nm→3nm and soon 2nm with gate-all-around transistors) and to specialty/other logic (automotive chips, analog, etc.).

Geographically, AMAT’s business is dominated by Asia. China, Taiwan, and Korea together accounted for ~78% of FY2025 revenue[8]. The single largest country market in FY2025 was China with 30% of sales (≈$8.53 B)[30], closely followed by Taiwan with 24% (~$6.86 B)[8], then Korea with 20% (~$5.61 B). The U.S. was ~11%, Japan ~8%, Europe ~3%, and SE Asia ~4%[31]. This mix has shifted significantly in the past year: China’s share dropped from 37% in FY2024 to 30% in FY2025[32] as U.S. export controls tightened and Chinese fab spending (especially on memory) pulled back. Meanwhile, Taiwan’s share surged (15% → 24%) on the back of TSMC’s 3nm ramp and advanced packaging investments, and Korea’s share rose (17% → 20%) with Samsung and SK Hynix spending on both logic and new memory (e.g. HBM)[8]. The U.S. and Europe shares actually declined despite hefty subsidy announcements – suggesting delays in domestic fab projects (Intel, GlobalFoundries, etc.) and that most near-term WFE growth is still in Asia. Going forward, we expect China’s share to fall into the 20s% due to sanctions[4][33], while U.S. and elsewhere could tick up as CHIPS Act-funded fabs start equipping (though material revenue impact likely in 2026–2027). This regional shift has strategic implications: losing some high-margin China business could be a headwind, but increased sales to TSMC and others for cutting-edge nodes may carry higher ASPs and more services attachment.

Installed Base & Services Attachment: Over 60+ years, AMAT has shipped a tremendous installed base of tools (management doesn’t publicly quote a total count, but it is on the order of tens of thousands of systems). This installed base is a cash cow. Each tool in the field generates recurring revenue through spare parts, consumables, software upgrades, and service contracts. Importantly, newer generations of equipment tend to have higher service intensity – meaning customers rely more on OEM support to maintain uptime and yield. AMAT’s strategy explicitly focuses on expanding comprehensive service agreements and “subscriptions” per tool[34][28]. In FY2025, the AGS segment (services) grew ~3% YoY[10], a bit slower than systems, partly because some 200mm equipment sales were still in AGS. With the reporting change, AGS will become purely services/parts and should reflect a steadier mid-single-digit growth even in down cycles (as fab utilization and maintenance needs persist). We view services as a stabilizing force in AMAT’s model – at ~22–23% of sales now, likely trending toward ~25%+, it provides a baseline of high-margin revenue even when new equipment sales dip. The gross margin on services is typically lower than on leading-edge equipment, but the operating margin is only slightly lower (high 20s% vs low 30s% for systems)[26], and services require far less R&D. Thus, a rising services mix supports solid free cash flow through cycles.

In summary, AMAT’s business model is a mix of new equipment sales (volatile, but currently on an upswing with AI/logic investments and an expected memory recovery) and recurring service revenues (stable, growing with installed base). The company has managed its regional and product mix shifts adeptly so far – e.g. offsetting China weakness with other markets – but this will be an area to monitor closely.

Valuation and Setup

As of Jan 6 2026, AMAT stock trades at $296.01, near an all-time high[48][49] after a +80% run in the past year. At this price, the market capitalization is ~$234.7 B and enterprise value is ~$233.2 B (net of ~$1.5–2 B net cash)[18][50]. Here are the key valuation metrics and what they imply:

Earnings Multiple: The stock’s TTM P/E is ~34× (using FY2025 GAAP EPS $8.66[51], which aligns with Finviz TTM EPS $8.67[18]). On a forward basis, using consensus FY2026 EPS (~$11.47[18], +32% YoY growth expected), the forward P/E is ~25.8×[18]. This is a rich multiple for a semicap company – historically, AMAT’s forward P/E ranged ~12–18× outside of bubbles. The market is thus discounting a strong upcycle ahead (AI-driven), and possibly a higher sustained growth rate than before. For context, peers Lam Research and KLA currently trade in the ~20–25× forward range as well after their 2025 run-ups, while ASML trades >30×. So AMAT’s valuation vs peers is elevated but not extreme given the AI narrative (it’s roughly in line with Lam and a discount to ASML).

EV/EBITDA: ~26× TTM EV/EBITDA[52]. This is high in absolute terms, reflective of peak-cycle earnings quality (and likely pricing in EBITDA expansion next year). EV/Sales is ~8.2×[52] on TTM revenue, which is also at the top of historical range (AMAT was ~3–5× EV/Sales for much of the late 2010s; the expansion reflects higher margins and optimism about growth).

Cash Flow Yield: Trailing P/FCF is ~41×[15], i.e. FCF yield ~2.4%. This low FCF yield partly reflects temporary factors (working capital, elevated capex) – on a normalized basis (if we assume FCF will improve with earnings), the forward FCF yield might rise to ~3–4%. Still, investors today are accepting a <3% owners’ yield in exchange for expected growth. By comparison, the 10-year U.S. Treasury yield is ~4%, underscoring that AMAT’s valuation embeds significant growth/margin expansion to justify the premium.

Now, consider what the stock is “pricing in”: At $296, if we assume mid-cycle EPS potential of ~$10–12, the market is implicitly assuming a growth trajectory that keeps EPS climbing into that range and beyond. Scenario exercise: Under a bull case, suppose FY2027 EPS could reach $13.00 (high end of forecasts if AI drives strong WFE growth). A 25× multiple on that would yield a stock price of $325 (meaning even from $296 there is upside if growth delivers). A more euphoric case – 30× $13 – would be ~$390 (perhaps if AMAT is viewed like a true secular growth story with scarce capacity). Conversely, under a bear case, if earnings stagnate around $9–10 (no growth from FY2025 levels due to a capex downturn or margin squeeze), a more typical cyclical multiple of ~15× would imply a stock in the $140–150 range. That wide range of outcomes explains the stock’s volatility – small changes in the narrative (compounder vs cyclical) warrant big swings in valuation.

One more lens: implied WFE share. AMAT’s FY2025 sales were $28.4B. Industry WFE was roughly ~$90B in 2023 and expected around ~$80B in 2024; forecasts see it rebounding to >$100B by 2026[5]. AMAT thus holds ~15–18% share of WFE (excluding services). If WFE indeed grows ~+10% in 2026 and another ~7% in 2027[5], and if AMAT can slightly outgrow the market (share gains, service growth), its revenues could plausibly hit ~$32–35B by FY2027. At the current EV, that implies an EV/Sales of ~6.5–7× on forward 2027 sales – still not cheap, but more palatable with 50% gross margins. This back-of-envelope check shows the stock isn’t baking in a totally implausible future; it’s just giving AMAT very little room for disappointment.

Technicals

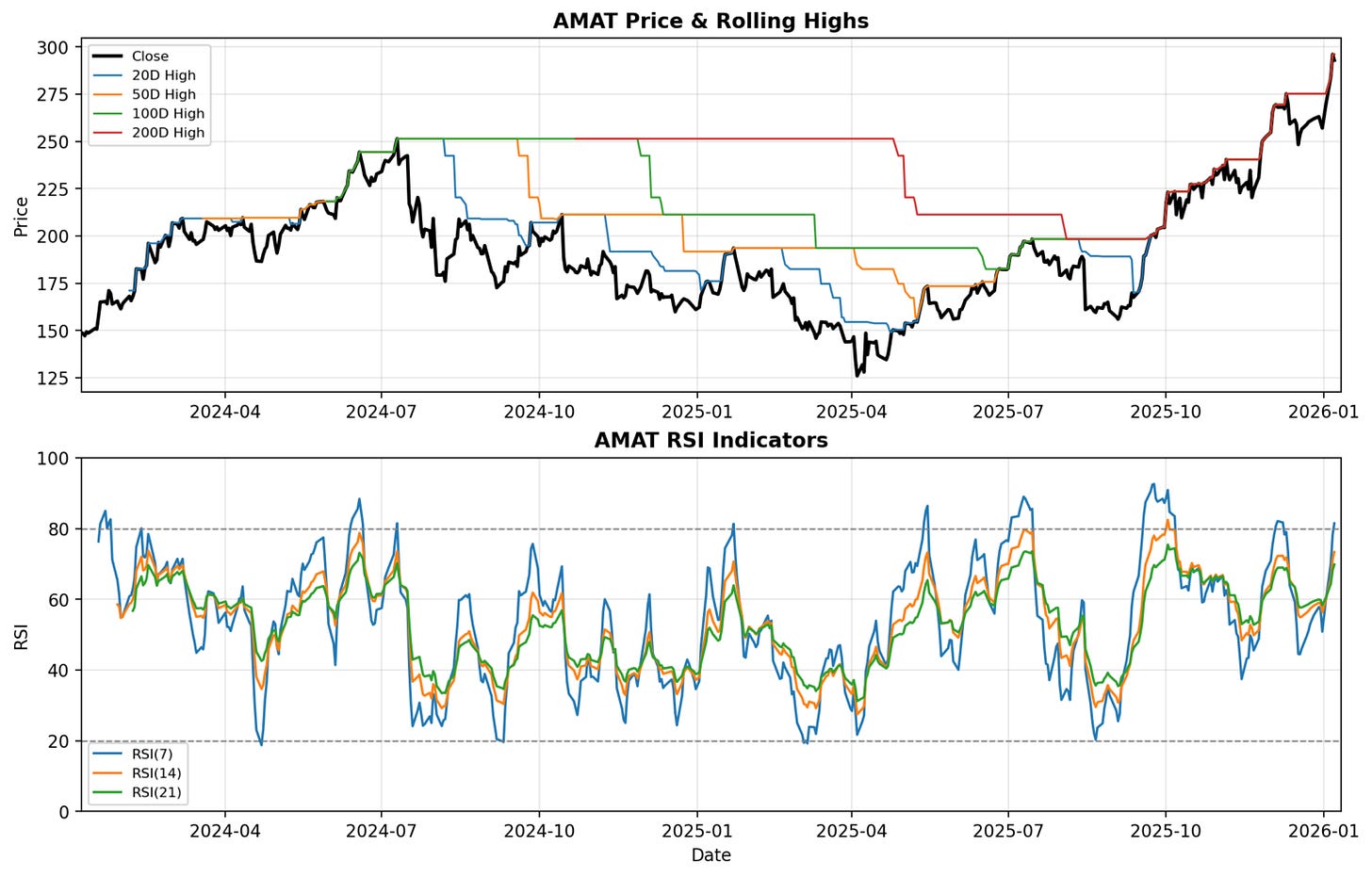

AMAT’s price action has been strongly bullish, but the stock is technically extended.

It’s trading above key moving averages on multiple time frames, indicating robust momentum but also elevated risk of pullback:

Short-Term Trend (1–3 months): The stock recently broke out to all-time highs above ~$287. It is well above its 21-day moving average (approximately in the $265–270 range) and about 12% above the 20-day SMA[53], reflecting a sharp near-term run-up. Volume on the breakout was solid, and relative strength vs. the broader market is high (YTD outperformance is >15% in just the first week of 2026[57]). However, an RSI ~74[58] suggests near-term overbought conditions – we wouldn’t be surprised to see consolidation or a modest pullback toward support.

Intermediate Trend (multi-month): The 50-day moving average (around ~$246) is ~17% below the current price[59][60]. The 100-day MA (~$217) and 200-day MA (~$192) are even further below[61]. These large gaps confirm a strong uptrend (the stock has essentially gone vertical since mid-2025), but they also highlight a lack of nearby support if the trend slows. The stock is ~53% above its 200-day MA[62], which is unusually stretched for a large-cap – typically, mean reversion or at least a pause could occur to let the averages catch up. On the weekly chart, AMAT has risen for several months in a row, pushing it ~40% above its 50-week MA (analogous to the 200-day).

Support/Resistance: On the upside, with the stock in uncharted territory, psychological levels like $300 will act as round-number resistance. Indeed, ~$300 also roughly marks the upper end of some analyst targets, so there may be profit-taking around that level. If it clears $300 decisively, momentum traders could carry it higher (the next Fibonacci extension or measured move might point to ~$320+). On the downside, the prior breakout zone around $285–$287 (the old 52-week high) should now act as initial support – the stock has already retested that area intraday and bounced. Below that, $250 is a key area: it’s near the 50-day MA and was a consolidation level in Nov–Dec 2025. We view ~$240–$250 as a “line in the sand” zone for the medium-term uptrend – a break and close below the low-$240s (which would likely coincide with falling below the 10-week/50-day average decisively) would signal a possible trend reversal or at least a change in character, prompting us to re-evaluate the long thesis’s timing.

Key Drivers (6–12 months)

Over the next year, a series of events and data points will indicate whether AMAT is delivering on the secular story or facing headwinds. We’ve identified the key drivers and catalysts to monitor, roughly in chronological order:

Earnings Releases & Guidance (Quarterly, next in Feb 2026) – Each earnings report will be critical to assess order trends and outlook. In mid-Feb 2026 (Q1 FY26 results), watch for: order momentum (bookings) especially in semiconductor systems, any change to full-year WFE outlook, and margins. AMAT guided Q1 FY26 rev $6.85B +/- $500M and non-GAAP EPS ~$2.18 +/- $0.20[64]; meeting or beating that is important to justify recent optimism. Also, backlog commentary will matter if provided – after Q4, management indicated some deferred China shipments would push into Q1[65]. We’ll want to see that convert and see if new orders are coming in above shipments (book-to-bill >1). Guidance for Q2 (May 2026) and any preliminary view on 2H 2026 WFE will set the tone; CFO Hill has signaled higher demand in H2 2026[44], so the market will be looking for confirmation of that in order intake by mid-2026.

AI Chip Capex / Hyperscaler Announcements (Ongoing) – Major AI players (NVIDIA, cloud hyperscalers like AWS, Google, Microsoft) indirectly drive WFE by their orders for advanced chips. If NVIDIA signals continued huge demand for H100/A100 successors, TSMC (which builds those chips) may accelerate expansion plans. Similarly, any public CAPEX disclosures by TSMC, Samsung, Intel in their earnings (Jan 2026 and Apr 2026) will be parsed. For example, if TSMC in its Jan 2026 call guides higher 2026 capex than expected, particularly allocating more to advanced nodes or CoWoS (advanced packaging) capacity, that would be bullish for AMAT’s tools. Intel’s progress on its foundry roadmap (and its own capex plans with government subsidies in US/EU) is another lever – a positive surprise (e.g. Intel pulling in equipment orders to hit its process timeline goals) would be upside. Conversely, any capex cuts or node delays (e.g. if 3nm yields or demand are below plan) would hurt sentiment.

Memory Market Inflection (Mid-2026) – The memory cycle is critical. DRAM and NAND makers (Samsung, SK Hynix, Micron) had cut capex in 2024 due to oversupply. A driver for 2H 2025 into 2026 is the anticipated memory spending rebound, especially for DDR5 and HBM. We expect signs of this by mid-2026: e.g. Micron’s earnings (e.g. around June 2026 for its FY Q3) and commentary on capex could be telling. If Micron (lagging in HBM) announces a big jump in FY2027 capex or new fab equipment purchases (perhaps enabled by U.S. CHIPS grants), that’s a strong tailwind for AMAT (Micron is a major customer in DRAM and NAND equipment). Hynix and Samsung are already spending on HBM – any news of HBM capacity doubling plans or new fabs in Korea would directly translate to tool orders (HBM involves advanced etch, deposition and metrology steps for through-silicon vias, etc., all of which AMAT supplies). Watch the DRAM pricing and inventory trends – by late 2025 DRAM prices were stabilizing; a sustained upturn in pricing into 2026 will green-light these companies to invest, benefiting WFE vendors. If, however, memory recovery is tepid or China’s YMTC/YMIC (flash/DRAM) cut spending further due to sanctions, that driver could disappoint.

China Export Policy & Demand (Ongoing; specific milestones in 2026) – U.S.-China tech tensions remain a swing factor. On one hand, as of late 2025, the U.S. tightened rules (which AMAT said will cut ~$600M from FY26 sales)[46], including effectively barring AMAT from selling tools for advanced logic and memory in China without license. Any further U.S. actions (for example, restricting tools for <28nm logic or certain deposition tools that were previously allowed, or clamping down on China’s trailing-edge capacity additions) would directly cap AMAT’s revenue. We should monitor U.S. policy – e.g. the potential renewal or changes of export rules around October 2026 (the rules are updated periodically). Conversely, any subtle easing (or loopholes) – for instance if Chinese fabs find ways to import via subsidiaries (the “affiliate rule” was suspended temporarily[66]) – could mean some revenue comes back. Also, China itself may roll out subsidies or stimulus for domestic fabs in response to economic pressures; if Chinese logic companies (SMIC) or memory firms get government backing to build more trailing-edge fabs (where they can still buy some older AMAT tools freely), that could surprise to the upside for AMAT’s low-end tool demand. So catalysts here include U.S. Commerce Department announcements, and China’s own semiconductor investment plans (watch for news around China’s five-year plans or emergency support for YMTC etc.). Baseline expectation: China demand for AMAT will be weaker in 2026 vs 2023, but not collapse – any deviation from that (much worse or much better) will move the stock.

Product/Technology Announcements (Industry Conferences, mid-2026) – AMAT’s technology leadership can be showcased in events like SEMICON West (July 2026) or its own product launches. We anticipate potential announcements of next-gen tools for GAA transistors, advanced patterning (maybe pattern shaping tools, new selective etch), or hybrid bonding for chiplets. If AMAT unveils a breakthrough platform that secures process-of-record wins at a leading customer, that can be a demand catalyst (and narrative boost). For example, any news that AMAT’s tools will play a key role in TSMC’s 2nm or Intel 20A/18A nodes (beyond what’s expected) could bolster the “complexity” thesis. Keep an eye on trade publications or investor day slides for quotes like “we have 2× more Applied content in [Customer X]’s next node”. Conversely, if a competitor like Lam Research or TEL announces a leapfrogging technology (say a new etcher or deposition tool that displaces AMAT at a big account), that would be a negative driver. So far, nothing suggests that – but it’s a space to watch, especially as new node ramps approach in late 2026.

Macro/Capital Markets Events (Ongoing) – While we won’t have a separate macro thesis, general macro conditions can amplify or diminish AMAT’s cycle. Key things to watch: global electronics demand (PC, smartphone, auto, data center) – if end demand falters, fab utilization will drop, delaying orders. Data points like global PMI, consumer electronics sales, and data center capex trends from cloud companies are indirectly important. On the flip side, secular demand from AI/ML seems robust. Also, interest rates and equity rotations can affect high-multiple stocks like AMAT; a rapid rise in yields or risk-off market might compress multiples regardless of fundamentals, at least temporarily. While not a “catalyst” per se, we incorporate this in monitoring risk (e.g. if inflation surprises or Fed pivots, how might that shift appetite for cyclicals or growth stocks). We will treat these as background drivers to adjust sizing/timing, rather than thesis core.

Customer Commentary & Industry Checks (Events like investor days or industry reports) – We should note specific events such as TSMC’s North America symposium (Spring 2026) or Samsung Foundry Forum, where these customers might discuss capacity expansion plans and technology roadmaps. Any mention of accelerating fab build-outs (e.g. TSMC might hint at needing more EUV and deposition tools for N2 early) is bullish. Also, watch SEMI’s quarterly WFE billings data and Taiwan’s export data for semiconductor equipment – these can serve as real-time indicators if orders to fabs are rising or falling faster than expected. If SEMI reports, say, a big jump in equipment billings in Taiwan or Korea in 1H 2026, it likely means AMAT and peers are benefiting.

Risks and Reversals

Despite the favorable outlook, there are several risks that could break the bull thesis or even reverse it into a negative spiral. We outline the key risks and what could go wrong:

Stricter Export Controls / Geopolitical Escalation (China Risk): This is arguably the largest external risk. The U.S. government has already restricted AMAT from selling its most advanced tools to China’s leading fabs, particularly impacting memory (AMAT “can no longer supply China’s memory chip market” per CEO[47]). If tensions worsen – for example, if the U.S. and allies further tighten export controls (lowering the tech threshold or banning more types of equipment), or if China retaliates by restricting material supply or imposing sanctions on US companies – AMAT could lose additional revenue and face supply chain disruptions. There is also Taiwan risk: an extreme scenario such as a Taiwan Strait conflict would massively disrupt semiconductor supply chains (TSMC operations and tool shipments), which is a tail risk that could devastate AMAT’s business temporarily. While such geopolitical events are low-probability, the impact would be high and essentially thesis-breaking in the short term. Mitigant: AMAT is diversifying customer base outside China and the CEO expects no “major new limits” beyond those already announced[47] – but this remains largely out of the company’s control. We have to monitor policy closely; any sign of new restrictions (e.g. talk of closing loopholes or adding more Chinese fabs to the Entity List) could materially hit sentiment.

Cyclical Downturn in Semiconductor Demand: Despite the AI strength, other parts of the semiconductor market could wobble. For instance, if global economic conditions deteriorate and there’s a slump in consumer electronics (smartphones, PCs) or enterprise spending, chip companies will cut capex. We saw this in past cycles (e.g. 2018–2019 memory crash, 2012 downturn). If AI chip demand proves less elastic to a recession than hoped, even data-center-driven orders might slow. AMAT’s backlog could shrink and new orders get pushed out, leading to revenue/EPS misses. Notably, while AI is a hot area, it’s not the entirety of WFE: auto, industrial, and consumer chip fabs are still significant. Any broad inventory correction (like the one that started in 2022 in some segments) could curtail WFE spending for a few quarters. Mitigant: the current industry expectation is that we’re entering an upcycle (with 2024 being a bottom for memory and 2025–26 rising)[5]. But if that consensus is wrong, AMAT’s stock could be over-earning at peak. We’d treat a sudden drop in book-to-bill or guidance as a warning that cycle risk is materializing.

Customer Concentration & Capex Behavior: A significant portion of AMAT’s business comes from a few big players (TSMC, Samsung, Intel, SK Hynix, Micron, etc.). TSMC alone could be >10% of sales (exact numbers not disclosed, but given Taiwan is 24% and TSMC dominates Taiwan). If any top customer decides to sharply cut or delay capex – e.g., TSMC delaying 2nm expansion due to high inventory or yield issues, or Intel scaling back fab ambitions due to cash flow constraints – AMAT would feel it. There’s also execution risk at customers: Intel has struggled to hit its process roadmaps historically; if it slips again, tools might sit idle or get cancelled. Similarly, Samsung’s mixed success in foundry could mean periods of under-investment. Mitigant: The broad base of customers (foundry + memory + logic) provides some diversification; in FY2025, AMAT’s largest vertical (foundry/logic) was two-thirds, with memory one-third[29], so weakness in one can be offset by another (as happened – logic slowed in 2023 but memory was already bottoming by late 2025). But simultaneous pullbacks (like in a global downturn) would hurt badly.

Competition and Technology Substitution: While AMAT is a leader, it faces strong competitors: Lam Research (etch & deposition), Tokyo Electron (etch, deposition, cleaning), ASML (lithography – not directly competing but takes WFE wallet share), KLA (metrology/inspection), and emerging Chinese vendors (Naura, AMEC in etch, etc.). Losing share in a critical tool segment is a risk. For example, Lam has been very competitive in deposition after acquiring Novellus; if Lam’s new products start displacing AMAT’s in areas like ALD or PECVD, that would hurt sales and pricing. Similarly, if customers choose different technical approaches that bypass AMAT’s strengths: e.g. extensive EUV patterning could reduce some multi-pattern deposition/etch steps (fewer steps = fewer tools needed), or using more advanced packaging might shift some value from front-end tools to back-end processes (an area where AMAT has less presence vs. companies like ASE or TEL’s packaging tools). Another substitution risk: yield improvements – if chipmakers find ways to get higher yield with fewer process iterations, tool demand per wafer could drop. Also, China’s domestic equipment companies are a medium-term risk: while they’re not yet competitive at leading edge, China is investing heavily in its own litho, etch, depo tools for >=28nm. Over time, Chinese fabs might buy more local tools to avoid sanctions, eroding AMAT’s share in that segment of the market. Mitigant: AMAT spends heavily on R&D and has decades-long process integration expertise; its deep relationships make displacement at leading edge difficult. Also, complexity is more likely to increase than decrease (so substitution by simplification is not likely at the cutting edge – e.g. even with EUV, we are seeing multiple EUV passes plus deposition/etch for things like gate-all-around). Nonetheless, competition could pressure margins (price competition) if, say, multiple suppliers chase a smaller memory capex pie – we will watch gross margins for any sign of discounting.

ASP Pressure and Mix: As the industry matures, big customers often negotiate hard on tool pricing, and some tools can become “commoditized” at older nodes. If a larger portion of AMAT’s sales shifts to trailing-edge or mature nodes (for instance, if a lot of 28nm capacity gets built, which uses older tech tools often with lower ASPs and more competition), the average selling price (and margin) could suffer. Similarly, within AMAT’s product mix, if more revenue comes from displays or legacy 200mm equipment (lower margin) and less from bleeding-edge tools, the financial profile could dilute. The risk is that services and trailing-edge might grow while leading-edge stalls, which could drag on blended margins. Mitigant: Right now, the opposite is happening – leading-edge logic and AI-related memory are driving growth, and those typically involve the highest-value, high-ASP tools (EUV aside). But it’s something to keep in mind for later in the cycle, especially if leading-edge capex pauses and only mature-node spending (e.g. auto chips on 40nm) continues.

Execution & Operational Risks: Internally, AMAT must execute on expanding capacity and new product deliveries. The company had some supply chain issues in 2021–2022 that delayed shipments (e.g. component shortages). If supply chain snarls return or if AMAT has trouble hiring and scaling to meet the expected H2 2026 demand surge, it could miss out on revenue or incur extra costs (expediting parts etc.). There’s also integration risk of any new technologies (AMAT occasionally makes small acquisitions or integrations like the 200mm biz re-org). Additionally, any quality control failures – e.g. a new tool not meeting specs, causing customer yield problems – could damage its reputation and result in lost future sales. So far, nothing glaring here, but rapid growth phases sometimes strain operations. Mitigant: AMAT has a seasoned ops team and they’re already making moves (e.g. building inventory of critical chips, qualifying second sources) to avoid the prior supply issues. Still, it’s a risk to monitor on earnings calls (look for commentary on lead times, etc.).

Macro and Currency: A strong dollar can be a headwind since AMAT sells globally (though much of their cost is also dollar-based; they hedge some FX). Inflation in wages or materials could pressure costs if they can’t pass it on (though gross margin uptick in FY2025 suggests they managed OK). Interest rate increases don’t directly hurt much (debt is low and fixed-rate), but higher rates could cool end-market investment (customers’ WACC goes up, making them more cautious on capex). Also, if the equity market starts favoring value over growth, high-multiple stocks like AMAT can derate regardless of earnings (that’s more of a risk to stock price than business, but relevant to us as holders).

In summary, the biggest risks are a policy shock and a demand downturn – either of which would likely remove the “secular growth” premium from AMAT’s stock and reveal it to be (in that moment) a cyclical supplier with potentially lower EPS, causing a sharp de-rating. We’ve seen historically that WFE stocks can drop 30–50% on cycle turns or macro shocks.

Conclusion

Our view is that Applied Materials can indeed be underwritten as a structural “complexity tax” compounder into 2026–2028 – but with a clear appreciation of cyclical risks and a plan for risk management. The company’s fundamentals are strong (record revenue, expanding margins, hefty cash generation[10][13]), and secular trends like AI, 3D chip architectures, and global fab expansion provide a credible runway for growth. AMAT is not a flashy AI stock per se; it’s the picks-and-shovels supplier benefiting from the AI boom’s capital spending, and in our assessment it has positioned itself at critical choke points of the value chain (leading-edge deposition, etch, and an installed base generating recurring services). This gives it elements of a compounder – high ROI, shareholder returns, secular tailwinds – that justify treating it as more than just another cyclical industrial.