Executive Summary

Fair Isaac Corporation (FICO) has achieved what few companies ever do – it’s become practically synonymous with the service it provides. The ubiquitous “FICO Score” underpins the vast majority of consumer lending decisions in the U.S., giving FICO a tollbooth-like position in the credit ecosystem.

This entrenched role, coupled with savvy management and a high-margin business model, has turned FICO into a profit machine for long-term shareholders.

ADFM thesis: FICO’s dominance in credit scoring and analytics provides a robust moat that should persist over the next three years, supported by steady growth in its core scoring business, expanding adoption of its decision software platform, and pricing power that it has proven willing to flex. The company’s strengths – an industry-standard product, deep integration with customers, hefty cash flows – position it well to continue compounding value.

That said, strategic challenges are on the radar: a competing credit score (VantageScore) is slowly making inroads, regulators are eager to foster more competition, and FICO’s valuation already reflects high expectations. Despite these caveats, I view FICO as a confident long-term hold for the three-year horizon: it’s a unique franchise that has repeatedly proven its resilience and ability to innovate. The stance here is straightforward – stay invested for the long haul, but keep an eye on the emerging risks that could test FICO’s fortress.

Background on FICO

Fair Isaac Corporation’s journey began in 1956, when engineer Bill Fair and mathematician Earl Isaac pooled just a few hundred dollars and a radical idea: use data and algorithms to make better decisions about credit (The FICO Score Is Probably The Biggest Innovation In Building The US Into The Consumer Economy: CEO William Lansing - Forbes India). In an era when loans were approved based on personal judgment and handshake intuition, Fair and Isaac’s analytics-first approach was a bold gamble. Early on, the company built custom scoring systems for individual lenders, crunching numbers on borrowed IBM computers to predict who would repay a loan. These efforts gradually seeded the concept of credit scoring in American finance. By 1989, FICO introduced its first general-purpose FICO Score – a three-digit number that could encapsulate a person’s credit risk. It was an instant hit: lenders craved a quick, objective way to evaluate borrowers, and FICO delivered.

An inflection point came in 1995, when U.S. mortgage giants Fannie Mae and Freddie Mac endorsed the FICO Score for virtually all home loans they purchased. From that moment, FICO’s score became the de facto passport to credit in America. By the year 2000, an estimated 75% of all U.S. mortgage applications were being decided with a FICO Score (The (Unlikely) End of the FICO Score - Fintech Takes).

As FICO’s influence grew, its business evolved. What started as a niche consulting outfit morphed into a software and scoring powerhouse. The company went public in 1987 and rode a wave of adoption as banks, credit card issuers, and even government agencies embraced its tools. (In a quirky anecdote, the IRS in the 1970s used FICO’s analytics to help identify tax evaders, illustrating how broadly applicable FICO’s models became (History of Fair, Isaac and Company – FundingUniverse).)

Through the 1990s and 2000s, Fair Isaac (which eventually rebranded simply as “FICO”) rolled out products beyond the classic credit score – from fraud detection systems for credit card transactions to marketing analytics that help banks cross-sell to the right customers. But at its core, the FICO Score remained the crown jewel. It seeped into the American lexicon; “What’s your FICO score?” became a common phrase, and consumers began actively tracking that magical number. In 2013 alone, lenders purchased over 10 billion FICO scores to evaluate borrowers, a testament to how embedded FICO’s product had become.

Industry Snapshot

The credit scoring and analytics landscape that FICO inhabits is one it largely shaped – but it’s not without challengers and change. For years, FICO has been the chief architect here, with its score serving as a common language between lenders, borrowers, and even investors in mortgage bonds (FICO® Scores Used in Over 90% of Lending Decisions According to New Study).

Competitors have long sought to breach FICO’s stronghold. The most notable is VantageScore, launched in 2006 as a joint venture by the three major credit bureaus (Experian, Equifax, and TransUnion). This “coalition of rivals” was designed to create an alternative credit score that could loosen FICO’s grip. While VantageScore models are in use (especially for things like free consumer credit monitoring services and some personal loans), they’ve historically played second fiddle to FICO in the most crucial arenas.

Case in point: for decades, if you wanted a conforming mortgage in the U.S., a FICO score was essentially mandatory. However, the landscape is evolving – regulators have stepped in to foster more competition in scoring. In late 2022, the Federal Housing Finance Agency (FHFA) approved the use of VantageScore 4.0 alongside FICO’s latest score for mortgage approvals (Credit Score Models and Reports Initiative | Fannie Mae). This means Fannie Mae and Freddie Mac (the gatekeepers of the U.S. mortgage market) will soon require lenders to provide both a FICO Score and a VantageScore on loans. It’s a landmark shift: FICO’s monopoly in the mortgage world will give way to a duopoly, and it introduces a real test of whether VantageScore can start chipping away at FICO’s entrenched position.

Beyond the direct scoring rivalry, the broader analytics space is buzzing with fintech innovation. Upstart Holdings, for example, touts AI-driven models that consider alternative data (like education or employment history) to approve more borrowers than traditional scores would – the CFPB found one such model could boost loan approvals by 27% without increasing default risk. Fintech lenders and “buy now, pay later” upstarts sometimes eschew FICO Scores for proprietary algorithms, especially when courting younger consumers or those with thin credit files. The threat is that if someone else perfects a more predictive or more inclusive risk model, lenders might one day pivot away from the FICO Score.

Regulatory trends also loom large. The Consumer Financial Protection Bureau (CFPB) keeps an eye on credit scoring fairness and transparency, raising questions like: Does heavy reliance on credit history inadvertently disadvantage certain groups? Could more competitive scoring foster inclusion? These pressures were part of what prompted the introduction of VantageScore for mortgages. Additionally, data privacy laws and control of consumer data are hot topics – credit bureaus (the source of data for FICO Scores) have had high-profile breaches, and any changes in how consumer credit data can be used or shared could ripple through FICO’s business.

Despite all this, FICO’s role in context remains akin to a keystone in a large arch: remove it, and the structure wobbles. Virtually every major U.S. lender still uses FICO Scores in some capacity. Even many fintechs that market “no credit score needed” loans quietly check a FICO behind the scenes or use credit bureau data that ultimately links back to a FICO Score. And when Wall Street bundles loans into securities, investors often demand to see the average FICO scores of the loan pool as a measure of quality.

FICO is deeply embedded in the financial infrastructure. FICO has a massive first-mover advantage, decades of performance data proving its predictive power, and a brand that’s effectively the seal of approval for creditworthiness. Over the next three years, I expect this industry dynamic to remain a narrative of evolution, not revolution: FICO will gradually adapt (e.g. releasing new score versions that incorporate trending data, or offering more analytics as a service), competitors will gain a bit of ground in secondary areas, and regulators will keep nudging toward more openness. However, barring an unforeseen technological leap, FICO’s position in the landscape should remain securely on top – the standard against which all others are measured.

Financial Analysis

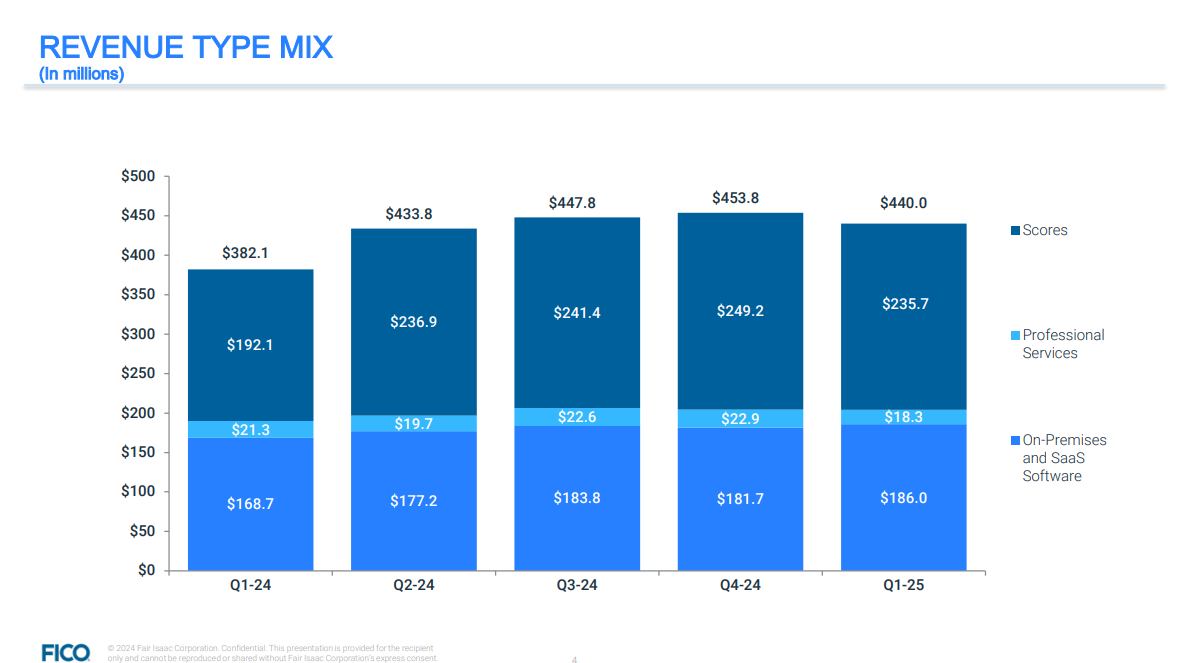

Financially, FICO has been on an impressive upswing. The chart above shows FICO’s revenue (blue bars) and net income (red line) from FY2015 through FY2024, highlighting a clear acceleration in growth and profitability in recent years.

In FY2024, FICO’s revenues hit a record $1.72 billion (up 13% year-on-year) and GAAP net income reached $513 million (up 19% YoY). To put that in perspective, back in 2015 the company’s revenue was around $839 million with ~$87 million in net profit. Today, those figures have roughly doubled – and net income has grown even faster, reflecting significant margin expansion.

FICO’s net profit margin now sits around 30%, a very high level for a software/analytics company. The jewel in FICO’s crown is its Scores segment (the business of selling credit scores to lenders and consumers), which contributes just over half of total revenues but an estimated 75% of the company’s profit (Fair Isaac's Crown Jewel Is Its High-Margin FICO Scores Business). This is a classic high-fixed-cost, low-variable-cost model: once FICO develops a scoring model, delivering one more score to a lender costs almost nothing – so the gross margins are phenomenal.

Speaking of pricing power, FICO provided a masterclass in 2024. The company raised the price of its flagship product – the FICO Score used in U.S. mortgage applications – by over 40%, from $3.50 to $4.95 per score. That is a hefty hike for a product that was already sold in the millions of units. Yet, tellingly, there was no mass customer exodus; lenders grumbled and even lawmakers took notice (FICO confirms credit score price increase for mortgage originations - Scotsman Guide), but they ultimately have kept paying because they need FICO Scores to do business.

This move speaks volumes about FICO’s business strength. It dropped straight to the bottom line and was a key factor in boosting the Scores division’s revenue by 19% in 2024. In fact, FICO noted that revenue from mortgage originations (which had been subdued when interest rates spiked) jumped sharply once some refinancing activity resumed – and now each of those loans brings in more fee than before. As Jim Wehmann, FICO’s EVP for Scores, explained, even after the price increase FICO’s fee is only ~0.2% of the average mortgage’s closing costs (FICO confirms credit score price increase for mortgage originations - Scotsman Guide).

In other words, FICO identified that its service was a tiny fraction of the overall value chain, and it confidently took a larger sip from the pie. This is pricing power in action, and it underscores the quasi-utility nature of FICO’s role: like an essential utility, it can raise rates and customers begrudgingly accept it.

Drilling down, FICO operates in two reporting segments: Scores and Software.

The Scores segment (about $920 million revenue in FY2024) includes B2B sales of credit scores to businesses (like banks pulling a FICO Score when you apply for a loan) as well as B2C sales (consumers buying their own score via myFICO or credit monitoring services). Scores revenue climbed 19% in 2024, with the B2B portion up a remarkable 27%. That surge was aided by the rebound in mortgage activity and the aforementioned price increases. Meanwhile, the B2C portion saw a slight dip (down 2%, as fewer people bought scores directly – likely because so many now get their FICO Scores free through banks’ “open access” programs. The Software segment (about $798 million in FY2024) grew more modestly at 8%. This business comprises FICO’s suite of analytics and decision tools used by enterprises – for example, software for fraud detection, loan origination decisioning, customer marketing, and the newer cloud-based FICO Platform. Here, FICO is in the midst of a transition: historically it sold a lot of on-premise software licenses and custom solutions, but now it’s pushing clients toward the unified, cloud-hosted FICO Platform offering, which is sold on a subscription/ARR basis. Progress is evident – platform Annual Recurring Revenue grew 31% in 2024 – but legacy software ARR was flat. The good news is that software customers aren’t leaving; they’re just slower to migrate, so FICO is carefully “farming” this base, maintaining service while gradually upgrading them to the modern platform. Over a three-year horizon, successful conversion of more clients to FICO Platform (which offers a more scalable, cross-functional analytics environment) could re-accelerate Software segment growth and expand its margins (subscription software typically yields higher lifetime value).

FICO’s financial footing is solid. Free cash flow in 2024 was about $607 million, implying a FCF margin near 35%. The company carries some debt (about 3x EBITDA, used opportunistically when rates were low), but with interest coverage of 6.9× and such strong cash generation, leverage isn’t a concern. In fact, FICO’s cash machine allows it to heavily reward shareholders. The company has no dividend – instead, it returns cash via stock buybacks. And FICO is aggressive on this front: in FY2022 it repurchased $1.1 billion worth of stock, followed by another $407 million in FY2023. In 2024, it bought back 606,000 shares at an average price of $1,366 (that’s roughly $830 million spent). These buybacks, combined with rising earnings, have supercharged FICO’s EPS growth. GAAP EPS hit $20.45 in 2024, up from about $14.18 just two years prior. The share count has been whittled down to ~24.4 million diluted shares, enhancing each remaining share’s claim on profits. It’s a shareholder-friendly strategy: FICO generates more cash than it needs to reinvest (the business itself doesn’t require heavy capital expenditure – developing a new score or software upgrade is more about brain power than capital), so it returns the excess to investors.

From a 3-year strategic lens, the financial story for FICO is one of continued steady growth with potential upside swings. The Scores segment may not grow 20% every year (that was partly cyclicality with mortgages in 2024), but even mid-single-digit growth in scores can drive outsized earnings gains, especially if accompanied by occasional price increments or new score products (e.g., FICO could monetize specialized scores for different industries or expand internationally). The Software segment is a bit more of a wildcard – if the new FICO Platform gains serious traction, we could see double-digit growth there as well, transforming that side of the business into a more typical SaaS growth story. Importantly, both segments feed into each other strategically: selling a bank the FICO Platform for decisioning likely helps cement that bank’s use of FICO Scores in every facet, and vice versa. We should also consider the economic cycle: if loan volumes surge (say, due to lower interest rates or economic expansion), FICO’s Scores revenue will get a natural boost (more credit applications = more score pull-through). Conversely, in a downturn, FICO’s revenue could flatline for a period if lenders pull back on lending (we saw a taste of this during early COVID-19 and in 2022’s mortgage slowdown). However, even in tougher times, FICO stayed profitable and kept growing modestly – a testament to its resilience. It has a substantial backlog of recurring revenues (especially now with $721 million in software ARR and a large portion of scores sold via long-term contracts with the credit bureaus), which provides a buffer against volatility. All told, the financial profile of FICO is that of a high-margin, cash-rich compounder. It may not be growing at hyper-SaaS rates, but its growth is dependable and often underappreciated – and when combined with share reduction and pricing moves, the per-share metrics paint a very strong picture.

Moat Analysis

FICO’s competitive advantages are as sturdy as a fortress – not impregnable, but formidable. The company’s primary moat comes from its deep integration and network effects in the credit ecosystem. Virtually every major lender, regulator, and investor speaks the language of the FICO Score. For a real-world sense of this: when an American consumer applies for a loan, there’s a better than 9 in 10 chance that a FICO Score will be used to evaluate that application. That kind of market penetration did not happen by accident; it’s the result of decades of trust-building. Lenders trust that FICO Scores effectively rank-order risk (because they’ve seen the outcomes over millions of loans), and borrowers have come to trust that if they maintain a good FICO Score, they’ll generally have access to credit. This mutual adoption creates a self-reinforcing network – the more lenders use FICO, the more indispensable it becomes to use FICO, because it’s the common yardstick everyone understands. As one Mercator Advisory Group study noted, even the bond market leans on FICO: 98% of securitized credit card and auto loan pools in 2016 referenced FICO Scores (FICO® Scores Used in Over 90% of Lending Decisions According to New Study). When a single score underlies everything from a $500 retail card to a $500,000 mortgage, that’s a wide moat built on standardization.

Another element of FICO’s moat is switching cost and embeddedness. Banks and financial institutions have FICO’s algorithms baked into their underwriting and risk management systems. Entire workflows, staff training, regulatory compliance processes, and audit trails are designed around FICO Scores. If a bank wanted to rip out FICO and use an alternative score, it would face enormous friction – not just technically, but culturally and regulatorily. Think of it like trying to change the engine of an airplane mid-flight. It’s theoretically possible but extremely risky. For example, even though VantageScore has been around since 2006, it struggled for years to convince lenders to move away from FICO because every internal model at the banks (from probability-of-default models to capital allocation) was calibrated to FICO. The FICO Score is sticky. Lenders renew their contracts for FICO’s scoring services year after year, and FICO often signs multi-year deals with the credit bureaus and large banks to provide scores in bulk, ensuring a steady, locked-in customer base.

Brand and reputation also play a huge role. “FICO” is arguably one of the most trusted brands in finance that consumers interact with without even realizing it’s a brand. Consumers might say “my credit score” but more often than not, it’s a FICO Score they’re referring to. FICO has spent years cultivating credibility – publishing research, updating its score algorithms to be more predictive and fair, and engaging in financial education. It sponsors “Score A Better Future” events for financial literacy and partners with organizations (even sports teams like the Chelsea Football Club, interestingly) to spread awareness. All of this reinforces that FICO is the gold standard. For a lender, using FICO carries a seal of objectivity and rigor that can be defended to regulators: “We used an industry-standard risk score in our decision.” That’s a powerful moat – it’s not just a score, it’s CYA (Cover-Your-Assets) for the bank, because if a loan goes bad, they can point out that the decision was supported by a widely accepted metric, not just gut feel.

FICO’s data and technology form another underpinning of its moat. Over 30+ years of scoring, FICO has accumulated unparalleled expertise and historical data on credit behavior. The performance of every FICO Score vintage (versions 2, 4, 8, 9, 10, etc.) across economic cycles feeds back into FICO’s R&D, allowing it to refine models continuously. New entrants might boast fancy AI, but FICO has something arguably more valuable: outcome data on billions of credit accounts spanning multiple recessions. This means FICO’s models have been battle-tested for stability and predictiveness. Moreover, FICO has proprietary algorithms and patents around scorecards and decision optimizers that give it a technological edge. While the core concept of logistic regression-based scorecards is not unique to FICO, the specific variables, scaling, and blending of multiple bureau data sources into a reliable score is very much a secret sauce. The result is that if a competitor like Vantage wants to match FICO’s accuracy, they often end up converging toward similar methods – and so far, FICO’s scores have maintained a perceived edge in predictive power (especially among risk managers who have used both).

One often overlooked moat component is ecosystem presence. FICO doesn’t exist in isolation; it has built an ecosystem of products and services around the score. For instance, FICO’s software solutions (the other half of the business) are often sold into the same clients that use FICO Scores. A bank that uses FICO’s “Falcon” fraud platform or “Origination Manager” software is even more deeply tied into the FICO universe. The integration between FICO’s scores and its decision software can create a one-stop shop that is convenient and hard for competitors to displace. Additionally, FICO’s Score Open Access program, which allows banks to share FICO Scores with their customers for free, means that hundreds of millions of bank customers regularly see their “FICO Score” on their statements or banking apps. This initiative was genius: it turned banks (and credit card issuers) into ambassadors for FICO’s brand, all while making the product even stickier (because those banks aren’t going to suddenly switch to providing a VantageScore to consumers – they’ve already trained them to look at FICO).

All that said, no moat is unbreachable. We should candidly note where there are vulnerabilities in FICO’s defenses. One is the slow but steady push by the credit bureaus to promote VantageScore – since the bureaus co-own VantageScore, they have incentive to give it attractive pricing or package it with their other services to sway smaller lenders.

Another is the possibility of big tech or alternative data players finding a foothold (imagine if one day an Equifax or Experian partnered with, say, a fintech that analyzes bank account cash flow data to create an “alternative FICO” that scores people ignored by traditional credit scores – that could carve a niche).

However, even these threats often underscore FICO’s moat: any new scoring system still has to prove itself against the benchmark, which is usually FICO performance. For a bank to adopt something new, they typically run it in parallel with FICO for years to validate it – effectively conceding that FICO remains the benchmark in the meantime. In sum, FICO’s competitive moat lies in being the standard and being everywhere.

Management Commentary

FICO’s management team, led by CEO William “Will” Lansing since 2012, deserves a lot of credit for the company’s strategic and shareholder-aligned execution. Lansing came aboard at a time when FICO was respected but perhaps not fully monetizing its potential. Over the past decade, he has shown a penchant for boldness and capital discipline that has materially boosted FICO’s fortunes. One of Lansing’s notable moves was to reprice FICO’s products to reflect their value. Under his watch, FICO has pushed through a series of price increases for its Scores business – something prior managements had been hesitant to do. The result, as noted earlier, is that FICO’s per-score fees for lenders have risen dramatically (three consecutive years of hikes in the mortgage score fee, culminating in that 40% jump in 2024. This has directly fed FICO’s bottom line and, by extension, enriched shareholders. Forbes recently highlighted that Lansing’s strategy of burnishing FICO’s dominance and charging what it’s worth has “made a bundle for long-term shareholders”.

Indeed, FICO’s stock price has exploded under his tenure – up roughly 10-fold since 2012. In 2023 alone, the stock soared 72.8%, reflecting stellar results and perhaps a long-delayed market appreciation of FICO’s quality. Lansing himself, who had a background in data businesses (InfoSpace, ValueVision) and even sat on FICO’s board before becoming CEO, is known to be a hands-on, data-driven leader. He often emphasizes FICO’s twofold opportunity: scoring and software, and how both can grow together (The FICO Score Is Probably The Biggest Innovation In Building The US Into The Consumer Economy: CEO William Lansing - Forbes India).

Another focus point: FICO’s leadership is operational focus. The company has kept its employee count lean (around 3,300 employees) relative to its revenue, and achieves very high revenue and profit per employee (over $500k revenue and $157k profit per employee – that’s Silicon Valley levels of productivity). This reflects a culture of efficiency instilled by management. They prioritize high-margin activities (like selling scores and SaaS software) and have been willing to sunset or downsize lower-margin consulting work. In earnings calls, Lansing often speaks to “quality of revenue” – preferring slower growth in a sticky, subscription-like model over one-time deals that might boost short-term sales but not long-term value.

Management has also navigated the political and regulatory waters shrewdly. When lawmakers and regulators began questioning the credit score oligopoly, FICO didn’t bunker down; instead, they engaged. For example, when the FHFA opened the door for VantageScore, FICO quickly got its newer Score 10T model approved as well (Credit Score Models and Reports Initiative | Fannie Mae) and has been lobbying to ensure lenders adopt it (leveraging the fact it’s more predictive with trending data). Lansing’s team also takes public stances to defend the company – witness the blog posts by executives like Jim Wehmann explaining the rationale for price increases in a transparent way (FICO confirms credit score price increase for mortgage originations - Scotsman Guide).

From a governance perspective, FICO’s board has notable members with tech and finance experience, and Lansing himself serves on a couple of other corporate boards, which broadens his perspective. There haven’t been any major governance controversies; the company is known for straightforward financial reporting and no drama. The main gripe one could have is that Lansing’s pay in some years has been high relative to peers, especially when big stock awards vested due to FICO’s outperformance. However, given the shareholder returns delivered, few are complaining.

In summary, management’s execution has been a strong positive factor for FICO. They have balanced investing in the business (R&D was about $135 million in 2024, a healthy ~8% of revenue, to keep FICO’s analytic edge) with returning cash to shareholders. They seem keenly aware of the franchise’s strengths and are methodically reinforcing them (e.g., moving clients to the FICO Platform to deepen the moat). Over the next few years, we expect the current team to continue in this vein – cautiously aggressive (if that oxymoron makes sense). They will likely keep tweaking pricing, pushing the platform transition, and expanding FICO’s reach, all while minding margins. For investors, the management’s track record inspires confidence that FICO’s business will be stewarded with a shareholder-friendly, long-term mindset.

Risk Assessment

No investment is without risks, and FICO, despite its strengths, faces a set of them – some old, some emerging. It’s important to spell these out in plain language: what could go wrong in the next few years for FICO’s story? Here are the key risks as we see them, framed candidly:

Competitive Encroachment: The elephant in the room is competition from VantageScore and other scoring models. With the upcoming mandate that mortgage lenders use both FICO and VantageScore for conforming loans, FICO’s near-monopoly is officially broken (Credit Score Models and Reports Initiative | Fannie Mae). Over a three-year horizon, we’ll see if VantageScore can eat into FICO’s market share. The risk is that some lenders might start favoring VantageScore (perhaps it’s offered at a lower price, or perhaps they find it predicts just as well for their needs). If, for instance, a major bank or two decided to switch their primary consumer credit score to VantageScore, it would not just be a symbolic blow – it could lead to lost revenue and pricing pressure for FICO. We think wholesale abandonment is unlikely (given FICO’s ingrained status), but even a 5-10% market share shift in certain product lines (like credit cards or autos) could slow FICO’s growth. Additionally, fintech lenders who cater to younger or niche markets might continue developing proprietary underwriting models that bypass FICO Scores altogether. If those lenders gain significant scale, FICO could be left out of a growing slice of the credit pie.

Regulatory and Political Risk: Ironically, the same forces that once blessed FICO (e.g., regulators in the ‘90s endorsing credit scoring to reduce bias could now pose a risk. There’s a populist angle to “big, mysterious credit score company raises prices on struggling borrowers” that can attract negative attention. We saw rumblings of this when FICO hiked prices – lawmakers sent inquiries and industry groups lobbied the FHFA to accelerate competition. There’s a risk that new regulations could aim to standardize credit scoring or cap costs. For example, imagine a rule that says credit scores used in mortgages must be provided to lenders at “fair and reasonable” rates, or a move to open up credit model competition even further (what if the government encouraged open-source credit score algorithms?). Extreme but not impossible scenarios. Furthermore, broader regulations on data privacy could impact FICO; if consumers gained more control over their credit data and could opt out of certain uses, or if bureaus were restricted in how they share data, FICO’s model development could be hampered. Lastly, any perception that credit scores are contributing to unequal access to credit (a social fairness argument) could lead to pressure for FICO to adjust its algorithms in ways that might be less predictive or to include data that’s not its forte – a risk to the efficacy of the score.

Innovation Lag / Disruption: FICO pioneered credit analytics, but we live in a world of rapid tech change. A risk is that FICO could fail to innovate quickly enough in incorporating new types of data or new modeling techniques. For instance, cash-flow underwriting (analyzing bank account data to gauge credit risk) is an area some startups swear by – if that proves significantly better than traditional credit scoring for certain populations, and FICO is slow to offer its own version, customers might look elsewhere. Similarly, advancements in AI could, in theory, produce risk models that adapt in real-time or use unstructured data (like someone’s online footprint) to assess credit – realms where FICO hasn’t played historically. While FICO has immense expertise, one can’t dismiss the risk of a disruptive innovation rendering the traditional FICO Score less relevant. This is a low-probability scenario in the near term, but not zero. Think of Kodak – they had the film industry locked until digital came. FICO’s “film” is credit bureau data. If the world moves to a different definition of creditworthiness (say, based on your income and spending patterns rather than loan history), FICO would need to adapt fast or find its core franchise erode.

Cyclical Exposure: FICO’s revenue has some sensitivity to the credit cycle. In a recession or credit crunch, lenders pull back – fewer loans, fewer credit card originations, fewer people seeking new credit. That directly means fewer FICO Scores pulled. We saw a mild version of this: in fiscal 2020/2021, FICO’s revenue growth was only ~1-5% as lending dipped. If we were to face a serious recession in the next couple of years, FICO could hit a speed bump. The Scores business would likely see a dip in volumes (especially if mortgage originations and credit card signups fall sharply). The Software business might also see slower sales, as banks tighten IT budgets or delay projects. Now, FICO isn’t as cyclical as, say, an actual lender – it doesn’t take credit losses – but it’s not immune to a lending downturn. Importantly for investors, such periods could create negative sentiment and stock volatility, even if the long-term value is intact.

Client Concentration / Partnerships: FICO sells through and to some very large entities. Its relationship with the Big Three credit bureaus is vital – they are conduits for distributing FICO Scores to thousands of lenders. If one of those bureaus ever had a fallout with FICO (perhaps over pricing or competition issues), it could temporarily disrupt FICO’s distribution. Similarly, a significant portion of FICO’s B2B score revenue comes from a relatively small number of large lenders (the biggest banks, auto finance companies, etc.). If one major client opted not to renew a contract or negotiated hard on price, FICO would feel it. So far, FICO has managed these relationships well – often signing multi-year agreements – but it’s a risk worth noting.

Reputation/Data Accuracy Risk: The FICO Score’s credibility is its lifeblood. If there were ever a scenario where FICO Scores were found to be dramatically wrong or someone uncovered a flaw (for example, suppose a data error at a bureau caused widespread incorrect scores that led to losses, or an event like the 2008 crisis occurred and critics alleged “FICO Scores didn’t predict this collapse”), it could tarnish the brand. Additionally, if an update to the scoring model had unintended discriminatory effects, FICO could face legal and reputational problems. While FICO is pretty conservative and rigorous in model changes, the risk is nonzero. Another reputational risk surfaced a few years ago: some fintechs argue that traditional scores exclude or mis-score certain consumers (for instance, some minority groups or younger folks). If that narrative gained political traction, FICO could be painted as part of the problem in financial inclusion, which could accelerate adoption of alternative measures. Essentially, FICO must continue to be seen as fair, accurate, and reliable – any cracks in that perception could widen the door for competitors or invite regulatory crackdowns.

Execution Risk in Software Transition: On the software side, FICO is moving from legacy products to the cloud Platform. Execution here is a risk – large tech transitions can see hiccups. If FICO fails to add enough new platform features or if customers find competitors’ platforms more attractive, the growth in that segment might stall. There are plenty of enterprise software competitors depending on the use case (fraud software from SAS or Nice Actimize, marketing analytics from Adobe, etc.). FICO has chosen to integrate a lot of functionality into its Platform, which is ambitious. The risk is that it stretches too broad and gets outcompeted in a few niches. However, so far the strategy seems coherent and progress is good, but it’s something to monitor because software markets can shift quickly (for example, if banks decide to build more in-house AI decision systems instead of buying from FICO, that’s a competitive threat).

In weighing these risks, I’d underscore that the biggest existential risk – losing relevance – appears remote in the next few years, but moderate risks around competition and regulation are definitely in play. FICO’s management is not unaware of these; they’re actively working to mitigate them (for example, by emphasizing the unique value of FICO 10T versus Vantage, and by joining industry efforts on financial inclusion). As investors, we should keep an eye on a few key signposts: adoption of VantageScore in actual usage (not just being approved), commentary from big banks regarding their use of scores, any regulatory announcements (FHFA implementation timelines, CFPB reports), and FICO’s own product pipeline (to see if they’re innovating at pace). FICO has a history of navigating challenges – it’s worth recalling that 15 years ago, many thought the introduction of VantageScore would severely threaten FICO, but FICO emerged even stronger, growing its revenues and expanding its business.

Valuation

FICO’s valuation is a tale of a premium business commanding a premium price – and for good reason, though it does warrant careful thought for long-term investors. Traditional valuation metrics paint FICO as expensive. The stock currently trades around $1,800+, which puts its trailing P/E in the mid-80s and forward P/E around 61. Its enterprise value is about 26× sales and ~61× EBITDA – multiples that are more akin to a high-growth software company than a mature financial services firm. By comparison, giants like Moody’s or S&P Global (which have their own wide-moat data businesses in credit ratings) trade at roughly 13× sales and 25-30× EBITDA. So clearly, FICO isn’t a “value stock” by the usual definition. The market is effectively pricing in many years of growth and continued dominance for FICO. Is that justified? I would argue that to a large extent, yes – because FICO’s business model and moat support a higher “quality premium,” and because its earnings are on a trajectory to grow into that valuation.

Let’s break down the valuation with some creative lenses:

Lifetime Value of a Consumer’s Credit Usage: One way to think of FICO is by considering how much value it derives from the average credit-using consumer. There are ~232 million credit-eligible adults in the U.S., and about 90% of them can be scored by FICO. Each time one of those consumers applies for a loan or opens a credit card, a FICO Score is likely used (often multiple scores if multiple bureaus are pulled). Over a person’s lifetime, they might generate dozens of FICO Score inquiries – mortgages, refinances, car loans, student loans, credit cards, etc. Even at a few dollars a pop, that adds up. If the economy and population grow, that pie grows. But importantly, FICO is trying to increase the value per consumer by introducing new scores (for example, FICO might score more use-cases, like periodic account reviews, or entering new markets like small business scoring). Every new domain that FICO’s algorithms can score is incremental revenue. So the customer lifetime value (CLV) of a consumer to FICO is trending up – not just through price increases but through more touchpoints (e.g., if FICO’s credit monitoring gains traction or if UltraFICO allows consumers to proactively use their bank data to get scored, that’s new revenue). This CLV perspective helps justify a rich valuation – FICO is deeply embedded in a consumer’s financial life and can monetize that relationship repeatedly at high margins.

“Toll Booth” Economics: FICO’s core model is like a toll collector on the bridge between lenders and borrowers. As long as that bridge has traffic, the toll collector makes money. And if traffic increases or the toll goes up, even better. Toll booth businesses (think Visa/Mastercard in payments, or Moody’s in bond ratings) often trade at elevated multiples because of their stability and pricing power. FICO belongs to this elite club. It has a strong return on capital (ROIC over 37% – indicating it needs little capital to generate profit) and converts a huge portion of earnings to free cash. These traits typically command a scarcity premium in the market. So investors are valuing FICO not on next quarter’s EPS, but on the durability of its cash flows for the next 5, 10, 20 years. When you model out FICO’s growth, even at, say, a conservative 8-10% revenue CAGR, with some operating leverage, you get to 15%+ EPS growth (especially with buybacks) – which means earnings could roughly double in 5 years.

Segment Sum-of-the-Parts: Another lens: consider FICO’s two segments separately. The Scores business is a super high-margin, quasi-monopoly with minimal capital needs – arguably one could value that akin to a software subscription or royalty business. It wouldn’t be crazy for that piece to be valued at 30-40× earnings on its own given its quality. The Software segment, growing slower and with lower margins, might be valued more like a typical software firm at, say, 20× earnings or a multiple of ARR. If Scores is ~75% of profit, and we slap, hypothetically, a 35× P/E on that and a 20× on the rest, we’d still end up in the ballpark of a 30×+ blended P/E for FICO. But FICO is currently at ~60× forward, implying the market is valuing it more like a high-growth SaaS firm and assuming the Scores business keeps its momentum. Perhaps investors are thinking of FICO as a unique hybrid – part fintech, part SaaS – deserving a unique multiple. It’s also possible the market is pricing in continued aggressive buybacks (which mechanically boost EPS growth). FICO’s share count is down ~1.3% in the last year and could shrink another few percent per year if buybacks continue, which makes the per-share metrics improve faster.

Peer Comparison and Intangibles: When comparing to peers, one must acknowledge that few companies are directly comparable to FICO. Credit bureaus like Equifax or Experian have similar elements (they sell scores and data), but they also have huge operations in data collection which have more costs (and they trade at lower multiples, ~20-25× earnings). Rating agencies (Moody’s, S&P) have the tollbooth model but in a different market (bonds vs consumer credit). Those trade around 35-40× earnings. FICO, by virtue of its smaller size and higher growth rate in recent years, commands more. It’s also a pure-play – if someone wants to invest specifically in the theme of “consumer credit scoring and analytics,” FICO is basically the stock for that, which can create a scarcity premium in itself.

All this is to say, at ~60× forward earnings, FICO is priced for excellence – the market is assuming FICO will continue to execute flawlessly and maintain its dominant role. This could lead to short-term volatility. When great businesses have decades-long growth runways, paying up isn’t necessarily a mistake (consider how Visa or Microsoft often looked “expensive” yet kept climbing). FICO has that profile, in my view.

Catalysts and Events

Looking ahead, several catalysts and events could materially impact FICO’s trajectory and investor sentiment. Being aware of these will help in monitoring the investment and potentially timing additions or trims to the position. Here’s what’s on the radar with a 3-year outlook:

Mortgage Score Competition (2025-2026): FHFA’s transition to requiring both FICO 10T and VantageScore 4.0 in mortgages is pivotal. Key watchpoints: lender adoption rates, indications of market preference shifts, and management commentary on competitive dynamics. Early signs of preference for FICO will reinforce its market dominance; significant adoption of VantageScore would pose a risk.

FICO Platform & Cloud Adoption: Monitor high-profile client wins and growth in Software ARR. A major global bank adopting the FICO Platform or accelerated Software ARR growth (double-digit percentages) would boost confidence and could re-rate the stock closer to a SaaS valuation.

Interest Rate and Credit Cycle: A decline in interest rates or stimulus-driven credit expansion could significantly lift mortgage activity, positively impacting score volumes. Conversely, sustained high rates or a recession-driven credit pullback would negatively impact revenue.

Capital Allocation (Share Buybacks/Dividend): FICO’s current $1 billion share repurchase authorization supports EPS growth and stock price stability. Accelerated buybacks during dips are positive signals. Dividend initiation or a stock split could enhance investor appeal and market sentiment.

M&A Activity: Watch for strategic acquisitions in software or analytics, signaling expansion of FICO’s technology offerings. Although unlikely, potential acquisition interest in FICO itself remains a speculative catalyst.

Product Innovation: Look out for new scoring products, upgrades, or specialty models (alternative data, gig economy scores, rental scores). Successful product launches (e.g., Mortgage Simulator) would reinforce FICO’s innovation narrative and create incremental revenue streams.

Conclusion

In wrapping up this deep dive, let’s revisit the core narrative: FICO is a unique, high-moat business at the intersection of finance and technology, and it has proven its mettle over decades. Over the next three years, I expect FICO to continue being a strategic cornerstone in credit markets, benefiting from sustained demand for its scores and increasing traction of its analytics platform. The investment thesis rests on FICO’s ability to maintain its virtual lock on credit scoring even as the environment shifts.

From an investor’s perspective, owning FICO is a bet on the enduring need for a trusted arbiter of credit risk in an ever more data-driven world. It’s also a bet on management to wisely capitalize on that position – by smart pricing, product innovation, and capital return – which so far they have. The key strengths – near-universal adoption, enormous data advantages, brand authority, and financial firepower – form a multi-faceted moat that few, if any, competitors can match in full. Those strengths manifest in tangible results: high growth, high margins, high returns on capital. Strategic challenges exist (and we discussed them in plain terms), but they seem manageable relative to FICO’s entrenched position. The credit scoring landscape may gradually open up, but it’s more likely to resemble a regulated duopoly than a commoditized free-for-all. And in a duopoly of FICO vs. anyone, FICO starts miles ahead.

The stock’s valuation is not cheap, and that means investors should brace for some volatility if any hiccups occur. However, given the company’s track record and multiple growth levers, we believe FICO will continue to grow into and justify its premium valuation. The next three years are set to be interesting: FICO will be defending its turf (in mortgages, for instance) while also expanding new frontiers (like broader enterprise decision software and international markets). If successful, by 2028 FICO could well be a larger, even more profitable company with an even stickier client base – potentially rendering today’s valuation multiples actually lower in hindsight, once higher earnings are in hand.

In my opinion, investing in FICO is investing in the backbone of the credit economy. It’s an investment in the idea that as long as people borrow money, lenders will need a quick, reliable way to size them up – and FICO will be there collecting its small toll on each of those decisions. Over a three-year horizon and beyond, that toll booth isn’t going anywhere; in fact, it may add a few extra lanes.

Thoughts after the recent sell-off? Fears overblown or thesis is over? Of course stock is still expensive but bounce back possible if regulatory pressures ease