Deep Dive: Texas Instruments (TXN)

Within the robotics theme - I like & own three companies: TXN 0.00%↑ / ADI 0.00%↑ and TER 0.00%↑. This year, I’ve been buying several names within themes I like for the fund. Texas Instruments’ performance YTD has been amazing, so I decided to do a deep dive on it. Investing worked, and now is the time for investigation. I’ll be doing deep dives on the two other names mentioned over the coming days also.

Texas Instruments (TXN) is emerging from a late-cycle slump in the analog semiconductor market. During 2024–2025, industrial and automotive customers worked down bloated chip inventories amassed during the pandemic, pressuring TXN’s revenue and free cash flow. Now in early 2026, evidence suggests the correction is ending: TXN’s Q4 2025 sales grew 10% year-over-year, and management says the “inventory correction that has plagued the industry during the last two years [is] essentially complete”[1]. The stock, which fell ~7% in 2025, has already rebounded over 13% year-to-date on hopes of an analog demand recovery[2].

The dominant narrative being tested is whether TXN’s massive investment in capacity will yield scarcity power and secular growth – or whether it was an overzealous bet in what remains a cyclical business. This moment is important because TXN’s newly built fabs are coming online just as the cycle inflects. Bulls argue TXN is positioned to compound value as a supply-constrained analog leader, while skeptics warn it’s still a cyclical chipmaker facing a potential glut if demand falters.

For the first time in 16 years, TXN expects to grow revenue sequentially from Q4 to Q1 – a stark break from typical seasonal declines[3]. THIS IS A HUGE DEAL.

In fact, TXN’s Q1 2026 guidance of ~$4.5 billion in sales handily beat consensus and implies an unusual Q1 uptick, sending the stock up nearly 9% in one day[4]. This rare timing mismatch (Q1 growth in a traditionally weak quarter) underscores a broader point: the analog chip downturn may be ending faster than the market assumed. It reframes TXN as not just a cyclical follower but potentially a beneficiary of structural demand (e.g. surging AI/data-center buildouts) that can offset seasonality. The question is whether this upside surprise marks the start of a long-run uptrend fueled by TXN’s strategic advantages, or simply a short-lived snapback in a still-cyclical trajectory.

What They Do

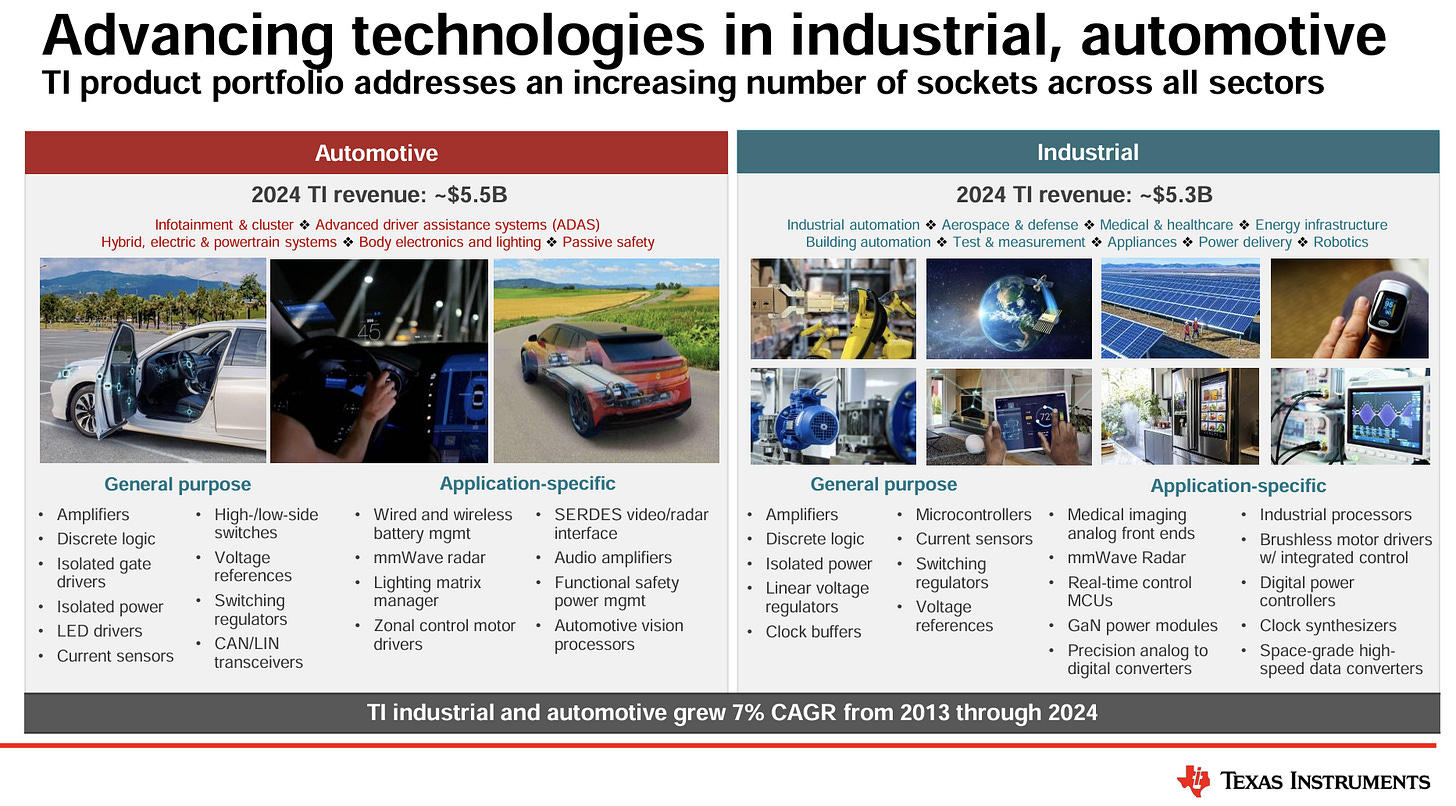

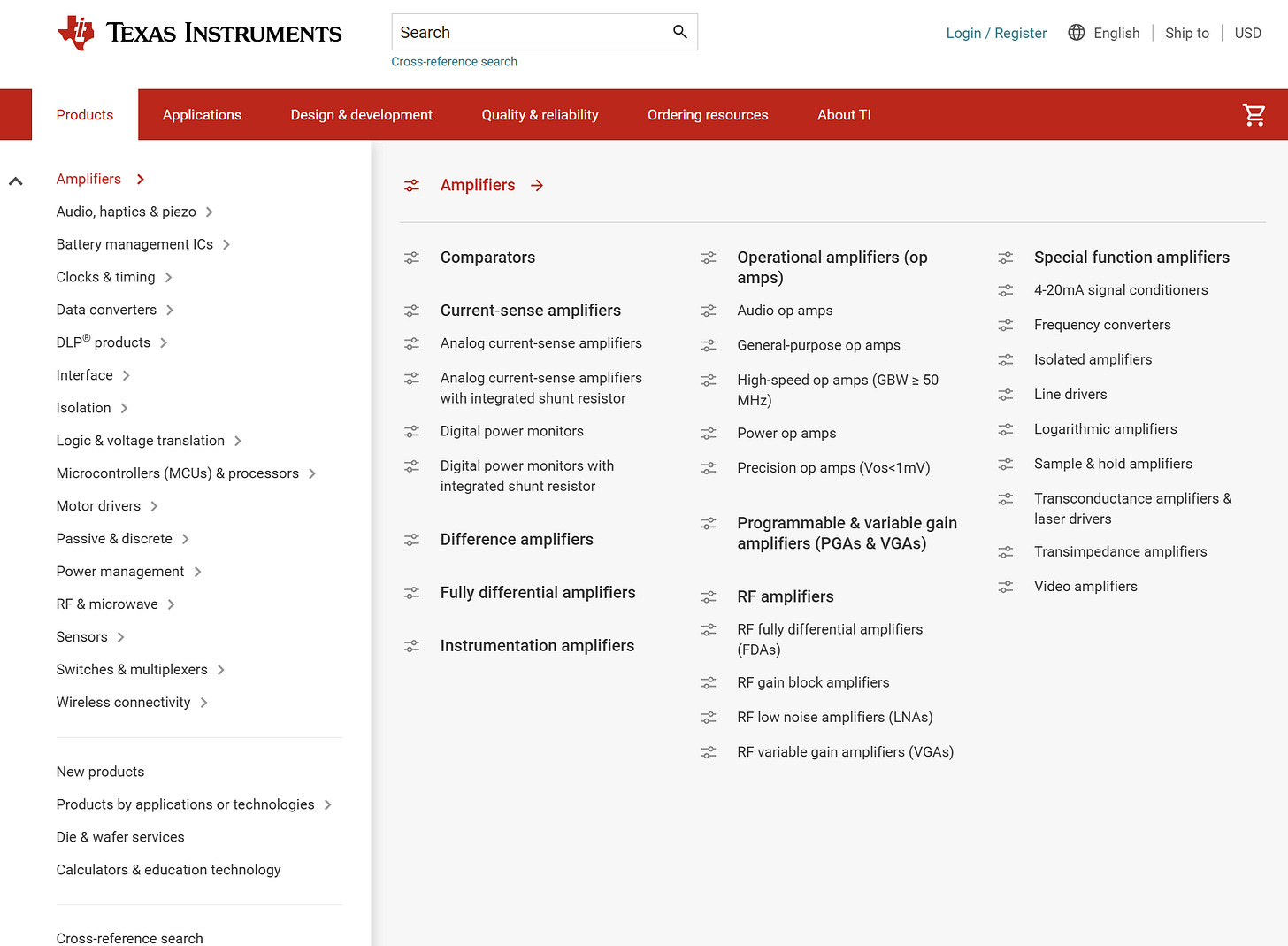

Texas Instruments is one of the world’s largest analog semiconductor suppliers, with a broad catalog of ~80,000 products sold to over 100,000 customers across industrial, automotive, personal electronics, communications, and enterprise markets[5][6].

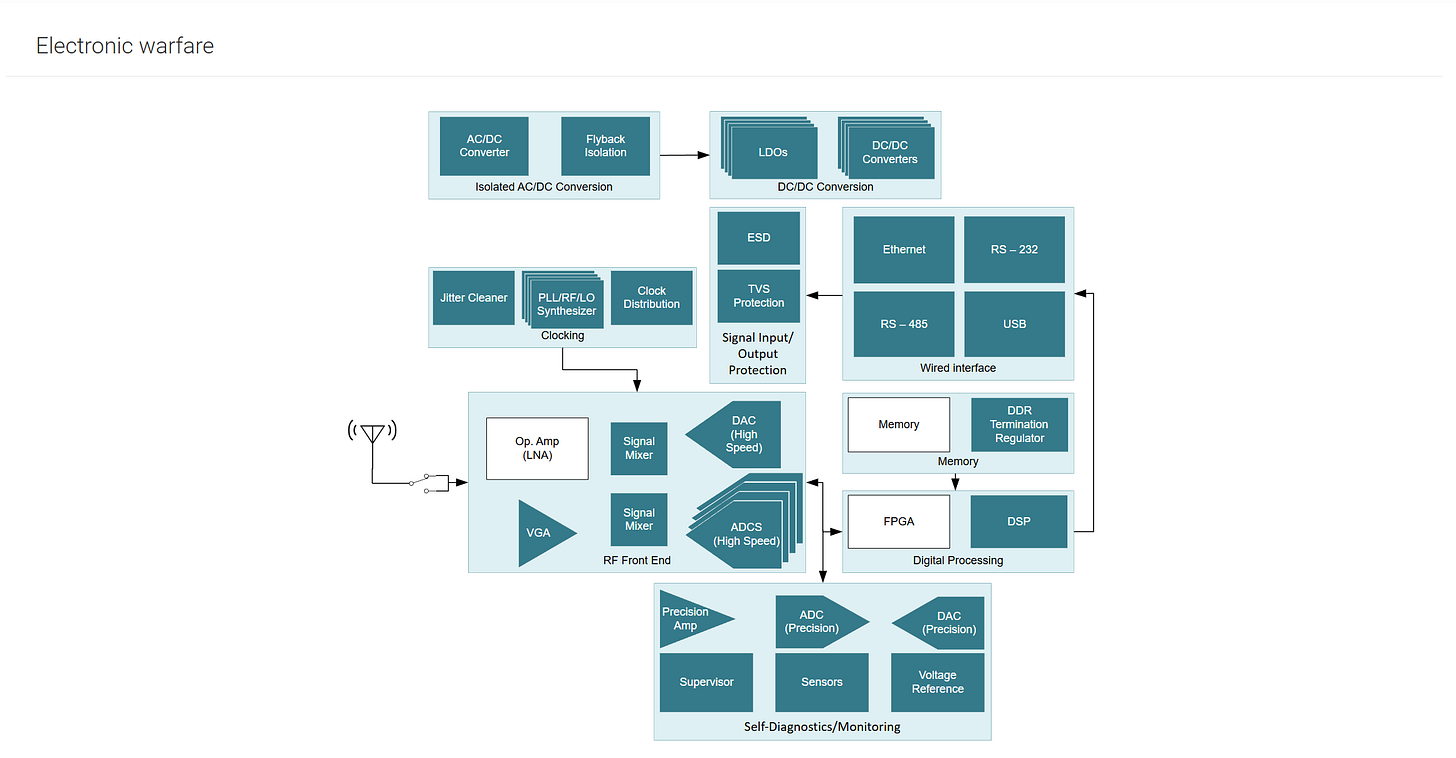

In plain English, TXN 0.00%↑ makes the “picks and shovels” of electronics: analog integrated circuits (amplifiers, data converters, power regulators, sensors, etc.) that convert, condition and manage real-world signals (like temperature, sound, or power levels) into the digital domain[7]. It also sells embedded processors (microcontrollers and connectivity chips) that serve as small brains in various devices.

TXN’s revenue mix is ~77–79% analog chips and ~15–17% embedded processors, with the remainder from smaller businesses (like its historic calculator/DLP units)[8][9].

Its chips are ubiquitous “behind the scenes” components.

For example, in industrial settings (about 40% of revenue), TXN’s analog and embedded chips go into factory automation systems, motor drives, and sensors that require high reliability over decades.

In automotive (~25% of revenue), TXN provides chips for advanced driver-assistance systems, battery management in electric vehicles, infotainment, and dozens of other automotive uses.

TXN deliberately focuses on long-life, high-mix/low-volume applications – it has minimal exposure to short-lived consumer gadgets, as personal electronics have fallen to ~20% of sales. Notably, TXN just broke out data center as a new end-market category, revealing that AI-driven server demand is a fast-growing slice (data center was 9% of 2025 sales after growing 70% in Q4)[10]. In data centers, TXN’s analog chips perform critical tasks like power management for AI accelerators and signal conversion on high-speed boards[11]. In sum, TXN’s portfolio is broad and essential: its products quietly enable the electrical “plumbing” in everything from factory robots and cars to communications infrastructure and cloud servers.

The Thesis

Is TXN an analog scarcity-rent compounder or a high-quality cyclicalist? TXN’s identity in the semiconductor ecosystem is defined by its focus on analog engineering and a unique degree of vertical integration. Analog chips are a niche where longevity and specialization breed high margins: top players can sell certain chips for decades with little design change, earning “scarcity rents” due to limited competition and the cost for customers to requalify parts. TXN epitomizes this model. The company has 100k+ diverse customers and 100k+ product SKUs, meaning no single client or chip dominates – it’s the opposite of the concentrated, boom-bust profile of digital chip firms. Because analog parts often sell for mere cents or dollars, performance and reliability trump cost in many industrial and auto applications. This gives TXN pricing power on legacy parts that competitors can’t easily replicate (some designs stay in production 20–30+ years, outlasting any one cycle). In effect, TXN’s long-lived products and massive catalog create an annuity-like cash stream – a classic scarcity-rent scenario where “sunk capex can generate cash-flows for extremely long periods” and price increases can be passed through gradually over time.

Importantly, TXN is fortifying this model with an unmatched manufacturing moat. Unlike most peers, TXN fabs a large share of its analog chips in-house, and it has aggressively transitioned to 300mm (12-inch) silicon wafers for analog production. This is larger than the 200mm wafers still standard for much of the analog industry, yielding huge scale economies. Internal data shows TXN’s 300mm lines have roughly 40% lower die cost per chip than comparable 200mm production. TXN already operates multiple 300mm fabs (RFAB1/2 in Texas, LFAB in Utah) and is building more (two new “mega-fabs” in Sherman, TX slated to ramp through late-decade).

Management bluntly calls low-cost manufacturing a key competitive advantage: “Our cash flow...again underscored the strength of our business model...and the benefit of 300mm production,” CEO Haviv Ilan noted in the latest results[22]. By owning capacity, TXN also offers customers supply stability (a lesson from the pandemic shortage) and avoids the foundry mark-ups that fabless rivals pay.

Where could this approach break down? If TXN’s “if you build it, they will come” philosophy overshoots actual demand, its prized scarcity could flip to oversupply. The company is pouring billions into capacity that will only pay off if utilization stays high. Should industrial or auto demand stumble (e.g. a recession or EV slowdown), TXN could be stuck with under-filled fabs – a double whammy of lower revenue and high fixed depreciation costs. Its ability to earn scarcity rents also assumes competitors don’t catch up; while TXN leads in 300mm analog, others (like Analog Devices) could leverage third-party fabs or M&A to counter TXN’s catalog breadth. There’s also a subtle strategic risk: TXN intentionally focuses on myriad “$0.25–$0.30 per socket” opportunities where competition is low[14] – but if it misjudges and chases higher-volume markets (or if customers consolidate designs), it could face margin pressure. Lastly, the moat of long product lifecycles cuts both ways: it protects TXN’s base, but in an era of rapid tech shifts (AI, electrification), TXN must keep releasing new analog solutions or risk its sockets being designed out over a decade. In essence, TXN’s thesis is that analog is a slow-moving, structurally profitable game that it can dominate through scale and patience; the antithesis is that even analog isn’t immune to cycles and competition, especially if TXN’s heavy capex floods a niche that prospered on scarcity.

Financials

At ~$216 per share, TXN is priced for a strong recovery but not without some skepticism. The stock’s forward P/E is ~28×[23], implying investors do expect earnings to rebound (consensus sees double-digit EPS growth next year). However, trailing free cash flow yield is very low (~1.5%) after two years of heavy capex, which may make value-oriented investors uneasy. The market appears to be in between two views: one camp believes TXN’s earnings and FCF will snap back strongly as capex falls (justifying a premium multiple for a high-quality compounder), while another camp focuses on current depressed FCF and cyclical risk (hence the stock, even after a pop, still trades ~15% below its all-time highs). This suggests potential mispricing if one side is materially wrong about the next 2–3 years. Is the market underestimating how quickly TXN’s free cash margins can expand as its investment cycle tapers? Or is it underestimating how vulnerable those future cash flows are if end-demand wobbles?

The single most decisive swing factor is factory utilization driven by end-market demand. TXN’s bull vs bear outcomes essentially hinge on whether the company can fill its new 300mm fabs with sales. If industrial and automotive demand recover cleanly (and early signs point to a broad upturn[24][25]), TXN’s revenues could accelerate into 2027, soaking up capacity. That would improve gross margins via better fixed-cost absorption and support pricing power (tight supply = firm pricing). However, if demand sputters or is uneven, TXN could be forced to run fabs sub-optimally or push excess inventory into the channel, eroding the very margin edge it built. In short, the fulcrum is analog demand vs. supply – if secular growth (EVs, factory automation, AI, etc.) keeps volumes rising, TXN wins; if there’s a prolonged air-pocket, its big factories become a burden.

In the upside scenario, TXN effectively graduates from cyclical laggard to compounding cash machine. Here’s how it would play out: TXN’s revenue growth reverts to a healthy mid/high-single-digit pace as industrial and auto orders normalize and new growth areas (like data center analog) add on. With its 300mm lines, TXN can meet this demand at 40% lower unit cost[19], so gross margins could inflect upward from ~57% toward the high-50s or 60% range over the next 1–2 years. Operating expenses are well-controlled (R&D and SG&A were ~$3.9B in 2025, just ~22% of sales[26]), so most incremental gross profit would drop to operating profit. Free cash flow would surge disproportionately: TXN just spent $4.6B on capex in 2025[27], but management has indicated 2026 capex could be flexed down to as low as ~$2 billion if conditions allow[28].

That means FCF could double or triple even on moderate revenue growth. In fact, in an optimistic case presented to investors, TXN outlined a path to $12 per share of free cash flow in 2026[29] – an almost 3× jump from ~$4.97 EPS in 2025[30][31]. The math: ~$12 FCF on a ~$216 stock = ~5.5% yield, which would be highly attractive for a business of TXN’s caliber (and likely drive the stock higher).

In this upside scenario, margins expand, capex shrinks, and pricing holds firm, creating a powerful earnings/FCF upswing.

In the downside scenario, TXN looks more like a typical high-quality cyclical that got a bit overextended. Suppose industrial recovery is weak or choppy – if factories don’t fully restock and instead remain cautious, TXN’s growth could stall out in the mid-single digits. Automotive, which had been a steady driver, could also slow if car production or EV uptake disappoints. TXN would then find itself with a lot of capacity but less urgency from customers to buy.

We would likely see utilization rate drops, which directly hit gross margin (idle fab space is pure cost). In this case, TXN might be forced to choose between undercutting prices to gain volume or running fabs below capacity – either way margins suffer. Free cash flow would remain constrained: TXN might still need to spend a baseline capex (say $3–$4B a year) to equip and maintain its new fabs, even if revenue isn’t ramping. With FCF margins stuck in the teens (2025 FCF was only 16.6% of sales[34] vs ~30–35% in peak years), the stock’s valuation could come under pressure.

At, say, $3B–$4B annual FCF (roughly the 2025 level of $2.94B plus a little growth)[35], TXN’s FCF yield would be barely ~1.5–2% – not appealing for a $190+ billion company unless growth is assured. In that downside case, today’s ~28× forward earnings multiple would start to look expensive for essentially flat performance, and the stock could de-rate toward a market-multiple (low-20s P/E or worse).

The asymmetry is notable: upside could drive a step-change in cash generation (and likely a higher stock if the market gains confidence in TXN’s long-term thesis), while downside risks both slower growth and a valuation multiple compression.

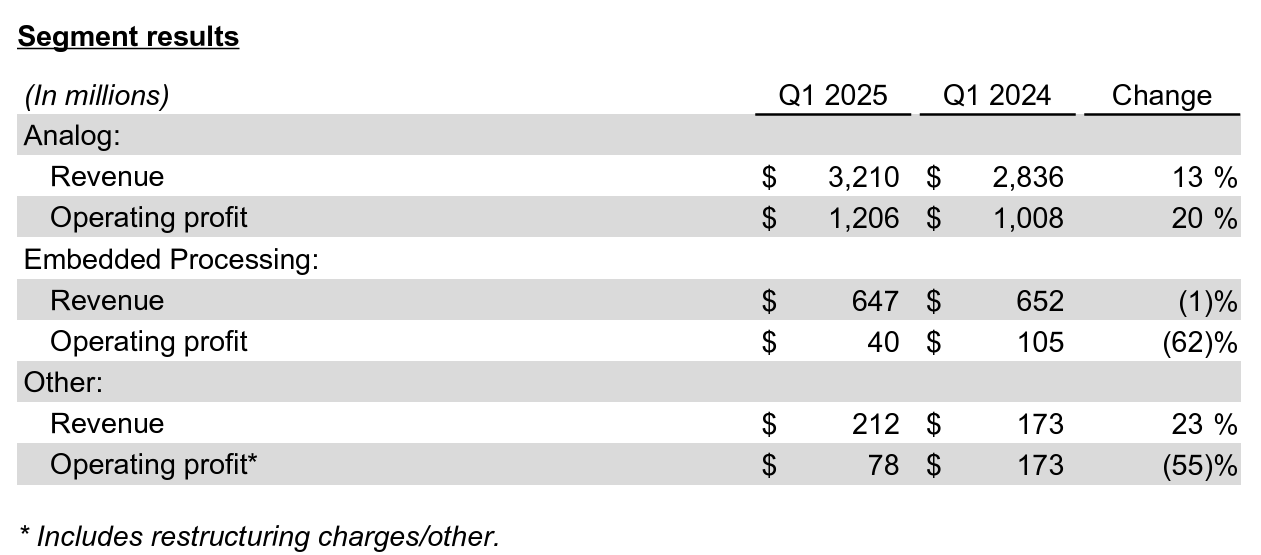

As of Q4 2025, TXN’s trailing 12-month revenue is $17.68 billion[38]. Despite the recent downturn, sales grew ~13% in 2025 (from $15.64 B in 2024), aided by strong automotive demand and pricing carryover.

Gross profit was $10.08 B, which is a gross margin of ~57.0%[39][40] (down from ~58% a year prior, reflecting slightly lower factory utilization and product mix).

Operating profit came in at $6.02 B for 2025, an operating margin of ~34%[41][42]. Margins compressed just a bit year-on-year (operating margin was ~35% in 2024) as cost of revenue grew faster than sales in the trough of the cycle.

Net income was $5.0 B[30][31], yielding a net margin of ~28%. This was up a modest 4% YoY – TXN remained solidly profitable through the slump, though net margin did slip from ~30.7% in 2024 due to higher depreciation and interest costs.

Notably, TXN’s free cash flow (FCF) is well below its earnings, reflecting the elevated capital spending. Over the last 12 months, FCF was $2.94 B, which is only 16.6% of revenue[34]. However, that FCF nearly doubled from the prior year’s $1.5 B as some of TXN’s heaviest CapEx rolled off[35]. Free cash flow is defined by TXN as operating cash flow minus capex plus any CHIPS Act incentives; in 2025, operating cash flow was $7.15 B[43] and gross capital expenditures were $4.55 B[44] (about 26% of sales).

TXN received $335 M in cash incentives from the U.S. CHIPS Act that partially offset capex[45][46]. Even after spending aggressively on new fabs, TXN continued to return cash to shareholders: in 2025 it paid $5.0 B in dividends (growing its dividend per share to $5.50 annually)[47][48] and bought back $1.48 B in stock[49]. These payouts exceeded free cash generation, so TXN did issue some debt – total debt increased by ~$0.45 B on net in 2025[50][51].

On the balance sheet, TXN remains in a reasonable position but not net-cash. The company had $4.88 B in cash and short-term investments at year-end 2025 (cash $3.23 B plus $1.66 B in short-term investments)[52][53]. Inventory was quite elevated at $4.8 B[54][55] – TXN has been intentionally building inventory (especially work-in-process) to ensure supply for customers, which is a strategic choice that temporarily ties up cash.

Total debt stood at $14.05 B (with $13.55 B long-term and $500 M current portion)[56][50]. Net debt is therefore about ~$9.2 B, which is roughly 1.5× EBITDA – a moderate leverage for a company with ~$7 B operating cash flow. TXN’s debt/equity ratio is 0.86[57], higher than fab-light peers but still comfortable given its consistent profitability and investment-grade profile. The interest coverage remains strong (interest expense was $543 M in 2025[58], easily covered by $6 B+ in operating profit). Overall, TXN’s financials show temporarily suppressed free cash flow and high capex, but a healthy core business underneath. The balance sheet can support continued dividends and strategic capex, but the real focus for investors is on that free cash flow snapping back as capex normalizes.

Product Mental Model

Think of TXN’s products as the invisible infrastructure that makes modern electronic systems work. In investor terms, TXN sells analog and embedded “content” for electronic devices, much of which is mission-critical but low-profile. For instance, in an electric vehicle, TXN might earn a few dollars of content via dozens of analog chips (sensing battery temperature, regulating LED headlights, converting 12V battery output to various voltages, etc.). In an industrial robot or factory machine, TXN’s chips convert sensor readings (pressure, motion, position) into data that a controller can use, and they ensure motors and power supplies get precisely the right currents – all of which enables automation.

These roles tend to be high-value to the customer but low-cost to implement, which is ideal: TXN’s components often cost under $1, yet without them a $10,000 piece of equipment might not function properly[61][15]. This dynamic grants TXN a bit of pricing latitude and extremely sticky customer relationships (engineers design in a TXN chip and often use that same part for a decade or more across product generations).

One can frame TXN’s product strategy as “everyday analog dominance.” Rather than chasing the bleeding edge of digital processors, TXN excels at the ubiquitous essentials – power management ICs, signal chain amplifiers, data converters, and microcontrollers that appear in almost every piece of electronics. Across industrial and automotive markets, TXN’s analog content tends to grow in line with or faster than unit volumes. For example, the shift to electric and hybrid vehicles is increasing analog content per car (for battery and power systems). Factory modernization and IoT adoption mean even traditional industries are adding more sensors and analog interfaces. TXN positions itself to capture that secular trend: the company has explicitly refocused its sales toward industrial (41% of 2023 revenue) and automotive (25%), away from volatile consumer gadgets[62].

In data centers, a newer arena for TXN, the explosion of AI hardware is a boon – high-performance computing boards require a multitude of analog chips for power regulation (voltage regulators for GPUs, etc.) and for feeding analog signals to ADCs/DACs in networking. TXN saw its data-center related sales jump 70% in Q4 2025[10], illustrating how even in cutting-edge AI servers, humble analog chips are indispensable.

From an investor’s perspective, TXN’s product set yields diversified, long-duration revenue streams. Each individual product line (say a family of op-amps or a specific MCU) might grow slowly, but taken together TXN has thousands of “mini-franchises” that collectively produce stable growth. The catalog breadth is a competitive advantage: TXN can cross-sell multiple components into the same customer application (e.g. a power management chip + a sensor + a microcontroller all together).

Moreover, TXN’s direct online presence and field application engineers make it easy for customers to sample and select parts, reinforcing TXN’s reach into new projects. The mental model is that TXN doesn’t rely on any one “hero” product; instead, it profits from the sheer diversity of analog needs in the world. As long as electronics continue to proliferate into more devices and industries (and they are), TXN will likely capture a steady share of that value in the form of analog content. Its products often outlive economic cycles – once a TXN chip is designed into a car or an industrial system, it might generate sales for 10-20 years with minimal upkeep. This underpins the compounder narrative: even when short-term demand fluctuates, the embedded base of TXN chips in the field grows and generates a stream of re-orders and replacements. It’s akin to a toll-collector model on the growth of electronic systems globally, albeit a toll measured in pennies per device but scaling to billions of devices.

Business Model

TXN’s business model is marked by vertical integration and capital-intensive investment for long-term gain. Unlike many semiconductor firms that went fabless, TXN chose to own the means of production for the majority of its analog output. It operates a network of wafer fabs in Texas and Maine (historically), acquired a fab in Lehi, Utah in 2021, and is building out new capacity in Sherman, Texas[20]. These fabs produce chips on large 300mm wafers, which dramatically lowers unit costs – “a chip built on 300mm wafers costs ~40% less than on 200mm”, according to the company[63]. This manufacturing edge is central to TXN’s model: by being the low-cost producer, TXN can maintain high gross margins and still price competitively to win sockets. It’s telling that TXN kept gross margin ~57% through a downturn[64] – a sign of cost leadership and pricing discipline.

The flip side is capital intensity. TXN is in the late stages of a massive capacity expansion program. Over 2020–2025, it embarked on a six-year elevated CapEx cycle, investing in what will be the world’s largest analog fab footprint. In 2024 alone TXN spent ~$5 B on capex, part of a planned ~$30 B U.S. manufacturing build-out[65]. By Q4 2025, management said they were about “70% through” this capex cycle and on track to finish by ~2026[29]. The goal is to set up TXN’s production base for the next 10–15 years of growth[29], capturing not just cost advantages but also supply chain security (having domestic fabs, benefitting from U.S. subsidies, etc.). The CHIPS Act is helping: TXN received $335 M in 2025 incentives and expects to utilize substantial Investment Tax Credits (up to 25% of qualified capex) to defray the cost[46][66]. Still, the burden is clear in the financials – capex was ~26% of revenue in 2025, far above TXN’s historical ~6–10% range in steadier times.

A key aspect of TXN’s model is “load the factories, then harvest FCF”. TXN builds capacity modularly, and management has emphasized they have flexibility to dial capex down if demand doesn’t justify it[67]. Starting in 2026, TXN plans to calibrate capex dynamically: e.g. it lowered its 2026 capex budget range to $2–5 B (vs a prior flat $5 B) to adjust to market conditions[28]. This flexibility is crucial – it means TXN won’t just blindly spend; if the cycle is weak, they can pause tool purchases (their new fabs are being built in phases). In essence, TXN’s manufacturing strategy is bold but not reckless: they’re securing the option to serve a much larger analog market, but they can slow the timetable if needed. Notably, owning fabs also locks in some fixed costs (depreciation, maintenance), which TXN accepts as the price of control. During low utilization, this hurts margins, but over a full cycle TXN believes the in-house production yields superior returns. Historically, TXN’s ROIC has been strong (20%+ in many years) and management expects high returns on these investments once they ramp.

Another element is TXN’s internal wafer supply vs foundry strategy. By largely manufacturing internally (around 80%+ of wafers are internal per recent disclosures), TXN avoids foundry capacity shortages and can prioritize its customers when industry supply is tight. This won it goodwill during the pandemic shortage (TXN was seen as more reliably delivering chips than some competitors). It also means TXN owns the capacity in strategic nodes – mostly older process technologies tailored for analog. This is a different playbook from peers who might outsource to TSMC or GlobalFoundries. TXN’s bet is that analog is less about cutting-edge lithography and more about process tweaks and analog-specific expertise, which they can do best in their own fabs. They’ve even re-tooled old digital fabs for analog (the RFAB and DMOS6 fabs in Dallas, for example, were 300mm facilities originally for digital, now making analog chips at scale).

Long term, the 300mm transition is expected to yield a structural margin boost and a fortress-like moat against smaller rivals. A new entrant in analog would struggle to match TXN’s combination of low costs and one-stop-shop product breadth. However, investors must watch the return on invested capital (ROIC) closely. TXN’s ROIC will likely dip in the near term because a lot of capital is work-in-progress (assets not yet fully utilized). The real test of the model is 2026–2028: if TXN can fill its new fabs and drive incremental revenue with minimal capex, ROIC should sharply rebound (management’s confidence is evident – they foresee “dependable, low-cost capacity” driving shareholder returns for 10+ years[68][69]). If instead capacity languishes, it could be value-destructive. So far, TXN’s execution has been solid: they delivered the RFAB2 expansion and integrated the Utah fab on schedule, and over 60% of their analog revenues now come from 300mm wafers, giving that cost edge[70][63]. In summary, TXN’s business model is a high-fixed-cost, high-margin flywheel – spend upfront, gain cost leadership, reap cash flows for decades. The coming few years will show just how strong that flywheel turns when the cycle winds change.

Valuation and Setup

TXN’s valuation reflects its premier status but also the recent earnings trough. At $216/share, TXN’s market cap is about $196 B and enterprise value ~$205.6 B[23][75]. By standard metrics, TXN trades at a Forward P/E of ~28× (based on 2026 EPS estimates)[23]. This is a premium to the broader market and most chip stocks, but not outlandish given TXN’s quality. It’s useful to compare TXN to analog peers:

Analog Devices ADI 0.00%↑: TXN’s closest analog competitor, ADI, is ~$146 B market cap and trades around 26.7× forward earnings[76] – slightly cheaper than TXN on P/E. ADI’s revenue ($11 B) and margins are a bit lower (gross ~55%, op ~27%)[77], and it has lower leverage. ADI’s P/S (~13.3×) is actually higher than TXN’s (~11.1×)[78][79], reflecting the fact that ADI’s net margins are lower (so it takes more sales to get the same earnings). On EV/EBITDA, ADI is ~30× vs TXN ~25×[80][81], indicating TXN generates more EBITDA relative to its price. ADI yields 1.3% vs TXN’s 2.5%[32][82]. Overall, TXN commands a slight premium, likely due to its higher margins and perhaps perceived better execution on cost (ADI carries a lot of acquired intangibles from its Maxim deal, which depresses GAAP earnings). The two trade in the same ballpark, reinforcing that TXN is valued as a top-tier analog franchise alongside ADI.

Microchip MCHP 0.00%↑: Microchip is a smaller peer ($30 B cap) focused on MCUs and some analog. It trades around 22× forward earnings[83], with a much higher dividend yield (3.3%)[84]. MCHP’s lower multiple partly reflects its heavier debt load and more volatile earnings (it had a GAAP loss recently due to one-time charges). Its gross margin (~40%) and op margin (~30% adjusted in good times) lag TXN[85], and its end-markets include more consumer. Essentially, MCHP is valued more like a cyclical – the market gives it a lower P/E for higher perceived risk. TXN’s premium vs MCHP highlights its stronger moat and consistency.

NXP Semiconductor NXPI 0.00%↑: NXP ($60 B cap) straddles analog and digital, mainly in auto and mobile. It’s at about 17× forward earnings, notably cheaper than TXN. NXP’s profile (53% gross, 25% op margin[86]) shows a lower profitability, and it has a bit more leverage (Debt/Equity 1.22)[87]. NXP is also more cyclical (over half of sales in automotive and some in mobile), which likely explains its discount. It yields ~1.7%[88]. NXP’s lower valuation suggests the market sees it firmly as a cyclical auto-chip play, whereas TXN (and ADI) get credit for diversification and durability. If one is bullish on an auto recovery, NXP might have more multiple expansion potential – but TXN’s higher multiple indicates its earnings are considered of higher quality (more stable, higher margin).

In absolute terms, TXN’s current valuation is somewhat elevated relative to its own recent history. During the height of the downturn in 2024, TXN traded closer to ~20× forward P/E (when skepticism was higher). The multiple has expanded as optimism on 2026–27 growth improved. On price/sales, 11× is near the upper end of TXN’s 10-year range (partly because sales are depressed). On price/free cash flow, TXN looks very expensive – over 75× trailing FCF[89] – but that’s expected to improve drastically as capex falls. The market is essentially looking through the trough FCF.

In conclusion, valuing TXN boils down to one’s conviction in the 2026–2028 earnings ramp. The stock is not the bargain it was at the depth of the cycle, but neither is it pricing in the full “scarcity rent” dream scenario. It’s somewhere in between – an arguably justified premium for a high-quality franchise with improving prospects.

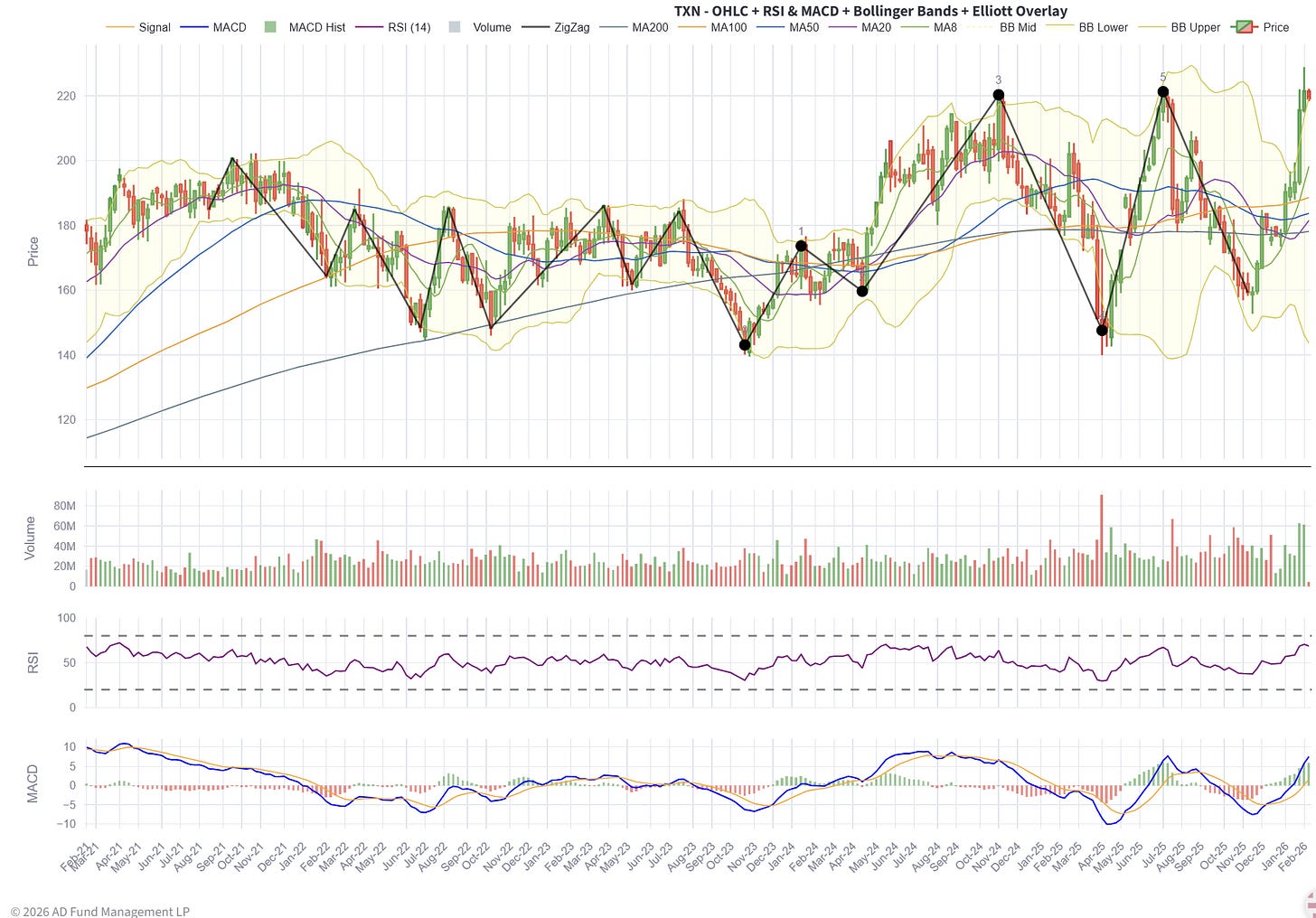

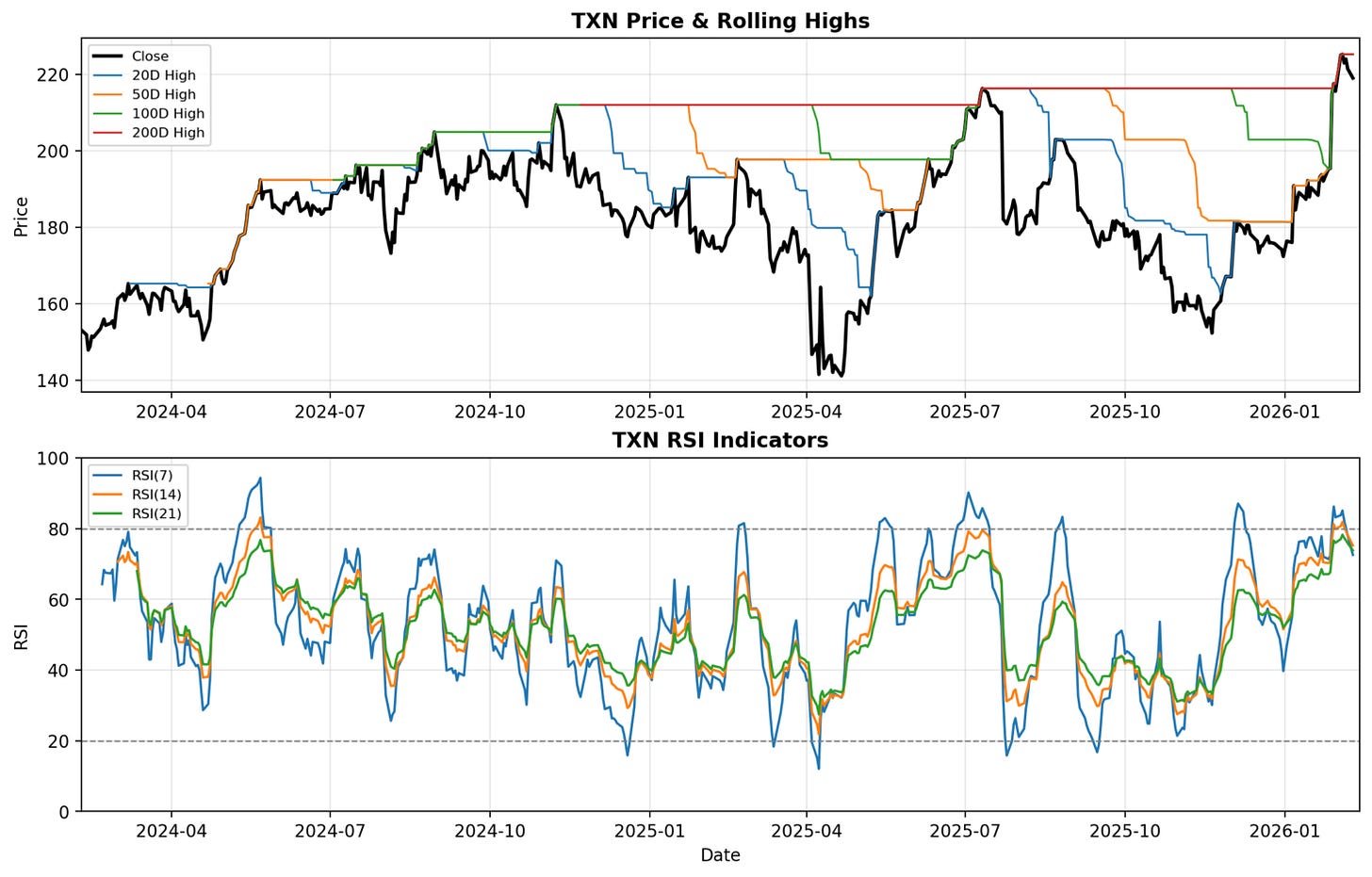

Technicals

TXN’s technical picture has turned bullish, albeit near-term overextended.

The stock recently broke out of a trading range on heavy volume after Q4 earnings. It jumped ~10% in one session to around $216[94], clearing prior resistance around $200–$205 (which now becomes support). Prices are now hovering just below the 52-week high[32] – essentially at levels last seen in mid-2022. All major moving averages are sloping upward: TXN is ~14% above its 20-day SMA, ~21% above its 50-day, and ~18% above its 200-day[95] – a sign of strong momentum, but also a potential indicator that the stock is overbought in the short run.

Indeed, the 14-day RSI is ~78, firmly above the typical overbought threshold of 70[36]. This suggests the stock may be due for some consolidation or a pullback to digest gains.

Moving average trends: The 200-day SMA is around $182 and rising[96], indicating the longer-term trend turned positive in recent months. The 50-day SMA around $179–$180 has crossed above the 200-day (a golden cross), which happened in late 2025 and is often seen as a bullish long-term confirmation. TXN held its 200-day support during the fall 2025 market dip (when it bottomed near $140 in October), and since then it’s been making higher lows.

Relative strength: TXN has outperformed the S&P 500 over the past quarter (up ~28% vs the market’s high single-digit gain) and is roughly in line with the Philadelphia Semiconductor Index (SOX) in the same period, albeit TXN’s move came in a burst post-earnings. The relative strength line vs SOXX ETF has ticked up, indicating TXN is starting to outperform broader semis, which aligns with rotation into cyclicals like analog as AI names took a breather. One technical watchpoint: volume on the breakout was significantly above average (nearly 3× normal daily volume on the earnings day), showing institution participation.

Key Drivers (Next 6–12 Months)

Several key drivers will determine TXN’s performance over the next year, bridging the gap between the current narrative and realized results:

Factory Utilization & Orders: Watch the book-to-bill and utilization rates. TXN’s upside case hinges on running its fabs hot. If order rates from industrial and auto customers remain strong or accelerate, TXN can ramp utilization of RFAB2 and start loading the new Sherman fab as it comes online. Higher utilization directly boosts gross margin by spreading fixed costs. Conversely, any slowdown in orders or build-up of TXN’s own inventory would signal lower utilization ahead. Utilization is effectively the heartbeat of TXN’s financial model now – it will decide if gross margins expand or stagnate. Investors should monitor TXN’s commentary on lead times and capacity usage.

Industrial Demand Stabilization: Evidence of a clean recovery in industrial electronics demand. Industrial is TXN’s largest end market (~40% of sales)[6], and it encompasses a broad range of sub-sectors (factory automation, aerospace/defense, energy, etc.). The key driver is that customers resume normal ordering patterns after the inventory correction. Metrics like PMI (purchasing manager indices) and capital expenditure trends in manufacturing will feed into TXN’s results. If we see sustained improvements – e.g. industrial sales growth turning clearly positive YoY and orders building – it confirms TXN’s core demand is back. A “restocking mini-cycle” in industrial could even provide a one-time volume boost. However, if industrial capital spending wavers (due to macro or geopolitical issues), TXN’s growth could be crimped. In short, industrial order inflection is a critical swing factor for the next 2–3 quarters.

Gross Margin Inflection: Monitoring TXN’s gross profit margin for upticks. As mentioned, TXN held ~57% GM at the trough[64]; the question is when and how fast this can climb. Key drivers here: improved fab loading (as above), and also product mix/pricing. TXN has been shipping a richer mix into auto and data center, which tend to have stable or higher ASPs. If gross margin ticks up above, say, 58–59% in upcoming quarters, it will be a clear signal that the capacity investments are yielding better unit economics. Gross margin is also a proxy for pricing discipline – if margins drop unexpectedly, it could mean TXN is having to discount to move product (or is underutilizing capacity). The market will likely reward even slight GM expansion given TXN’s huge investments. Look for commentary on how much 300mm is contributing to cost savings and any easing of underutilization charges.

AI/Data Center Contribution: Growth and visibility of the new data center segment. Now that TXN will report data center as an end market, investors can track its progress. It was 9% of 2025 sales[10]; will it be, say, 12–15% of 2026 sales? The AI server build-out is expected to continue robustly through 2026, so this is a potential upside lever for TXN’s growth rate. The content story is important: if TXN can embed more power management and analog content per AI system, data center could become a second “automotive” for TXN in terms of growth driver. Any disclosure like “data center revenue doubled year-over-year” or new design-win announcements in that space would be taken very positively. Conversely, since data center is new, it’s also lumpy – watch for any indications that this 70% growth was partly a one-time spike. But overall, AI-driven demand is a key driver to watch, as it could make TXN’s growth more secular and less tied to traditional cyclicals.

CapEx Trajectory & FCF: Updates to capital spending plans and resulting free cash flow. A major driver for the stock will be how quickly TXN’s capex falls from the ~$5B level toward a normalized level. The free cash flow margin (just 16.6% in 2025[34]) is expected to rebound – any evidence of that (e.g. 2026 FCF % guidance or actual improvement in quarterly FCF) will drive the narrative that “the capex bill is paid.”

Inventory and Lead Times: Channel inventory levels and TXN’s lead times. Over the next 6-12 months, one driver of sales will be how distributors and customers manage inventory. Right now, inventory days are high on TXN’s balance sheet (they built stock), and presumably lower at customers (after destocking). If customers start fearing tight supply again, they may place longer-dated orders or hold more inventory, effectively pulling in demand for TXN. Alternatively, if end demand is just modest, they might stay lean. TXN’s average lead times (the wait from order to delivery) give a clue: if lead times start extending, it means demand is outpacing current capacity and customers are queuing up – a bullish sign that often presages price increases or at least firm pricing. Conversely, if lead times stay short, it implies supply-demand is in balance. TXN’s webench and online store stats (if disclosed) or anecdotal industry reports can hint at this. In summary, any signs of industry tightness (rising lead times, low channel inventories, allocation of certain parts) would be a positive driver for TXN’s near-term sales and potentially margins.

In essence, the next year’s key drivers for TXN boil down to execution on meeting resurging demand and prudently managing its newfound capacity. Utilization, margins, and capex are the triad to watch internally; industrial/data center trends are the external validators.

Risks and Reversals

No investment thesis is bulletproof, and TXN’s has its share of risks that could thwart the “analog scarcity rent” story:

Demand Fragility & Inventory Swings: The foremost risk is that the anticipated demand recovery does not materialize as cleanly. If macroeconomic conditions deteriorate (e.g. a global industrial recession, geopolitical shock, etc.), TXN’s industrial customers could cut or delay orders again. Industrial and automotive are cyclical; a dip in auto sales or a slowdown in factory orders would hit TXN’s top line. Customer inventory dynamics could also swing negatively – for instance, if end demand disappoints in late 2026, distributors might suddenly find themselves with too much inventory (the opposite of 2024’s situation) and abruptly reduce orders to TXN. Such bullwhip effects are common in semis. The risk is TXN moves from an under-shipment environment (2024) to an over-shipment one in 2026 if customers overshoot, leading to another downturn. Essentially, TXN could be whipsawed by the cycle if the recovery is not as linear as hoped.

Overcapacity & Utilization Miss: TXN’s heavy capex program could misfire if it ends up oversupplying the analog market. The company’s bet is that long-term demand warrants much more capacity, but if they’re wrong by even a couple years, it could create a glut. Analog chips typically don’t have a quick “kill switch” on supply; fabs, once built, will run to absorb costs. If competitors (or TXN itself) flood certain product areas with inventory, pricing pressure could ensue. TXN might then be forced to discount to move volume, eroding the scarcity premium. Additionally, underutilized fabs carry high fixed costs – TXN could face margin dilution from depreciation on unneeded capacity. This is a classic risk for semiconductor manufacturers: build too much, margins collapse. Right now TXN insists they’ll calibrate capex, but if demand looks even mildly positive, there’s a temptation to keep building (especially with government incentives). The worst-case scenario would be TXN spending, say, $3–4B a year on new fabs only to see mid-single-digit revenue growth – ROIC would tank and investors would lose patience with the “build it and they will come” approach.

Execution & Yield Issues: Ramping new fabs is not trivial. TXN is bringing up multiple 300mm facilities (RFAB2 is ramping, Sherman fab 1 presumably in 2025/26). There’s risk around manufacturing yields and start-up costs – any hiccups (equipment delays, process node issues, staffing) could raise costs or delay cost benefits. TXN is also transferring some analog processes to 300mm; if certain products don’t transition smoothly, TXN might have to run older 200mm lines longer (inefficiently) or even face product quality/reliability issues. While TXN is experienced in fabs, these expansions are the largest in its history, so there’s non-zero execution risk. An example risk event would be: “Sherman fab output is below plan due to tool calibration problems” – this could mean TXN can’t meet some demand (losing sales) or has higher scrap rates (lower gross margin). So far TXN’s updates have been positive, but until new fabs reach volume production, there’s that operational risk.

Free Cash Flow/Capital Allocation Risk: TXN has essentially promised that all this capex will translate into greater free cash flow in the future. If that fails to happen on schedule, investor trust could erode quickly. For instance, if by late 2026 TXN’s FCF margin is still under 20% (well below historical ~30%+) and they guide another big capex year, the market may question management’s discipline.

Competitive Pressure: While TXN enjoys a strong position, competitors are not standing still. Analog Devices (ADI), Infineon, Microchip, NXP, STMicro, and numerous smaller players all compete in slices of TXN’s portfolio. ADI in particular, while fab-light, has very deep application expertise and customer relationships; it acquired Maxim Integrated in 2021 to broaden its catalog. One risk is that competitors decide to get more aggressive on pricing or inventory to gain share now that supply is more available. If, say, ADI or MCHP see TXN’s huge fab build as an opportunity, they might use foundries to temporarily oversupply certain products and steal market share, undermining TXN’s pricing. Additionally, Chinese analog firms (e.g. Will Semiconductor, HiSilicon) could target mature TXN products with low-cost alternatives, especially given China’s push for self-sufficiency. TXN has a vast catalog, but not every part is unassailable – some commodity analog (voltage regulators, simple op-amps) could face margin pressure if cheaper clones emerge and if geopolitical tensions encourage customers to dual-source away from U.S. suppliers.

Technology and Substitution Risk: There’s a risk that technological shifts reduce discrete analog content. For example, integration of analog functions into digital SoCs – companies like Apple or Tesla sometimes design custom ICs that pack in analog functionality, potentially displacing stand-alone TXN chips. If more system designers pursue mixed-signal SoCs (maybe using advanced nodes for certain analog-heavy chips), TXN could lose sockets. Similarly, new semiconductor materials (like GaN or SiC for power management) might alter the competitive landscape.

Conclusion

Texas Instruments is on the cusp of proving whether it’s truly a secular analog compounder or just a well-run cyclical in an upturn. At this juncture, the evidence tilts positive – TXN’s bold capacity build is aligning with what appears to be a definitive end to the analog down-cycle. The company’s Q1 outlook, strong industrial rebound, and expanding foothold in AI/data center suggest that the feared “capex overshoot” scenario is unlikely in the near term.

Instead, TXN looks poised to harvest the benefits of investments: we expect margins and free cash flow to improve markedly through 2026–2028, validating the long-duration moat thesis. TXN’s internal manufacturing and 300mm scale advantages should start manifesting as scarcity-driven market share gains (customers know TXN can supply reliably) and superior cost structure (supporting ~60% gross margins even as peers struggle at mid-50s). In a sense, TXN is creating its own luck – by spending in lean times, it can capitalize in the coming fat times. Texas Instruments is graduating into a new era where it can leverage a structurally stronger moat to compound earnings – but it must execute and there’s little room for complacency.