If you read ADFM’s May investor letter, you’ll see that I’m betting against China. Even though Chinese equities are doing well this year, my short book there has generated strong returns overall. On Friday, I closed my Alibaba BABA 0.00%↑ short and rolled the proceeds into two speculative eVTOL companies that currently have zero revenue: Archer Aviation ACHR 0.00%↑ and Joby Aviation JOBY 0.00%↑ .

Coming from a real estate background, I’ve always anchored my investment process in the three fundamental financial statements. These positions, frankly, run counter to that entire discipline. But adopting Soros’ reflexivity framework - and forcing myself to keep an open mind - has been transformative. As Steve Cohen says, “math is not an edge.” In markets driven by narrative, sentiment, and regime shifts, fundamentals can miss the point entirely. Sometimes, the edge is in seeing where the story might outrun the spreadsheet. I believe the market is set to trend higher in the second half of 2025 and into 2026, so it made sense to add some speculative exposure as I increase the fund’s net exposure.

I know very little about the eVTOL space, and as I dig in, I want to write about these companies to bring some structure to my thesis. As of Saturday, June 14, 2025, all I see is hype, decent-looking charts, and some cool renderings. This is my starting point.

Why These Two, Why Now

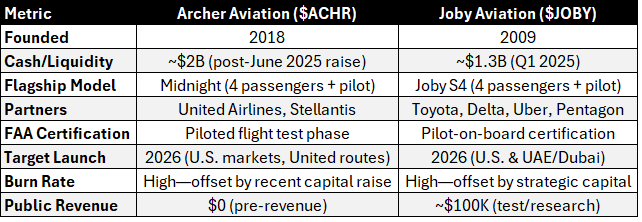

Archer Aviation and Joby Aviation are the two U.S.-listed frontrunners in the emerging electric vertical takeoff and landing (eVTOL) air taxi sector - a space aiming to reshape short-distance urban mobility with battery-powered aircraft that promise to bypass ground congestion. Both companies are pre-revenue, heavily venture-backed, and trading on future expectations rather than proven commercial viability.

Archer, headquartered in California, is developing its “Midnight” aircraft with ambitions to launch urban air taxi services in partnership with United Airlines, with an initial focus on routes like Manhattan to JFK. The company is backed by high-profile investors and recently raised $850 million, boosting its liquidity to around $2 billion, which is critical as it burns through capital to achieve FAA certification and commercial deployment.

Joby, also based in California, is arguably the best-capitalized and most technically advanced of the group, with approximately $1.3 billion in liquidity and a strong record of progress in certification. Its ecosystem includes major partners such as Toyota and Delta, and it has made early inroads with the Pentagon and through the acquisition of Uber Elevate. Joby’s near-term goal is to secure full FAA certification and begin piloted commercial flights in select markets, both in the U.S. and internationally (notably in the UAE), with a target of 2026 for scaled operations.

Both companies are pre-revenue and hemorrhaging cash, and both are positioning themselves as first-movers in a market that doesn’t exist yet - urban air taxis are a promise. They trade almost entirely on future optionality and the idea that, once certified and operational, the winner(s) could enjoy a network-effect moat akin to early Uber or Tesla. For now, what Archer and Joby offer investors is exposure to a potential category killer: a multi-decade secular growth story with all the classic risks of hardware, regulation, and hype-cycle volatility. Whether you buy in or not, you can’t ignore the fact that these are lottery tickets on a vision that, if it lands, will look obvious in hindsight - and, if it doesn’t, will get marked down as another “future-of-mobility” flameout.

Why the Hype?

The recent surge in Archer and Joby shares is the product of a perfect storm of policy catalysts, and momentum-driven capital. Both companies have seen their market caps swing wildly on headlines alone - most recently, President Trump’s executive order in early June, which explicitly prioritized the domestic eVTOL and drone sector, drove a 20–25% rally in both stocks almost overnight. Archer followed that with an $850 million capital raise that immediately extended its liquidity runway to nearly $2 billion, even as the resulting dilution shaved 15% off its stock in a single session. Meanwhile, Joby, already sitting on $1.3 billion in liquidity thanks to long-term strategic partners like Toyota and Delta, has captured a steady stream of bullish press coverage after hitting key certification milestones - including the high-credibility “pilot-on-board” phase with the FAA.

Both names have become darlings of the retail crowd, in part because their price action and “story stock” narrative are perfectly aligned: the charts have shown steep, media-fueled uptrends that attract even more attention every time there’s a government tailwind, a viral test flight video, or a new partnership announcement.

The result is a reflexive feedback loop - speculative capital chases momentum, financial media amplifies every catalyst, and the hype cycle intensifies. If this feels familiar, it should. The eVTOL sector’s speculative boom echoes the SPAC wave of 2020–21, when dozens of pre-revenue “next big thing” companies - whether flying taxis, EVs, or space tech - rushed to market with billion-dollar promises. Most have since faded into irrelevance, but Archer and Joby have emerged as the clear survivors, benefiting from both institutional capital and headline dominance. Still, the fundamentals are unproven, the sector is littered with failed dreams, and the only thing keeping the story alive for now is a cycle of fundraising, regulation-driven headlines, and speculative money crowding the trade.

What’s Real, What’s Risk?

Business Models: Route Economics, Partners, and the Elusive Revenue Plan

At the core, both Archer and Joby are selling a vision: short-hop, on-demand urban air travel, priced at a premium to ground rideshare but positioned to be affordable for business travelers and upper-middle class commuters. The “killer app” is not mass-market commuting but specific high-traffic city pairs - JFK to Manhattan, LAX to Santa Monica, SFO to Silicon Valley. In theory, United and Delta are committed launch customers: United has pre-ordered up to 200 Archer Midnights; Delta is working with Joby on integrating air taxis into its airport ground game. But these partnerships, while headline-grabbing, don’t guarantee demand or recurring revenue. The business model assumes airport authorities, regulators, and infrastructure players will buy in quickly enough to support launch, and that consumers will pay a premium for 10 - 20 minute hops versus cheaper, if slower, alternatives. Until the first city launches with paying customers, the entire revenue story is hypothetical.

Balance Sheet: Cash Burn and Dilution

Neither company generates real revenue. Archer is running an annualized cash burn north of $400 million; Joby is in the same league, though a bit lower given its longer runway and more methodical scaling. Archer’s $850 million raise was a necessity; it pushed liquidity to ~$2 billion, but at the cost of a sharp dilution hit that the market promptly punished. Joby, sitting on $1.3 billion as of Q1 2025, claims it has enough cash to reach commercial operations by 2026, but this assumes no major certification delays or cost overruns. For both, the recurring worry is dilution - any material delay in FAA sign-off or capex blowout could force another raise at far less favorable terms. Until there’s real revenue, cash management is existential. If this sector hits a risk-off period or the funding window closes, these “future of mobility” bets can unwind fast.

Regulatory Gauntlet: FAA and Beyond

Certification is the single biggest gating factor. The FAA process for eVTOLs is unprecedented; regulators are building the playbook as they go, and the certification bar for aircraft carrying commercial passengers is orders of magnitude higher than anything the drone industry has faced. Archer has begun piloted test flights, a key milestone, but still faces a long checklist before commercial launch; Joby is further along, having entered the “pilot-on-board” phase with the FAA. Both target U.S. commercial operations by 2026, but any slip in the regulatory timeline. There’s no reason to assume a straight path. International expansion adds further complexity: Joby has made early moves in the UAE, where regulatory timelines are faster, but global commercial viability remains an open question.

Tech Differentiation: Execution and Moats

On paper, both companies tout unique advantages. Archer leans into aggressive commercialization, leveraging United’s network and a “build fast, scale fast” Silicon Valley ethos. Joby’s edge is technical depth—over a decade of R&D, a library of IP, and partnerships with manufacturing titans like Toyota. Joby also has more logged test flight hours and a longer safety and operational record, which could matter when regulators and insurance markets make final calls. Still, from an outsider’s view, there is little evidence that either has a defensible, Tesla-like technical moat; execution - speed, capital discipline, and regulatory finesse - will likely determine who survives the hype cycle. Safety, reliability, and fleet utilization will decide who gets repeat business once the first aircraft are flying routes for paying passengers.

Investment Case: Bull vs. Bear

Bull Case

If air taxis work at scale, we’re looking at a transportation market that could easily rival regional airline travel in TAM. McKinsey and Morgan Stanley have thrown out market size estimates ranging from $500 billion to over $1 trillion by 2040 - a ludicrous figure if you’re a skeptic, but even a fraction would be transformative. Archer and Joby are positioned as clear first-movers: they have real cash, credible partners (United, Delta, Toyota), and now, thanks to U.S. government support, a regulatory environment that is at least directionally aligned with their interests. The winner could benefit from enormous network effects and brand equity, the way Tesla did in EVs, Uber in rideshare, or SpaceX in commercial launch. Execution: getting through certification, launching the first profitable routes, and proving utilization is everything, but if either company pulls it off, the upside is asymmetric.

Bear Case

The bear case is obvious. Delays are almost a given in aerospace, especially with unproven tech, new regulatory categories, and major infrastructure hurdles. The path to profitability is a black box: every forecast right now is based on optimistic utilization, premium pricing, and regulatory green lights. The sector is burning hundreds of millions per year just to get to first revenue. Any slip, be it a technical setback, a regulatory “pause,” or a funding drought, could mean another round of highly dilutive capital raising, which would crater the equity. Infrastructure and local permitting, not just airworthiness, could become choke points. And as we saw with SPACs, retail money and narrative-driven flows can dry up as quickly as they arrived; the hype cycle cuts both ways. If public appetite or risk capital fades before these companies get to cash flow breakeven, the sector could see a massive shakeout.

My Current Stance

This is not a core, multi-year compounder bet for me. These are contained, high-volatility positions, sized accordingly. The upside is real: if even one of these companies achieves commercial scale and captures first-mover economics, the returns could be spectacular. But I’m not pretending I know how this market looks in five years. For now, the risk/reward justifies a small, speculative position, especially in a macro environment that still rewards innovation and “next big thing” optimism. I’m treating these as high-beta trades with optionality, not as permanent portfolio fixtures.

What Would Change My Mind?

There are clear red and green lights that will determine whether I scale up, hold, or exit:

Green Lights:

FAA certification with minimal delay - especially if either company leapfrogs competitors.

Real revenue. Signed, paying contracts for commercial flights, not just “MOUs” or PR deals.

Sustained partnerships. United, Delta, Toyota actually deploying capital and operational support, not just names on a slide.

Evidence of demand. Full test routes, high utilization, repeat customers, and clear pricing power.

Red Lights:

Major technical blowups - accidents, public safety incidents, or critical failures in test programs.

Regulatory setbacks. FAA or international regulators slow-walking or changing the rules midstream.

Management turnover or “founder departure” signals.

Additional highly dilutive capital raises before a clear revenue path is visible.

Loss of key partnerships or breakdowns in airport/city infrastructure relationships.

If the green lights stack up, I’ll consider increasing exposure, if the red lights start flashing, I’ll cut or exit.

Very unique space! Thanks for the writeup