Deep Dive: Robinhood Markets, Inc. $HOOD

Robinhood Markets (HOOD) sits at the crosshairs of today’s market zeitgeist. In a high-rate environment that’s rewarding cash-rich financial firms, Robinhood has found an unlikely tailwind – earning hefty interest on idle client cash (Robinhood posts surprise profit on interest income boost, trading rebound | Reuters). At the same time, generative AI mania is sweeping tech, and Robinhood is angling to infuse AI into personal finance. Add looming regulatory crossfires (think SEC scrutiny of payment for order flow) and you have a perfect storm of relevance.

Robinhood’s neon logo became an icon of the pandemic-era trading boom, representing a surge of new retail investors. Now, in 2025, the company finds itself at a crossroads of opportunity and scrutiny.

Robinhood’s rise is timely. After a post-meme crash, its stock nearly tripled in 2024 amid a crypto rebound and new product momentum. With markets normalization and Gen Z coming of age financially, the question “Why now?” answers itself: Robinhood is positioning to be the financial operating system for a new generation right as that generation accumulates influence (and inheritance).

The company’s narrative – rebellious fintech liberator or irresponsible casino? – makes it a magnet for both fervent fans and harsh critics.

Company Story & Psychology

Robinhood’s journey reads like a roller coaster. Founded in 2013 with a mission to “democratize finance,” it pioneered zero-commission trading and captured the imagination of millions of first-time investors. During the pandemic boom, Robinhood became the venue for armchair traders flooding the market. Monthly active users exploded, and the app’s slick, game-like interface turned stock trading into a viral consumer product. By early 2021, Robinhood was at the center of a retail trading frenzy – the GameStop saga – as newbie traders on Reddit’s WallStreetBets used the app to wage war against hedge funds.

But with fame came backlash. When Robinhood infamously halted buying of GameStop and other meme stocks in Jan 2021 due to clearinghouse constraints, outrage ensued. To many users, it felt like a betrayal – siding with institutions over the little guy. “I don’t think I could trust a company that freezes buys during the 2021 GameStop incident,” one Redditor wrote, calling it the largest breach of trust imaginable. That event sparked political backlash (Congressional hearings featured Robinhood’s CEO defending the move) and a crisis of confidence among users. The app that empowered retail investors suddenly looked like a double agent. Robinhood’s brand went from heroic disruptor to suspect intermediary practically overnight.

This speaks to the core tension in Robinhood’s psychology: Is it a serious brokerage platform or a gamified dopamine machine? Massachusetts regulators once accused Robinhood of treating trading “as some sort of game that you might be able to win” (Robinhood settles ‘gamification’ case with Massachusetts regulator for $7.5M). The app’s early design – confetti animations, free stock giveaways – was lauded for engaging newcomers but criticized for “gamification” of investing.

That criticism turned very real in 2020 when a young Robinhood user tragically took his life after misunderstanding an options trade; observers blamed the app’s game-like UX for encouraging risky behavior without sufficient safeguards. Robinhood has since tempered its style (no more confetti cannons when you trade) and added educational and safety features. Still, its identity balances precariously between accessible and addictive. The company wants to be seen as the real deal – a gateway for serious long-term investors – but it can’t fully shake the perception (partly self-inflicted) that it’s also “Vegas in your pocket.” This duality defines Robinhood’s story: a fintech folk hero with a lingering reputation hangover.

The Numbers

By the numbers, Robinhood’s business has undergone whiplash changes – from explosive growth to painful contraction, and now a cautious upswing. After peaking around 21 million active users in the meme-stock era, user engagement cooled. As of late 2024, funded accounts stood at 25.2 million (up 8% year-over-year) (Robinhood Reports Fourth Quarter and Full Year 2024), but monthly active users remain below their 2021 highs. Notably, average revenue per user (ARPU) has more than doubled: reaching $164 in Q4 2024, up 102% from a year prior.

On the face of it, that’s an incredible jump – but it comes with context. A large chunk of Robinhood’s revenue is now driven by interest income (thanks to 5%+ interest rates) and a resurgence in crypto trading, meaning the ARPU spike says as much about macro conditions and crypto volatility as it does about users trading more. In fact, trading activity per user is recovering from the 2022 doldrums, but the bigger story is Robinhood milking more dollars per user via new products and higher yields.

(Robinhood posts surprise profit on interest income boost, trading rebound | Reuters) Robinhood’s revenue mix has dramatically shifted. “Transaction-based” revenues (green) from trades plunged after the 2021 boom, but net interest income (black) surged as interest rates rose. By late 2023, interest earnings actually eclipsed trading revenues – a stark reversal of the 2021 model.

The latest financials show Robinhood hitting its stride profit-wise. Q4 2024 total revenue was $1.01 billion, up a stunning 115% year-on-year. For the full year 2024, revenue reached $2.95B (up 58%) and GAAP net income swung to $1.41B – its first full-year profit. These are eye-popping growth rates, but let’s unpack the drivers. In Q4, transaction-based revenues (payment for order flow from equities/options/crypto) came in at $672M, over 200% higher than a year prior.

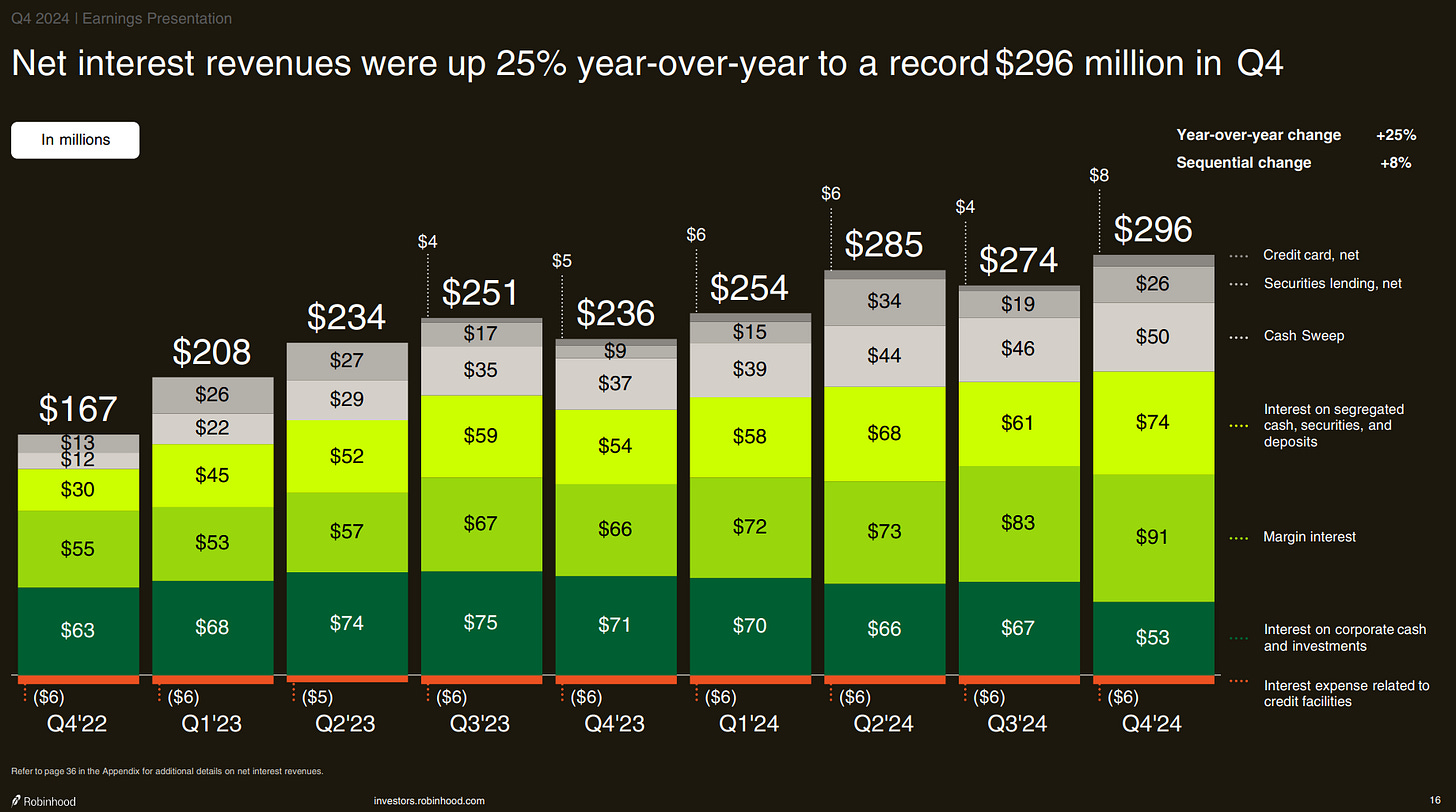

The big boost? Crypto trading. Crypto revenue hit $358M in Q4, skyrocketing over 700% year-over-year. After a crypto winter in 2022, Robinhood benefited from a crypto trading revival (Bitcoin’s price doubled in 2024, sparking trading interest). Options trading revenue also grew 83% to $222M, reflecting that Robinhood’s core user base is engaging in more complex trades as the platform rolls out advanced features. Equity trading revenue was a smaller $61M (up 144%), highlighting that stock commissions – once Robinhood’s claim to fame – are now a minor piece of the pie. Meanwhile, net interest revenue reached $296M for Q4 (up 25%), as Robinhood earned juicy yields on customer cash and margin loans. With Fed rates high, every idle dollar in a Robinhood account became a profit center. In essence, 2024’s numbers reflect a new reality: Robinhood makes more money when users aren’t trading (just holding cash) and when they trade the riskiest stuff (crypto and options). It’s a paradoxical mix of steady and volatile income streams.

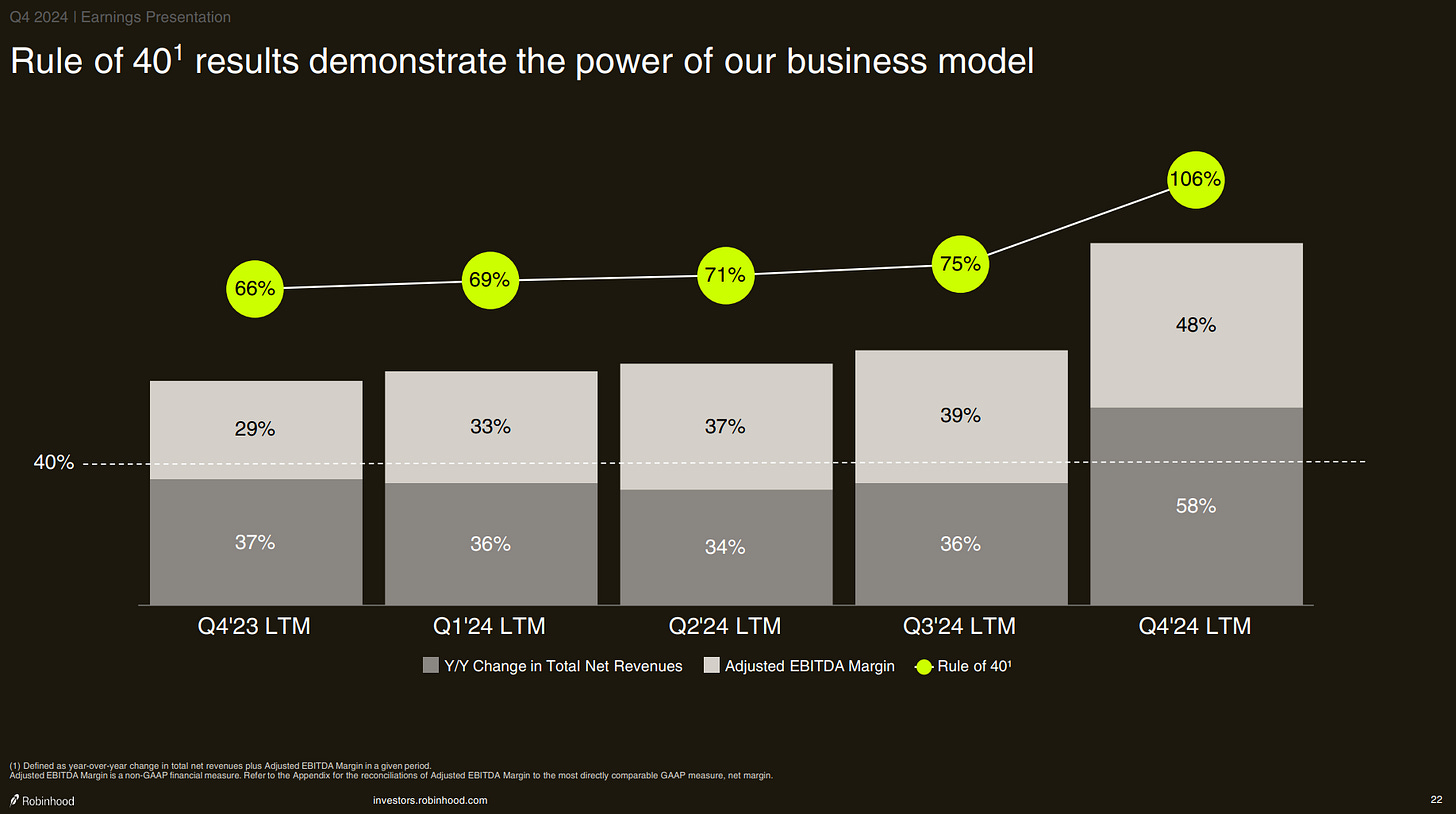

Critically, Robinhood achieved GAAP profitability in recent quarters after years of losses. It earned $0.18 per share in Q1 2024 and $1.01 per share in Q4 2024 (boosted by one-off tax benefits). Even adjusting for those, the company is solidly in the black on an operating basis. That’s a far cry from 2021-2022, when ballooning expenses and shrinking revenues led to heavy losses. Management slashed costs – multiple rounds of layoffs (about 5 layoffs in 1.5 years, by some counts) were the painful part of that fix. The result: operating expenses in Q4 2024 were only 3% higher than a year prior, while revenues doubled – operating leverage in action. Robinhood’s EBITDA margins are now robust. Crucially, the company still has a ~$4B war chest of cash and even bought back ~7% of its shares (including a repurchase of the entire 7.6% stake once owned by Sam Bankman-Fried) for ~$606M – a shareholder-friendly move that removed an overhang. For a “story stock,” these numbers impart real credibility. The trajectory shows a company that went from hyper-growth (2020) to crisis (2021-22) to a more mature, diversified revenue model in 2024. The risk signals in the numbers? User growth is modest – Robinhood may have saturated the U.S. millennial/Gen Z trader market, and monthly user counts actually dipped in 2022-2023 before stabilizing. The recent revenue boom relies on crypto trading (notoriously fickle) and interest rates (which could fall). So, while the financial snapshot is strong now, investors must ask: how sustainable is this mix? Robinhood will need to keep users engaged (so that transaction revenue doesn’t slip) and also keep them funded (so it can earn interest), a balancing act that will define its “new normal.”

AI Capabilities & Optionality

If 2024 was about financial performance, 2025 and beyond might be defined by AI and innovation for Robinhood. The company is aggressively exploring how artificial intelligence can enhance its platform – both as a differentiator and a new revenue stream. One flagship initiative is Robinhood Cortex, an AI-driven investment assistant slated to launch in 2025 (Introducing Robinhood Strategies, Robinhood Banking, and Robinhood Cortex - Robinhood Newsroom).

Billed as a “real-time analysis and insights” engine, Cortex aims to put a “premium research assistant in your pocket,” according to Robinhood’s product team (Introducing Robinhood Strategies, Robinhood Banking, and Robinhood Cortex - Robinhood Newsroom). In practical terms, Cortex will use AI (likely large language models or similar) to help users digest market news, answer the perennial “Why is this stock up or down today?” question with automated summaries, and even suggest potential trades based on technical signals. Notably, Robinhood is careful to frame Cortex as assistive AI, not a trading autopilot – “Cortex is not placing trades for you,” the company emphasizes. Over time, however, one could imagine more AI-driven personalization: tailored investment ideas, risk alerts, maybe even AI-crafted portfolios within user-defined parameters.

Robinhood has also made moves in robo-advisory and AI-powered advisory. In late 2024 it announced Robinhood Strategies, a low-cost robo-advisor service with a 0.25% fee (free over certain balances for Gold members) (Introducing Robinhood Strategies, Robinhood Banking, and Robinhood Cortex - Robinhood Newsroom). Unlike pure passive robo-advisors, Strategies will include a mix of ETFs and individual stocks, adjusted to user risk tolerance, with features like Monte Carlo simulations of future returns and tax-loss harvesting built in. This signals Robinhood’s intent to move upmarket – courting users who want a managed portfolio or financial planning, not just DIY stock picks. How does AI figure in? Robinhood’s CEO Vlad Tenev has hinted at eventually layering AI into wealth management, but interestingly, he’s not rushing fully autonomous AI advice yet. In fact, Robinhood acquired a startup called Pluto Capital in 2025, which offers AI-powered investment research and “highly-customized investment strategies based on customer needs and goals”. This suggests that Robinhood is amassing the tech to algorithmically generate personalized portfolios or trade strategies – a potential robo-advisor 2.0 that could leapfrog traditional robos. For now, Tenev indicated they’re holding off on letting AI manage money autonomously, opting to launch a more conventional robo-advisor first. But the pieces (Pluto’s AI, Cortex’s insights, and the new RIA custody platform via TradePMR acquisition) point to a future where Robinhood could deploy AI agents for finance. Imagine an AI that knows your goals and risk profile, watches the markets 24/7, and nudges you (or even reallocates for you) when needed – that’s the kind of optionality Robinhood is quietly building.

Separating hype from reality is important here. Many fintechs are bandying about AI buzzwords. What’s real for Robinhood is the user-facing features coming soon: AI-driven news summaries, smarter screeners, perhaps chatbot-style support answering “what’s the P/E ratio?” etc. These are incremental but useful. Also real is Robinhood’s push into leveraging AI for scale – for example, risk management (AI to detect fraudulent activities or risky trading patterns) and customer service (chatbots to handle common queries) could improve efficiency. The hype would be assuming AI alone will transform Robinhood’s economics. It likely won’t – not immediately. Competitors can and will implement similar features. However, Robinhood’s edge is its massive retail dataset and a user base that is very digitally native. If any brokerage can get users comfortable with an AI co-pilot for investing, it’s probably Robinhood. The optionality here is huge: AI could enable new services like personalized portfolios on the fly, automated tax optimization, or even AI-guided education (“teach me options trading”). Robinhood might also partner with established AI players; e.g., integrating something like an OpenAI API for financial Q&A, or partnering with an asset manager to create AI-monitored funds for its platform. In sum, Robinhood is treating AI as the next frontier to keep its young customers engaged and to broaden into advisory without heavy human headcount. The moves (Cortex, Pluto, Strategies) show a sharp focus reminiscent of how it approached crypto early. The reality to watch: Will these AI and advisory offerings actually attract a wider array of customers (older investors, or newbies who want guidance), or will they mostly be add-ons for existing users? Breaking into full-fledged investment advice is crucial if Robinhood wants to capture the upcoming $84 trillion wealth transfer to millennials (Ground News) – AI might be the key to doing it at scale.

Sports Betting: Robinhood’s Vegas Moment

In a move that blurs the line between Wall Street and Las Vegas, Robinhood is dipping its toes into sports betting – or more precisely, sports trading. Earlier this year, Robinhood quietly rolled out sports event contracts tied to major events like the Super Bowl and March Madness (You can now make March Madness bets on Robinhood. Will regulators allow sports contracts at more brokerages? - MarketWatch). These are essentially financial derivatives that let users wager on the outcomes of sporting events, treating games like just another asset class. For example, a contract might pay out if Team X wins the championship, and trade up or down in value leading up to the game. It’s a novel attempt to bring the multibillion-dollar sports-betting industry into Robinhood’s domain. Why would Robinhood do this? Because its user base skews young, male, and risk-friendly – overlapping heavily with the demographics of sports bettors. And with U.S. sports betting revenue hitting a record $13.7B in 2024 (up 25% YoY), it’s a huge (and rapidly growing) pie to get a slice of.

Robinhood’s approach isn’t to become a traditional sportsbook (they’re not trying to be the next DraftKings exactly), but rather to create a betting exchange model. CEO Vlad Tenev hinted that any sports betting product would likely take the form of “event contracts” where users trade outcomes with each other, instead of betting against the house. In other words, Robinhood wants to be the neutral marketplace for bets, much like it is for stocks, taking a small fee on each transaction. This peer-to-peer model could offer bettors better odds (since there’s no built-in house edge), effectively making Robinhood the NASDAQ of sports bets. They tested the waters with event markets for the 2024 Presidential election and big games; user interest was reportedly strong (March Madness contracts garnered attention) and it fits Robinhood’s ethos of turning anything and everything into a tradable asset. Culturally, it’s also on-brand: Robinhood has always gamified stock trading – now it’s literally converging with actual games.

However, this “Vegas moment” for Robinhood comes with substantial hurdles. Regulation is the big one. Traditional sports betting is regulated state-by-state via gaming commissions, whereas Robinhood is attempting to do it under the umbrella of the CFTC (Commodity Futures Trading Commission) as event-based futures. The CFTC has historically frowned upon event contracts that resemble gambling. In fact, it’s currently fighting to prohibit platforms like Kalshi from offering political betting markets, and has proposed a rule that would ban exchanges from listing contracts on “gaming” events (sports, elections, etc.) as contrary to public interest (Robinhood’s Sports Betting Dreams Face a Challenging Reality). Robinhood, for its part, is lobbying against that – its derivatives chief argued to regulators that sports event contracts can serve legitimate hedging purposes (e.g. a business could hedge revenue tied to a sports outcome). But the outcome is uncertain. In plain terms: it’s legally easier to open a sportsbook in, say, New Jersey than to get a nationwide event-contract approved. So Robinhood’s sports betting dreams face a gauntlet of red tape. Tenev acknowledged the difference, noting their version would be “very, very different” from the standard state-regulated model – meaning more like trading contracts than placing parlays.

Then there’s the competitive landscape. Should Robinhood go full tilt, they’d square off against entrenched players like DraftKings, FanDuel, BetMGM, etc., who have spent billions on marketing, user acquisition, and securing licenses in dozens of states. Analysts are skeptical Robinhood can just parachute in and grab market share. JMP Securities noted it’s “incredibly hard to start from scratch” in sports betting given the intense competition and infrastructure needed. They suggested Robinhood would have better luck sticking to an exchange model (which, indeed, is the plan) to avoid the costly war of promotions and free bets that traditional sportsbooks engage in. Strategically, Robinhood’s advantage is its existing user base of investors who might welcome a one-stop app for both stocks and sports wagers. It can cross-sell with relatively low cost – e.g. “you trade stocks all day, why not trade the Lakers game tonight?” The product-market fit is plausible: young traders often do view the stock market like sports betting (many cut their teeth during the meme stock era by effectively gambling on volatile stocks). So giving them a legitimate outlet to wager on sports within the same app could increase engagement and retention. The growth potential is significant if they crack the code. Even a small share of that $13B+ sports betting revenue market could add a new high-margin revenue stream (since exchange-style betting would have nice take rates without the risk exposure of a sportsbook).

Still, execution will be key. Robinhood will need to simplify event contracts so they’re as easy to use as a FanDuel moneyline bet – a UX challenge. And regulatory clearance must come; otherwise, Robinhood might be limited to offering these contracts in only a few jurisdictions or not at all. In summary, Robinhood’s sports betting foray is a bold, controversial bet in itself. It underscores management’s “why not trade it?” philosophy – if people will speculate on it, Robinhood wants to offer the venue. This could become a unique differentiator versus fintech peers (none of whom have ventured into this territory yet). Or, if regulators balk, it could be DOA. For now, consider it a high-upside call option in Robinhood’s portfolio of strategies – one fittingly akin to a longshot sports bet: potentially lucrative, but far from guaranteed.

Who are Robinhood’s Challengers?

Robinhood isn’t playing alone in the fintech arena. On one side are the fintech upstarts: SoFi, Cash App (Block), Coinbase, Webull, etc., which each attack a slice of the market; on the other side, the legacy titans like Charles Schwab, Fidelity, and Morgan Stanley who have adapted to zero commissions and offer soup-to-nuts financial services.

Versus Fintech Peers:

– SoFi: Once known for refinancing student loans, SoFi has transformed into a one-stop financial platform (banking, lending, investing, credit cards, etc.). It now boasts over 10 million members as of late 2024 and a nationwide bank charter. In investing, SoFi offers stocks, ETFs, robo-advisory, crypto, and even IPO access, similar to Robinhood. However, SoFi’s users often come for the high-yield savings or loans and then dabble in investing, whereas Robinhood’s come for investing first. SoFi’s advantage is a breadth of product – it can upsell a Robinhood trader into a SoFi mortgage, something Robinhood can’t (yet) do. Robinhood’s advantage is focus and brand in trading. SoFi’s investing interface is improving but less slick/gamified than Robinhood’s. In short, SoFi is a direct competitor in courting young investors, but it positions itself more as a traditional financial advisor (“get your money right”) whereas Robinhood leans into trading as empowerment and entertainment. SoFi’s marketing (naming NFL stadiums, etc.) is heavy; Robinhood has been more viral and organic in growth. Both have positive momentum – SoFi grew members ~30% in 2024 and Robinhood’s assets under custody grew ~88% in 2024, suggesting room for both. But if Robinhood moves into banking (hello, Robinhood Banking launching with checking/savings for Gold members, it’s a shot across SoFi’s bow.

– Cash App (Block): Cash App has ~50 million active users and is deeply embedded in peer-to-peer payments and the cultural zeitgeist (it’s a verb – “CashApp me”). It offers basic investing: you can buy stocks and Bitcoin in the app, even in tiny fractions. Cash App’s strength is its massive user base who use it daily for payments; converting some of them to investors is a bonus. However, Cash App’s investing feature is extremely simple (no options, limited securities) – it’s more akin to a hobbyist tool. Robinhood, in contrast, is a dedicated investing app, with far more products (options, margin, crypto variety) and a community of engaged traders. Brand-wise, Cash App resonates for convenience and inclusivity (it serves underbanked populations too), whereas Robinhood is more about active market participation. The two overlap on Bitcoin trading – both are popular ways to buy BTC among young people. Block’s ecosystem (Square merchants, Cash App, Tidal, etc.) could give it long-term cross-selling advantages (e.g., use Bitcoin earned via Cash App for purchases), but in pure investing mindshare, Robinhood is ahead. The risk for Robinhood is that Cash App’s gigantic scale could easily ramp up investing if it chose – though given Block’s focus, it’s not their priority to become a trading platform. So in this chess match, Cash App is like a rook that’s mostly moving on a different file (payments), but always capable of sliding over into Robinhood’s territory.

– Coinbase: In the crypto realm, Coinbase was the incumbent that Robinhood encroached on. Coinbase has ~100 million registered users globally (though far fewer active) and a trusted reputation in crypto, but it charges relatively high fees to retail traders. Robinhood offered commission-free crypto trading (with revenue via spreads/PFOF), undercutting Coinbase’s model for casual traders who just want to dabble. In 2022’s bear market, both companies’ crypto volumes plunged, but 2024’s rebound saw Robinhood’s crypto volumes surge over 400% (Robinhood Reports Fourth Quarter and Full Year 2024). Interestingly, Robinhood is making moves that could challenge Coinbase more directly: adding more coins (it listed several new assets in 2024), enabling crypto transfers to external wallets, and even introducing **crypto staking (in the EU) and plans to acquire Bitstamp, a long-running crypto exchange. If the Bitstamp acquisition closes, Robinhood gains a foothold in Europe and a platform for more sophisticated crypto traders (including an institutional client base) – effectively expanding its chessboard overseas. Coinbase still has a deeper crypto offering (dozens of altcoins, NFTs, etc.) and the mindshare of being “the crypto trading app” for many. But Robinhood has something Coinbase craves: diversification. Coinbase is very correlated to crypto cycles, whereas Robinhood can fall back on stocks, options, and interest income. Also, if U.S. crypto regulation tightens (SEC has sued Coinbase, labeled some coins securities), Robinhood has been nimble – it preemptively delisted tokens like Cardano and Solana when the SEC signaled trouble. So in crypto, we have a rivalry where Robinhood is fighting on Coinbase’s turf, and arguably winning the newbie segment (if you’re a first-timer wanting a bit of Bitcoin, doing it in an app where you also trade stocks is convenient). The optionality from Bitstamp indicates Robinhood wants to go global and maybe even support advanced trading like Coinbase’s exchange. This competition will heat up as crypto recovers.

– Smaller Brokers (Webull, eToro, etc.): Webull is often cited as an alternative for disgruntled Robinhood users (it, too, offers free trading, options, crypto). It’s backed by Chinese investors and has grown quietly, reportedly picking up users especially during the meme stock fallout when some left Robinhood. Webull’s interface is more technical (more charts, data) but less fun; it’s like a mini-Thinkorswim. Robinhood still dwarfs Webull in user count and AUC. eToro, a social trading platform big internationally, tried to go public and expand in the U.S., but hasn’t materially dented Robinhood’s share yet. These niche players may nibble at the edges, but none have achieved the brand resonance Robinhood has in the U.S. Robinhood remains the name synonymous with retail trading app for Gen Y/Z. That brand power is an asset – despite controversies, millions still have the app on their phones and many came back as markets turned up.

Versus Legacy Brokers:

– Charles Schwab / Fidelity / E*Trade (Morgan Stanley) / Vanguard: The established brokers largely followed Robinhood’s lead in eliminating commissions by late 2019. They enjoy scale and trust, managing trillions in assets. For example, Schwab now has over $10 trillion in client assets (Schwab Reports Monthly Activity Highlights) and ~34 million brokerage accounts after acquiring TD Ameritrade. These giants have features Robinhood is racing to add: full banking services, retirement accounts, wealth management, advisor services, etc. In 2022-2023, many frustrated Robinhood users (especially older ones) moved assets to firms like Fidelity, which saw a surge of new retail accounts. The incumbents’ strength is comprehensive offerings and reliability – they won’t crash on a volatile day (usually), they have 24/7 customer support phone lines, and decades of reputation. Robinhood historically lagged here (it infamously had outages and poor support in its early days, though it’s improved since, adding 24/7 phone support in 2022). Culturally, Robinhood’s challenge is to convince more serious investors to keep money there. The average Robinhood account is a few thousand dollars; the average Schwab account is in the six figures. That’s why Robinhood launching Robinhood Retirement (with a 1% IRA match to entice contributions) was key – and saw $13 billion in retirement assets in a year, a 600% jump, showing strong uptake. The new TradePMR acquisition (an RIA custodial platform) signals Robinhood wants to host independent financial advisors and their wealthy clients’ assets – a direct play into Schwab’s core business. It’s a bold move: imagine advisors being able to custody assets on Robinhood’s infrastructure (perhaps attracted by lower costs or better tech). If successful, this could start capturing the boomer wealth that currently lives at the big firms.

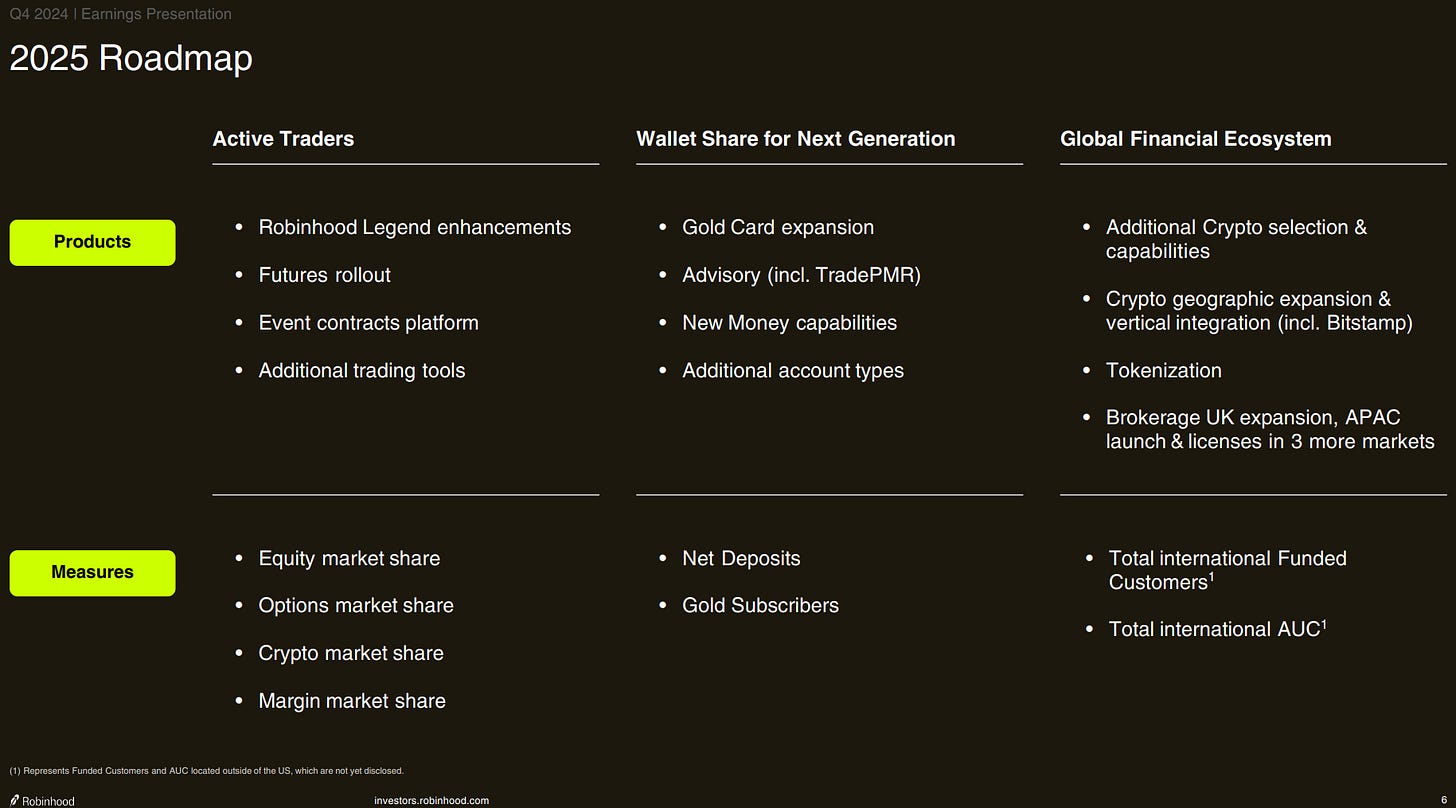

Still, legacy firms aren’t standing still. Fidelity launched its own youth-oriented app (“Fidelity Spire”), offers fractional shares, crypto trading for retail, and even has a thriving Reddit-esque community (Fidelity’s subreddit and social media presence are surprisingly hip). Schwab is consolidating TD Ameritrade’s superb trading tools (thinkorswim) – advanced traders who graduated from Robinhood’s simplicity often go to Thinkorswim or Interactive Brokers for more sophisticated needs. Robinhood is countering by launching “Robinhood Legend,” a desktop platform with advanced charting and futures trading to court active traders. This is essentially saying: Don’t leave us for TD or IBKR; we’ll give you pro tools in the Robinhood ecosystem. It’s an important pivot – acknowledging that as its users mature, the platform must mature with them or risk losing them.

In terms of innovation vs. marketing strength: Robinhood clearly has been an innovator (zero commissions, fractional shares at scale, mobile-first design, instant account opening, etc., were adopted by others later). Its product development pace in 2024 was frenetic – launching index options, futures, a credit card, retirement, advisory, crypto expansion – a breadth that starts to rival full-service brokers. The incumbents, however, have marketing muscle and trust. For many, seeing a Super Bowl ad for E*Trade babies or having a Fidelity branch in town confers legitimacy that a flashy app might not. Robinhood’s brand resonates strongly with younger users; a 19-year-old first-time investor is far more likely to think of Robinhood than Schwab. But with that resonance comes the baggage of the past scandals. The company has been working to repair its image (ad campaigns emphasizing long-term investing, more educational content, emphasizing “Investing for All”). Trust is a currency that Schwab and Fidelity have earned over decades; Robinhood is still, in some circles, rebuilding it.

Regulation & Risk

No Robinhood analysis is complete without addressing the regulatory elephant in the room. This is a company that, by its very nature, has poked the hornet’s nest of regulators since day one.

Payment for Order Flow (PFOF): This is the mechanism that underpins Robinhood’s commission-free trades – selling order flow to market makers for a rebate. PFOF makes up a significant portion of transaction revenue (especially for equities and options). It’s also been a magnet for criticism, with claims it creates a conflict of interest (brokers might route orders to whoever pays the most, not who offers best execution). Gary Gensler, the SEC Chairman, has repeatedly voiced skepticism about PFOF, calling out brokers like Robinhood and Schwab by name (Wall Street lines up against Gensler on one of his controversial ideas). In late 2021, the SEC floated the idea of an outright ban on PFOF – something that sent chills through Robinhood’s stock back then. Where do we stand now? The SEC did propose major order-handling reforms in 2022, including potential auction mechanisms for retail orders, but by mid-2023 it seemed the commission backed off an outright ban. Instead, we might see enhanced disclosures and perhaps an attempt to force more competition for retail orders (which could compress the PFOF margins). For Robinhood, a full PFOF ban would have been borderline existential in its early years – it would mean finding a new revenue model or charging commissions (unthinkable for its brand). Now, however, the company is more diversified. If PFOF were curtailed, Robinhood could likely survive by leaning on other revenue (net interest, subscriptions, maybe small per-trade fees or premium tiers). Still, it’s a risk: anything that reduces PFOF or makes routing less profitable could dent revenue. The good news: this risk seems to be diminishing, as regulators opted not to swing the axe entirely. And internationally, Robinhood is expanding in regions (UK, EU, Australia possibly) where PFOF is banned – so it’s learning to operate with different models (like charging explicit FX or small commissions). Fixable? Yes, with adjustments (they could charge for an optional “premium execution” or simply live with slimmer margins). Existential? Not unless they ignored it completely, which they aren’t.

Gamification & Fiduciary Duty: Regulators and lawmakers have scrutinized Robinhood’s user engagement tactics. As discussed, Massachusetts regulators filed a high-profile complaint in 2020 calling Robinhood’s app a “game” that encourages excessive trading. That legal battle ended in early 2024 with Robinhood agreeing to a $7.5M settlement and to overhaul certain app features (no more celebratory animations tied to trades, toned-down nudges, etc.). Robinhood did not admit wrongdoing, and even said the allegations didn’t reflect the current app. With that settlement, one major gamification cloud is lifted – it resolves a 3-year fight and likely sets a compliance framework Robinhood can live with. The company has already shifted its tone: more emphasis on long-term investing, adding customer support and safeguards. The risk here is if further regulations come that require brokers to adhere to a stricter “duty of care” for customers (similar to how investment advisors must). If every brokerage had to ensure trades were in a client’s best interest, Robinhood’s high-volume model could be in jeopardy. But such rules have not materialized broadly; instead we see piecemeal actions like FINRA’s 2021 fine of $70M against Robinhood for outages and customer harm – essentially punishing past missteps. Those were big headlines, but Robinhood survived them and upgraded its systems. This category of risk – platform outages, misleading communications, etc. – is largely fixable with better infrastructure and transparency. Robinhood can’t afford another March 2020-style outage on a big trading day; so far, it’s held up well since. As for addictive design – that’s somewhat subjective, but clearly Robinhood is under the microscope to keep things responsible. It has implemented things like risk warnings, restrictions on instant options approval, etc. Future innovations (like the sports contracts) will also be watched closely for skirting into gambling territory.

Crypto Regulation: Robinhood’s foray into crypto opens another flank of regulatory risk. The SEC’s aggressive stance in 2023 – suing major exchanges and declaring many tokens as unregistered securities – forced Robinhood to adjust. In mid-2023, Robinhood proactively delisted Cardano (ADA), Polygon (MATIC), and Solana (SOL) after those were named in SEC actions. It was a prudent move to avoid getting directly entangled. Still, the broader uncertainty remains. If the SEC or Congress imposes strict rules on crypto trading for retail (e.g. limiting it to registered broker-dealers, or prohibiting PFOF in crypto), Robinhood will have to comply – likely it would, since it’s already a regulated broker. The company is also registered with FinCEN for its crypto business and has a New York BitLicense (through its subsidiary), meaning it’s more regulated than pure crypto-native companies. Risk factor: if crypto were essentially “regulated away” for retail (unlikely at this point, given its entrenchment), Robinhood would lose a big growth driver. More realistically, they’ll have to continue curating which coins to list (a conservative approach could mean missing out on some trading fads, but also avoiding legal trouble). Also, custody and security regulations could increase costs (ensuring coins are held safely, etc.). The existential threat of the U.S. banning crypto trading seems low; but periodic crackdowns could temporarily hurt volumes or require adaptation. On the flip side, Robinhood acquiring Bitstamp suggests confidence that crypto will remain a key part of the future – they wouldn’t be expanding internationally in crypto if they thought the rug was getting pulled domestically. Perhaps a positive regulatory wildcard: if the U.S. actually establishes clearer crypto rules, mainstream players like Robinhood could benefit at the expense of sketchier platforms.

Legal and Compliance Risks: Robinhood faces various ongoing legal issues, from class-action lawsuits (e.g., over the meme stock trading restrictions) to potential new regulations on digital engagement practices (the SEC has looked at whether broker apps improperly nudge trading). Most of these are manageable – either settled with fines or addressed via policy tweaks. One notable item: in 2023, the SEC concluded an investigation into Robinhood’s early 2021 trading restrictions with no enforcement action (US SEC closes investigation into Robinhood with no action | Reuters), which removed a big overhang. That suggests that, while the saga hurt reputation, legally Robinhood might not be punished further for it by federal regulators. Risk differentiation: The existential risks (those that could truly threaten the business model) have receded – e.g. PFOF ban not happening, gamification issue settled, liquidity/clearing crisis like Jan 2021 was one-off and now they keep more buffers. The fixable risks are the ongoing ones: complying with evolving rules, adjusting to market conditions, and maintaining user trust.

One often overlooked risk: competitive risk coupled with regulation – if Robinhood fails to comply as diligently as competitors, users could flee to those seen as safer or more reputable. Thus far, Robinhood has stepped up its compliance game (hiring legal, risk officers, etc.). Another risk: technology – being a victim of a hack or major security breach would be disastrous given they hold assets and personal info. They haven’t had a known major hack (some smaller incidents aside). They need to remain vigilant here (especially as crypto involvement can attract hackers). This is fixable by investment in cybersecurity, which they likely have increased.

Finally, headline risk: Robinhood is under a microscope. Any scandal, however small, can blow up in media or online forums. That’s a risk of being high-profile. But as the company matures, these have lessened (e.g., no more viral stories of young traders blowing up – now we hear more about Robinhood adding IRAs, which is frankly less sensational).

User Trust Timeline + Culture

Robinhood’s relationship with its users and its internal culture have been a story of trust lost and (gradually) regained. To chart the timeline of user trust: early on (2015-2019), Robinhood enjoyed a honeymoon – millions flocked for free trades, and trust was high almost by default because it was giving access that previously cost money. The app store ratings were stellar (and still sit around 4.2★ on over 4 million reviews) (Robinhood review: Top trading platform to start investing?), indicating broad satisfaction with the product experience (Robinhood Review: $0 Commission Investing App, How It Works). The first cracks appeared in March 2020 when Robinhood suffered a massive all-day outage during a historic market rally, preventing users from accessing their accounts. That incident infuriated customers (some lost money or missed gains) and led to regulatory fines. It was a wake-up call: users loved the app, but needed it to be reliable. Robinhood compensated some users and upgraded infrastructure, but trust took a hit among those affected.

Then came 2021’s meme stock saga, the ultimate trust crisis. When Robinhood halted buying of GameStop/AMC, many users felt betrayed. Social media was ablaze with accusations that Robinhood “sold out” retail traders to protect hedge funds (a narrative later debunked, but powerful at the time). Politicians on both sides criticized the move. Instantly, Robinhood went from hero to villain for a portion of its audience. Some swore never to return; others grudgingly stayed but with a wary eye. The company’s credibility as the champion of the little guy was tarnished. Vlad Tenev’s apology tour and explanations (that clearinghouse deposit requirements forced their hand) helped somewhat, but a lot of young investors learned a cynical lesson: if things get too wild, my platform might shut me down. For a company whose name evokes a folk hero fighting for the people, that was a brutal irony.

In the aftermath, Robinhood has had to rebuild user trust step by step. They raised billions in capital to shore up clearinghouse deposits and avoid a repeat. They improved transparency (posting regular updates on their blog about system status, etc.). Importantly, they focused on user support – introducing 24/7 live phone support in 2022, so users could actually talk to someone (something unthinkable in their early lean years). They also removed or toned down the controversial gamification elements (as noted, confetti is gone, and you won’t see overt “You’re on a streak!” messages for trades anymore). Essentially, Robinhood had to grow up in public, and users noticed. By mid-2023, sentiment on forums had started to soften: some users acknowledged that despite lingering distrust, they still used Robinhood because it’s easy and, frankly, many alternatives weren’t that much better in offering the same features.

Fast forward to today: How do users feel? It’s a mixed bag. Hardcore members of Reddit’s r/WallStreetBets still use “Robinhood trader” as a synonym for clueless newbie – that stigma will linger. But on more beginner-focused communities, you’ll find plenty of folks saying Robinhood is a great starting point for investing, if used carefully. One highly-upvoted comment from a beginner in 2024 said they “really like Robinhood because it is extremely simple to use…and you can invest as little as $1,” praising it as an excellent choice for those without much money. That captures Robinhood’s enduring value proposition: accessibility. Even detractors often concede its interface is top-notch. Negative anecdotes still surface – e.g., a user complaining their account was locked for suspected fraud for weeks – indicating customer service hiccups happen. But overall app ratings remain high, suggesting that the average user (who is not posting on Reddit) is getting what they expected. The trust that matters is whether users trust Robinhood enough to keep their money there and maybe bring more. The fact that net deposits were $50+ billion in the past year, with net inflows from every major brokerage in 2024 as the company claims, indicates retail investors are indeed entrusting more assets to Robinhood (perhaps lured by that 4% cash sweep interest and IRA match).

Now, the culture inside Robinhood also went through upheaval. The hyper-growth years were by some accounts chaotic – rapid hiring, a youthful team, perhaps lacking in seasoned oversight in risk/compliance. Then the 2022 downturn forced layoffs: Robinhood cut about 9% of staff in April 2022, then another 23% in August 2022, and had smaller reductions into 2023. This whiplash had an effect. Glassdoor reviews from late 2022 and 2023 paint a picture of shaken morale. One review described it as “the worst culture ever and 0 work-life balance,” claiming leadership had “absolute zero care for you”.

Another wrote in Sept 2024 of a “toxic culture of nepotism and lacking leadership” with a 1-star rating. Common themes included frustration over constant strategy shifts and job insecurity (“five layoffs within one and a half years is a huge pain point”). It’s clear that internally, the company had to transition from a free-wheeling startup to a disciplined, regulated entity, and not everyone loved that. The founders (Vlad Tenev and Baiju Bhatt) are brilliant visionaries, but managing a ~2000-person company in crisis required different muscles. By mid-2023, Robinhood brought in more experienced execs in compliance and scaled back hyper-ambitious projects (they even canceled the launch of a U.K. service in 2020 to focus on core business, only to rekindle it later when ready).

The current culture seems to be stabilizing. Management communicated a goal of “profitable growth” and in 2024 they actually delivered it – success can boost morale. The CFO said headcount would be roughly flat to slightly up going forward, signaling an end to the layoff era. Employees that weathered the storm perhaps feel a new sense of focus: the company is no longer in survival mode but back to offense (rolling out many new products). Glassdoor ratings, while mixed, show mid-3’s out of 5 for culture and values – not fantastic, but not dire either. The worst reviews might be outliers, but they highlight an important risk: retaining talent. Robinhood competes with Silicon Valley firms for engineers, and with Wall Street for finance talent – it needs a compelling mission (and maybe a recovering stock price helps with equity comp). The mission is compelling if communicated well: “democratize finance” still resonates, especially now that it’s expanding into things like advice and banking that truly were out of reach for many young people before.

On the user sentiment front, Robinhood has been actively repairing its brand. Marketing campaigns in 2022-2023 shifted tone: from “crazy confetti trading” to “We are all investors”, highlighting people using Robinhood to save for a home, or learn about investing responsibly. They want to be seen not just as the app for YOLO trades, but as a platform you stick with as you build wealth. Trust, ultimately, is proven over time. In 2021, trust was broken for many. By 2025, with a few years of calmer operations, some of that trust is tentatively returning. Robinhood still ranks #1 in brand recognition among young investors. And consider this: Gen Z tends to be skeptical of institutions, yet millions of Gen Z-ers use Robinhood. The company’s challenge – and opportunity – is to mature along with its users. As 25-year-old novice traders turn into 30-year-old professionals with bigger portfolios, will they feel comfortable keeping their money in Robinhood? The answer will depend on whether Robinhood can continue to prove itself trustworthy (no major snafus, prompt customer support, treating customers fairly) and useful (offering the services those older customers want, like retirement, advice, etc.). Robinhood’s brand repair is still a work in progress, but momentum is on its side now rather than against it.

Valuation in Context

With all its twists and turns, how does one value Robinhood today? The stock’s journey has been as volatile as the activity on its app. IPO-ing at $38 in mid-2021 and briefly skyrocketing to about $85 during the meme frenzy, HOOD later sank into the single digits in 2022 amid user attrition and losses. Fast forward – as of early 2025, Robinhood’s stock has staged a comeback, now trading around the mid-$40s per share. That gives it roughly a $40 billion market capitalization. In other words, the market is pricing Robinhood as one of the most valuable fintechs, on par with some established financial firms. Let’s break down the valuation multiples and what’s priced in.

At ~$44/share, Robinhood carries a trailing P/E around 28 (using 2024 EPS of $1.56. A ~28x earnings multiple for a company that just turned profitable might seem rich, but consider that earnings grew massively in 2024 and are expected to continue growing (albeit not at the same breakneck pace). On a forward basis, if one strips out the one-time tax benefit and projects more normalized earnings, the P/E might be a bit higher. However, relative to other high-growth fintechs (many of which aren’t profitable at all), Robinhood looks reasonably valued. For example, SoFi is still at a high forward P/E (as it just reached profitability) and Coinbase swings between losses and profits based on crypto cycles. Legacy brokers trade at lower multiples (Schwab around 15-18x, for instance) because of slower growth. Robinhood, with expected growth, commands a growth premium.

On a revenue basis, HOOD is around 13-14x 2024 sales (market cap ~$40B / $2.95B revenue). That’s high if you compare to a bank or broker (Schwab might be ~5x revenues, for instance), but again, Robinhood’s growth and margins differ. Its gross margins are extremely high (most of its revenues minus transaction costs drop to the bottom line, since it's largely electronic and low variable cost). Its EBITDA margin hit ~50% in Q4 2024 on an adjusted basis, which is excellent. So, one could argue a PEG ratio (PE to growth) for Robinhood isn’t outrageous if growth continues at double digits.

The question is: what’s priced in vs. what’s not? After nearly tripling in 2024, the stock likely reflects a lot of good news: the return to profitability, the crypto rebound, success of new features, etc. Wall Street’s sentiment has turned positive; in fact, the average analyst price target sits around $68, implying they see more upside as those themes play out. That suggests that some upside (like further growth in assets or maybe the value of new initiatives) might not be fully priced in yet, at least according to analysts. The street might be valuing Robinhood as not just a broker, but as a platform with multiple optionality: perhaps a bit of an implied value for the crypto business (especially if Bitstamp gives it global reach), some value for future advisory or banking revenue, etc. In other words, investors are valuing Robinhood not simply on current earnings, but on the narrative of what it could become – a dominant financial app for the next generation.

At ~$40B market cap, one might compare Robinhood to historical precedents. Is it the next Schwab? Schwab’s market cap is about $130B (with trillions in assets). Robinhood at one point had only ~1/20th of Schwab’s assets but was valued at ~1/3 its market cap during meme euphoria – that was unsustainable. Now, with ~$200B in assets and $40B valuation, Robinhood is ~1/50th of Schwab’s assets for ~1/3 of the valuation – still a premium, reflecting its higher growth and monetization per dollar of assets. If Robinhood can eventually reach, say, $1 trillion AUC (very long-term, but not impossible if they capture a generation’s worth of investing), it could justify an even larger market value in the future. But that’s a long game.

What’s priced in now? Likely a continued growth in net deposits (but maybe not another doubling of revenue – expectations will be more modest, like “grow ~20-30% annually” rather than 115% every quarter!). The stock price also probably bakes in that the worst is over in terms of user exodus and that 2022 was the trough. If any signs appear to contradict that – e.g., a quarter where users or assets drop unexpectedly – the market would react harshly. Also, the current valuation includes optimism on new initiatives: perhaps a bit of value for the sports betting possibility (not large yet, but if that hits, it’s pure upside), and for Robinhood Gold subscription growth (already 2.6M subscribers; this recurring revenue could be valued at a higher multiple like a SaaS business if it keeps growing 80% YoY). It might not fully price the AI advisory side because that’s more nebulous, so success there could be a positive surprise.

It’s worth noting the stock’s beta – Robinhood is a high-beta stock (~2.0), meaning it moves about twice as volatile as the market. This will likely continue – it’s sensitive to sentiment swings.

From a valuation perspective, one must also consider dilution risk via acquisitions. Robinhood agreed to pay ~$300M for TradePMR, presumably in cash, and an undisclosed sum for Bitstamp (rumored in the few hundred million range). They have the cash to do these deals without issuing stock, which is good. If they attempted a larger acquisition (for instance, buying a competitor or another big crypto exchange beyond Bitstamp), that could involve stock and dilute shareholders. But such a scenario isn’t clearly on the horizon right now.

Finally, we should contextualize valuation narrative. Robinhood’s stock trades as much on narrative as on raw numbers. In 2021 the narrative was sky-high user growth and “future of finance,” so it overshot fundamentals. In 2022, the narrative was “fad is over, users left, company bleeding money,” so it arguably undershot. In 2024-25, the narrative is more balanced: “Robinhood found its footing and is expanding into new areas.” As long as that narrative holds (and numbers support it), the valuation can remain elevated relative to traditional benchmarks. Should that narrative falter (if, say, growth disappears or a new regulatory threat emerges), the valuation could compress quickly.

Final Take

Robinhood has evolved from a scrappy disruptor to a multifaceted financial platform – but the core question remains: is this the next-gen financial super app or just a flashy trading gimmick? After deep analysis, a bold view emerges: Robinhood is shaping up to be a long-term contender – essentially a call option on Gen Z’s financial future – but it’s not without its Greeks (volatility and delta) along the way. The company has navigated through its trial by fire and emerged stronger, with real profits and an expanding arsenal of products. In other words, Robinhood today looks less like a one-trick pony and more like a young thoroughbred in the fintech race.

My thinking: Robinhood is on track to become the “money OS” for the mobile-first generation, integrating investing, saving, spending, and yes, even a bit of responsible speculation under one roof. It’s not fully there yet, but the trajectory is convincing. The stock, accordingly, is not a value play – it’s for believers in that vision. Think of HOOD as part brokerage, part tech startup, part social phenomenon. The upside if they execute is that Robinhood could capture a significant share of the $84T wealth transfer as millennials and Gen Z inherit and invest (Ground News), and even siphon off business from incumbents as those users stick with Robinhood into their higher net-worth years. The downside is that any stumble – either market-driven or self-inflicted – could remind us that competition is fierce and moats in this space rely on user loyalty and constant innovation.

To monitor whether Robinhood is living up to its promise, here are 2–3 KPIs to track closely going forward:

Active User Growth & Asset Inflows: Keep an eye on Monthly Active Users (MAUs) and Net Deposits/Assets Under Custody each quarter. These are the lifeblood of Robinhood’s ecosystem. In Q4 2024, MAUs were ~12.5M (up from the trough) and AUC hit $193B. We want to see MAUs at least stable or growing modestly and net deposits remaining strongly positive (e.g. 20%+ annualized growth). Consistent growth here means Robinhood is retaining and adding users, and importantly, capturing more of their wallets – a sign of trust and relevance. If MAUs start shrinking or net deposits turn negative (funds flowing out), that’s a red flag the narrative might be turning.

Monetization & ARPU: Average Revenue Per User is a key metric that encapsulates how well Robinhood is monetizing its base. It soared to $164 in Q4 ’24. Going forward, ARPU might fluctuate with interest rates and trading cycles, but track the components: transaction revenue per user and interest income per user. A healthy Robinhood will show that even if one component dips, the other picks up slack (e.g., trading slows, but more assets yield interest, or vice versa). Essentially, Robinhood needs to demonstrate it can generate high ARPU without inciting unhealthy behavior – so growth in ARPU via subscriptions (Gold), higher assets (interest), and new services (perhaps advisory fees) would be positive quality indicators, versus purely from more crypto trading (which, while lucrative, can be ephemeral). Steady or rising ARPU, especially relative to peers, signals Robinhood’s model is humming.

Engagement & New Product Adoption: This is a bit more qualitative, but look at metrics like options trading volume share (Robinhood’s share of retail options trading was 19% and rising and Gold subscriber count (2.6M and growing). These speak to how deeply users are engaging and using premium features. Also watch user uptake of new offerings – e.g., how many users open IRAs (retirement AUC was $13B and climbing fast, or how many try the advisory service or card. If Robinhood can successfully cross-sell new products, it increases lifetime value and stickiness. Engagement can also be seen in trading activity relative to peers: the company reported increased equity and options market share – continuation of that trend means Robinhood is not just adding dormant accounts, but active ones.

In closing, Robinhood’s story is far from finished. The company is making the delicate leap from hyper-growth startup to mature enterprise, and doing so under intense public gaze. It has powerful tailwinds – a cultural brand presence, a tech-savvy user base, and multiple revenue levers – as well as challenges in satisfying both its users and regulators. My take is that Robinhood will continue to surprise to the upside. It has become bigger than its mistakes, and its community of retail investors is not disbanding; in fact, they’re growing up and bringing more capital into the system. Robinhood is positioning itself to capture that, whether through offering a 4% yielding account or the thrill of a hot IPO or the convenience of an AI portfolio checkup. Owning HOOD stock is effectively a bet that this platform will be the preferred financial interface for tens of millions as they accumulate wealth.