Inflection Point: The Fed’s First Cut of 2025

The first U.S. rate cut since Donald Trump returned to the presidency

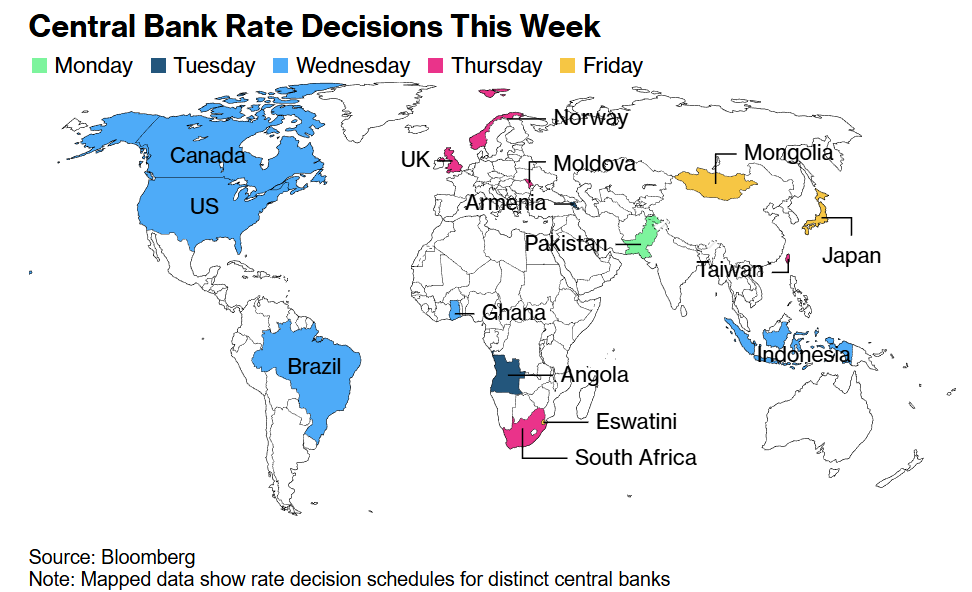

Since Friday’s market close, I’ve been focused on the upcoming FOMC and the series of September central bank meetings where policymakers will weigh the health of their economies and decide whether to ease or tighten monetary conditions.

The first U.S. rate cut since Donald Trump returned to the presidency is set to dominate headlines, anchoring a week that could reset policy for half of the world’s ten most-traded currencies.

The sequence begins with the Bank of Canada, followed by the Federal Reserve on Wednesday, then the Bank of England on Thursday, and concludes with the Bank of Japan. Each central bank faces a choice: adjust borrowing costs, signal intentions for the final quarter of the year, or attempt to do both.

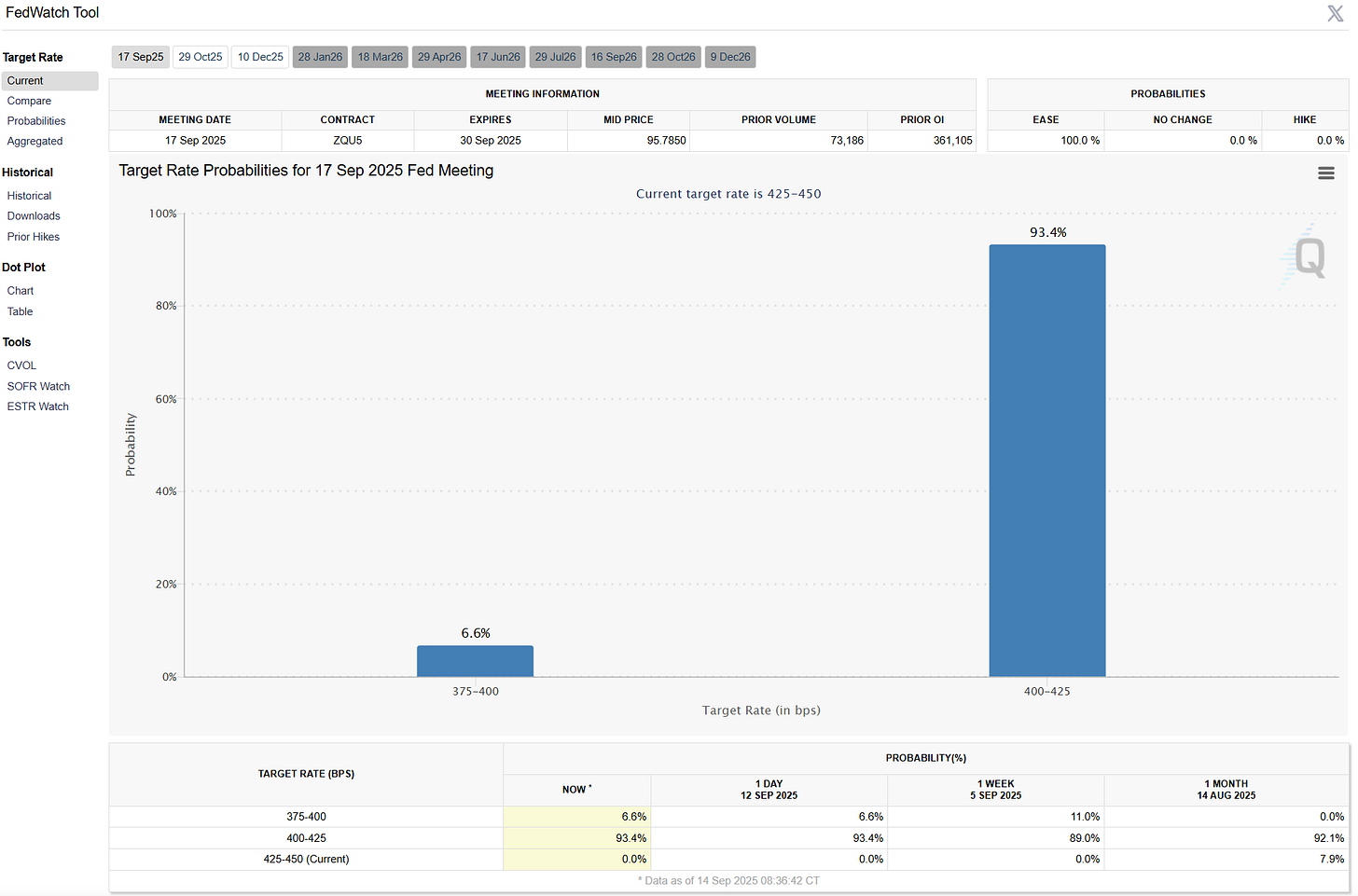

I want the Fed to cut rates by 50-basis points, but most likely they will cut 25-basis points. Why? Because, since 2009 the Fed followed the market expectations and did not deviate once from consensus.

Who am I to opine on central bank policies, but since June 2025 I’ve been making the case for rate cuts. We are at an inflection point. I’ll lay out my reasoning below and touch on ways to position for a shift in the global central bank regime. Because when it comes, it won’t just be the Fed, it will be a coordinated reset across markets.

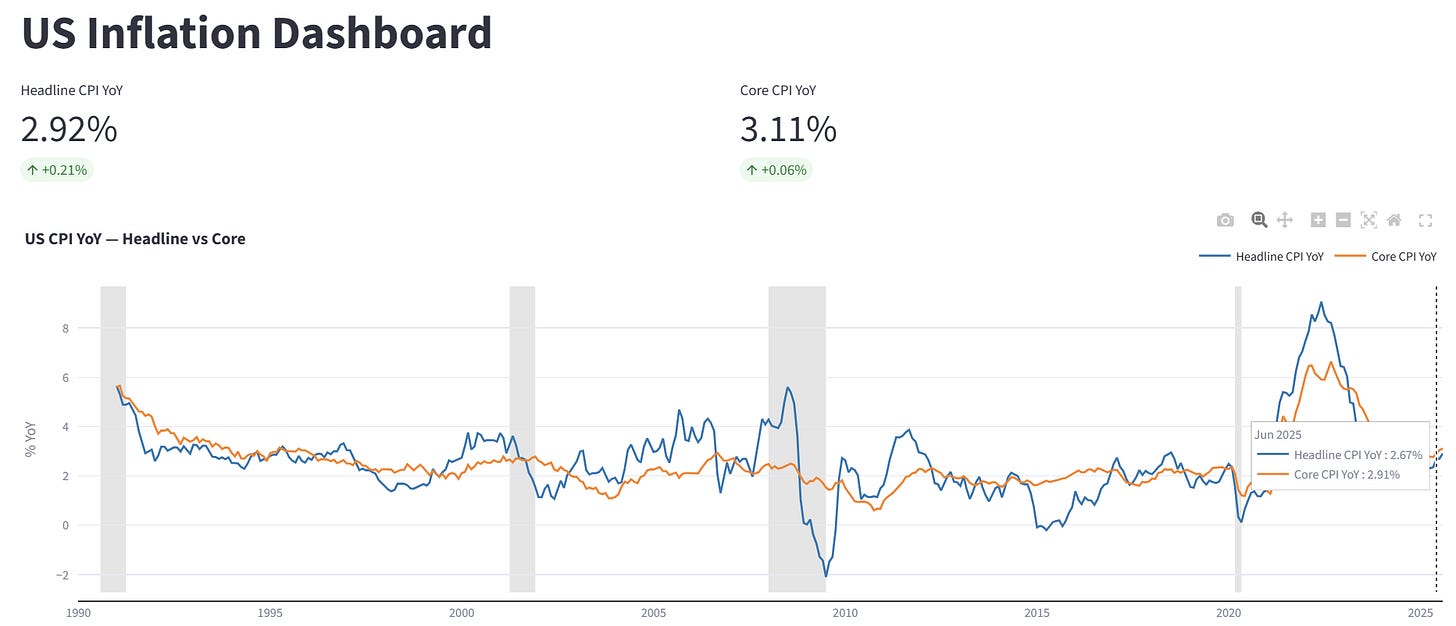

Inflation coming down significantly

One can argue that inflation is stuck around 3.00% and that the Fed’s 2.00% target is both unmet and unlikely to be achieved over the next three years. That’s a fair observation. But I would push back and ask: WHERE WERE YOU when the Fed spent more than a decade failing to get inflation up to 2.00%? Back then, WERE YOU ADVOCATING for negative Fed Funds rates? WERE YOU CALLING for even more aggressive quantitative easing?

Trends take years to entrench, and this current 3.00% plateau is not purely a structural “sticky inflation” story. In my opinion, it’s partly the byproduct of a restrictive policy stance. A Fed Funds rate above 5% has created a risk-free alternative yielding 4.00%+ in money market funds. That’s over $7 trillion sitting in these vehicles, allowing wealthy households to finance consumption while taking virtually no risk. In other words, high policy rates themselves are sustaining the persistence of 3.00% inflation.

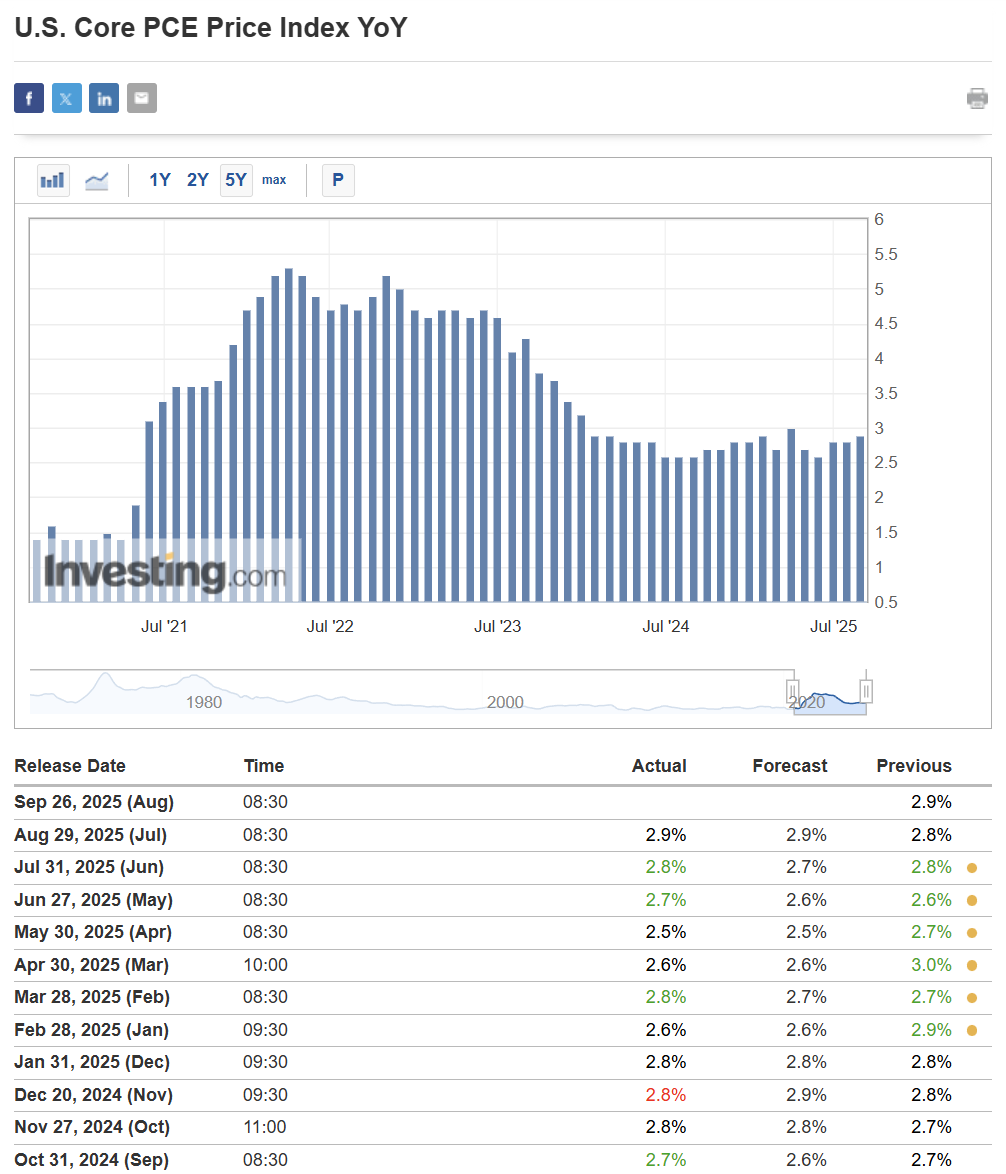

Since April 2025, inflation has eased meaningfully on a year-over-year basis, supporting the case that price pressures are cooling. Core PCE inflation stood at +2.5% YoY in April, ticked up slightly to +2.7% in May, then +2.8% in June, and +2.9% in July and August, according to BEA data. At the same time, CPI data from the BLS shows core CPI at roughly +2.8% YoY in April, edging higher to +2.9% in June, and holding at +3.1% in both July and August. The fact that headline inflation has only inched higher despite tariffs and volatile energy swings underscores the argument: inflation is no longer accelerating materially, it is settling into a narrow 2.5–3.0% band. This stability, after years of much higher volatility, suggests disinflation has already done much of the heavy lifting, and with growth visibly slowing, the Fed has room to begin easing without risking an inflation re-acceleration.

Growth slowing / weakening demand

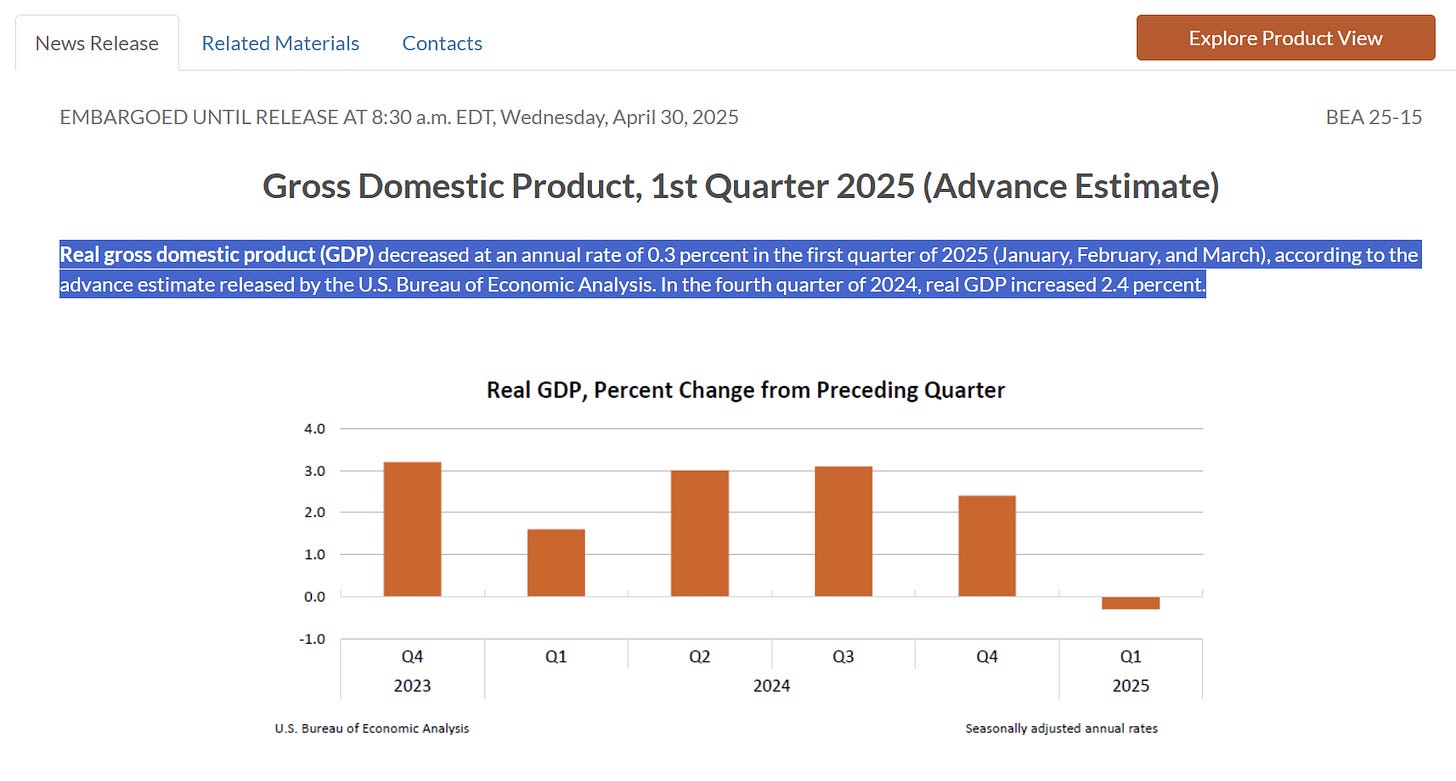

You can make the argument that the economy is strong, and getting hot via anecdotal evidences. You know what US Bureau of Economic Analysis says? “Real gross domestic product (GDP) decreased at an annual rate of 0.3 percent in the first quarter of 2025 (January, February, and March), according to the advance estimate released by the U.S. Bureau of Economic Analysis. In the fourth quarter of 2024, real GDP increased 2.4 percent.”

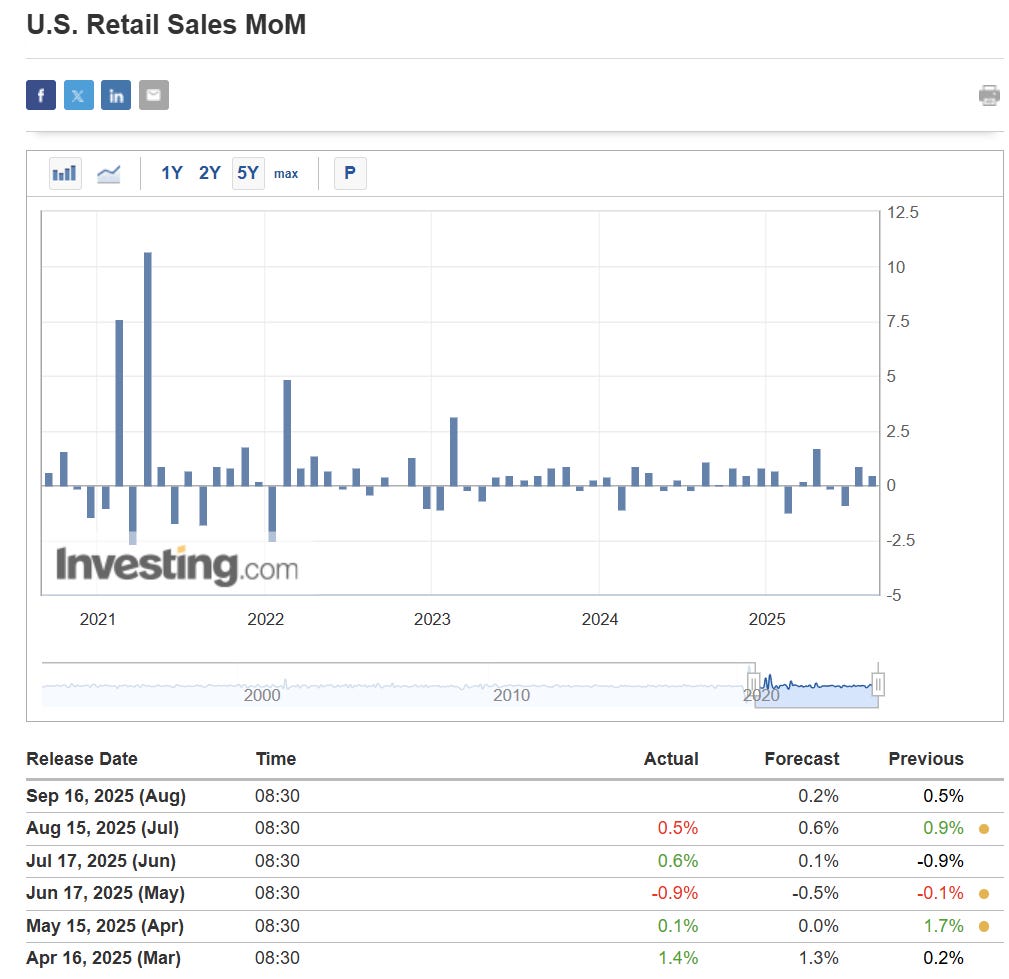

Moreover, U.S. Retail Sales have been weak since March 2025. Retail sales growth has decelerated: in April 2025, retail sales barely rose (~0.1%) from March, a stark drop from 1.7% in March. Subsequent months show modest gains: +0.5-0.7% MoM in June & July 2025. In real (inflation-adjusted) terms, retail sales are growing mildly; ~1.15% YoY by July 2025.

Look at what the Federal Reserve Bank of Philadelphia says - don’t listen to me I am 30 years old and studied civil engineering in college, I haven’t taken a single course in economics as an undergraduate.

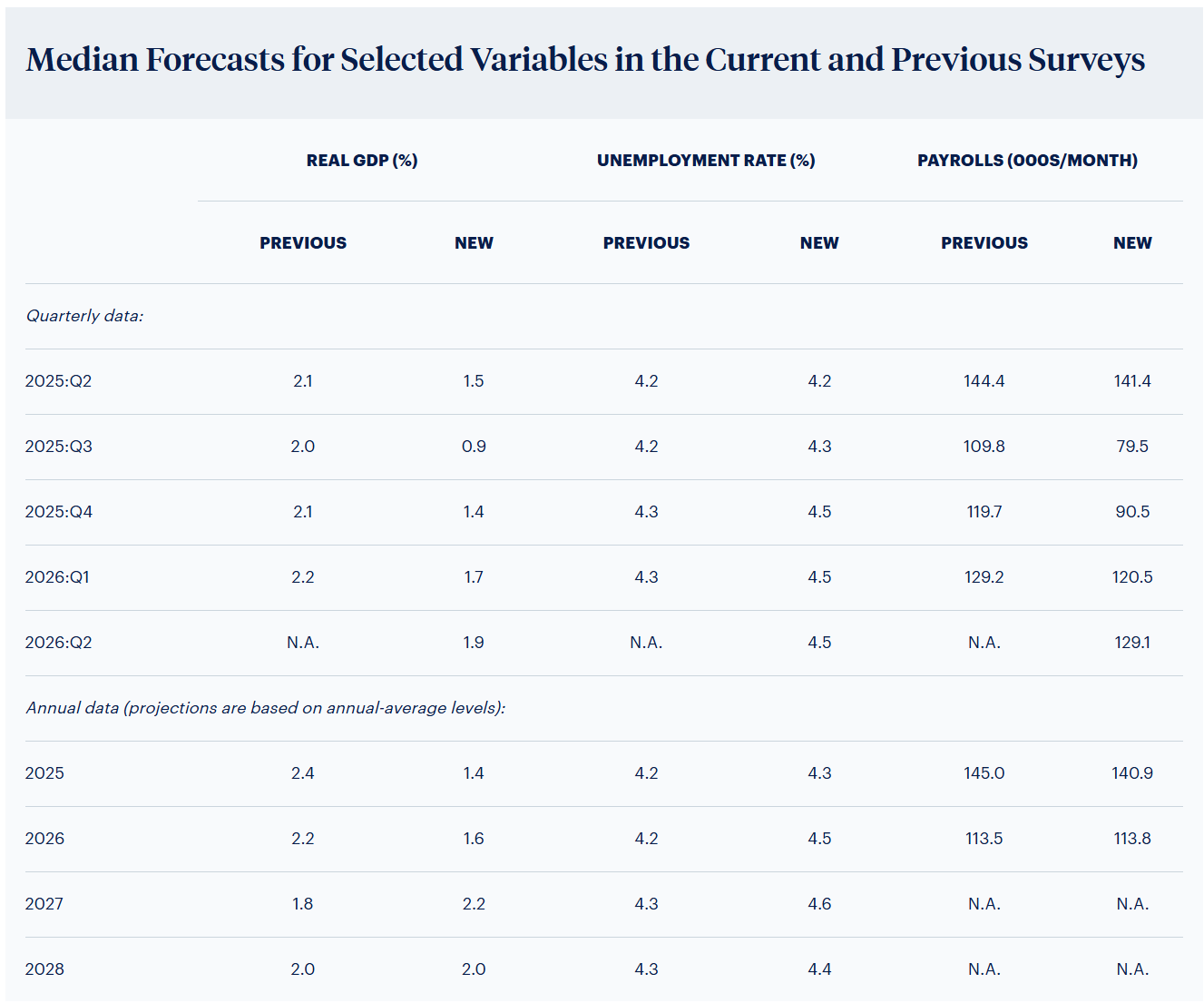

The outlook for the U.S. economy looks dimmer now than it did three months ago, according to 36 forecasters surveyed by the Federal Reserve Bank of Philadelphia.

Median forecasts for the US don’t seem great, and keep in mind this analysis is from May 2025 where the unemployment rate % forecasts are stable. We are seeing a weakening labor force that is accelerating.

Tariffs, trade disruption & external shocks

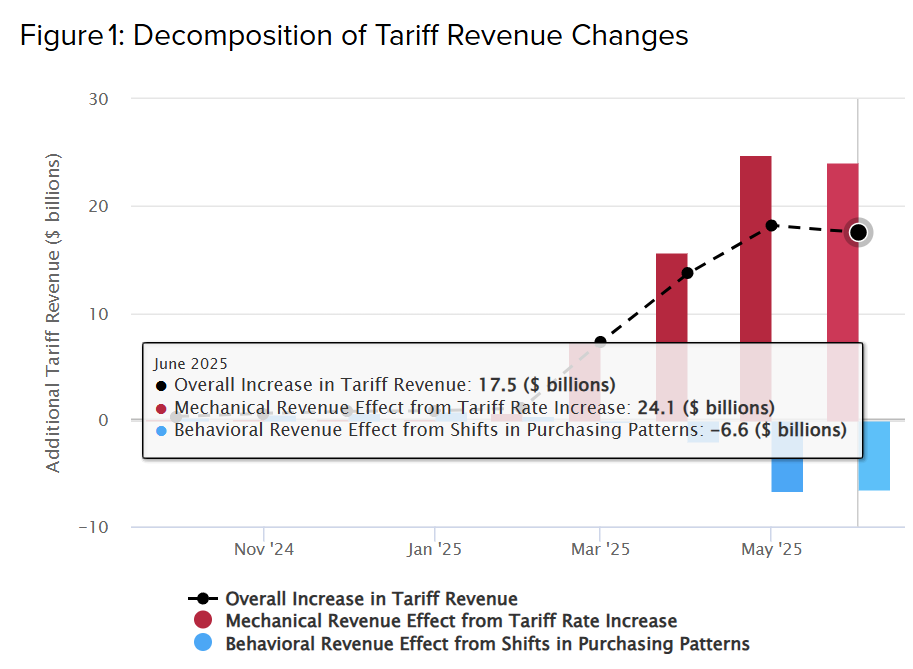

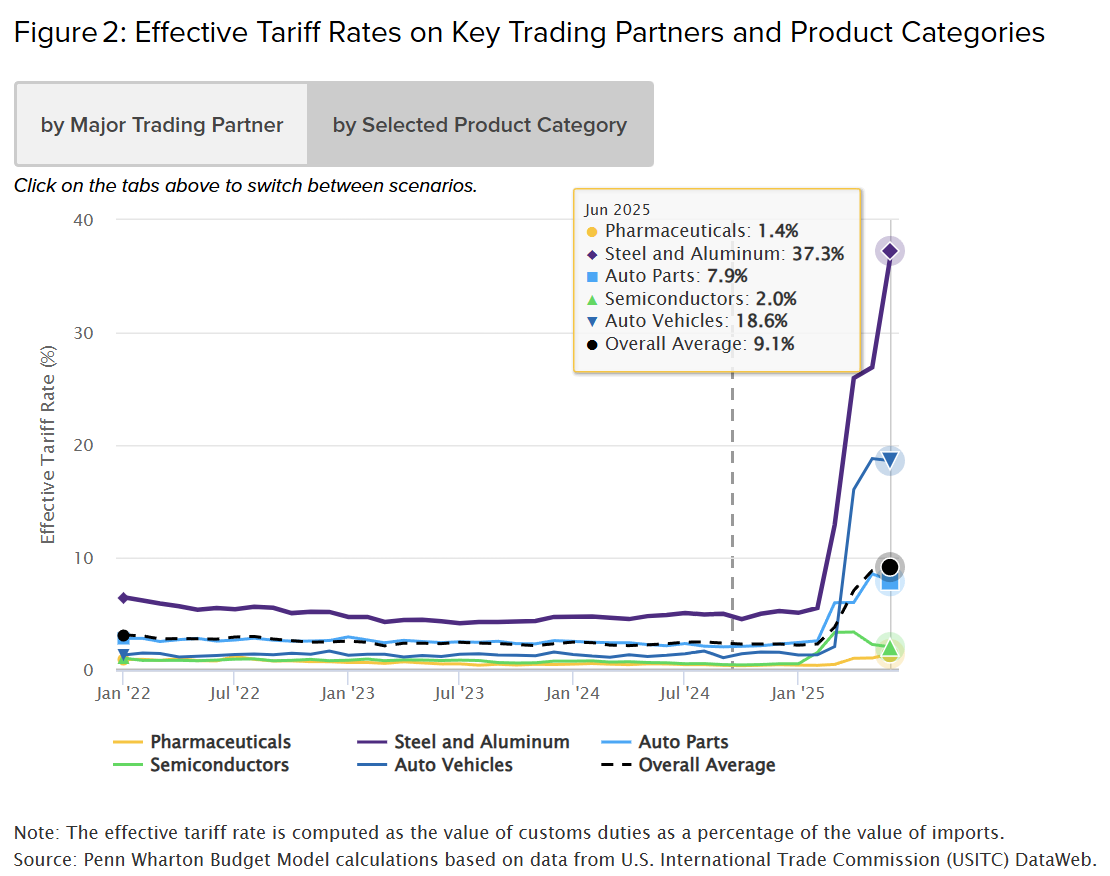

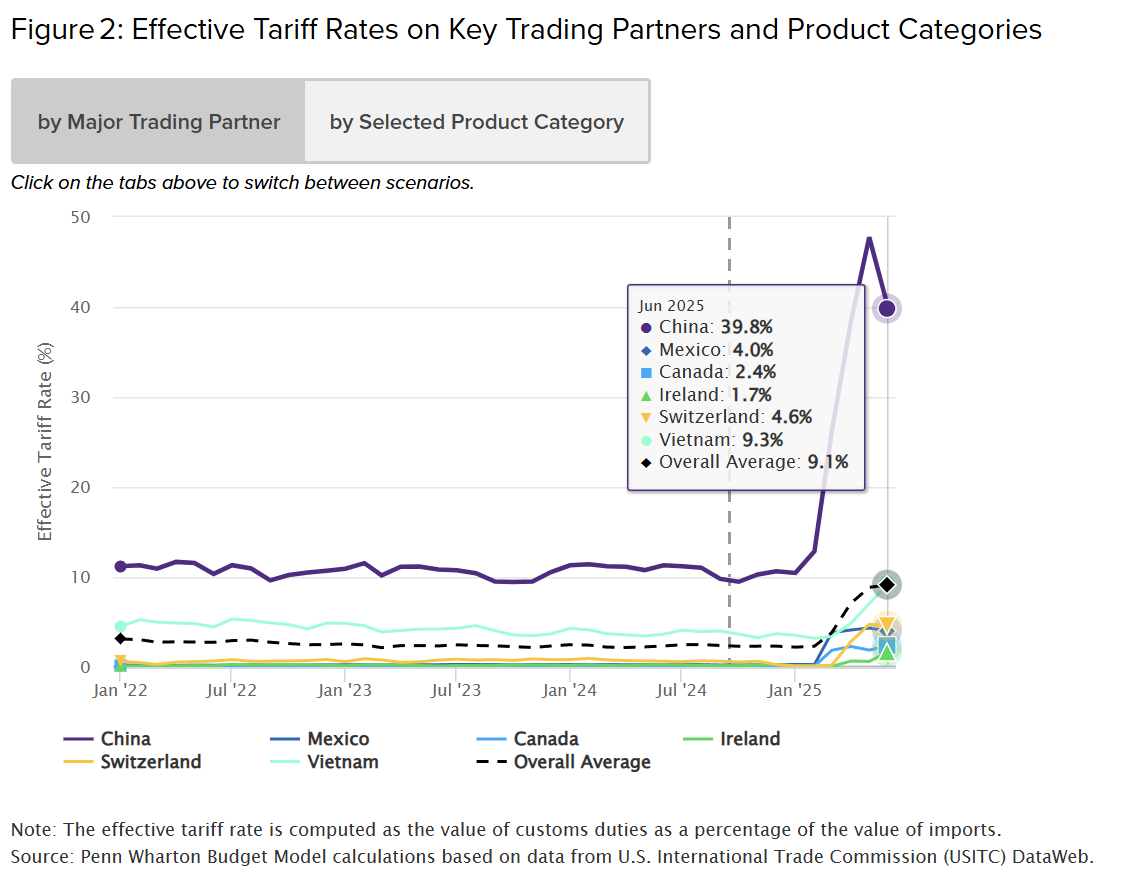

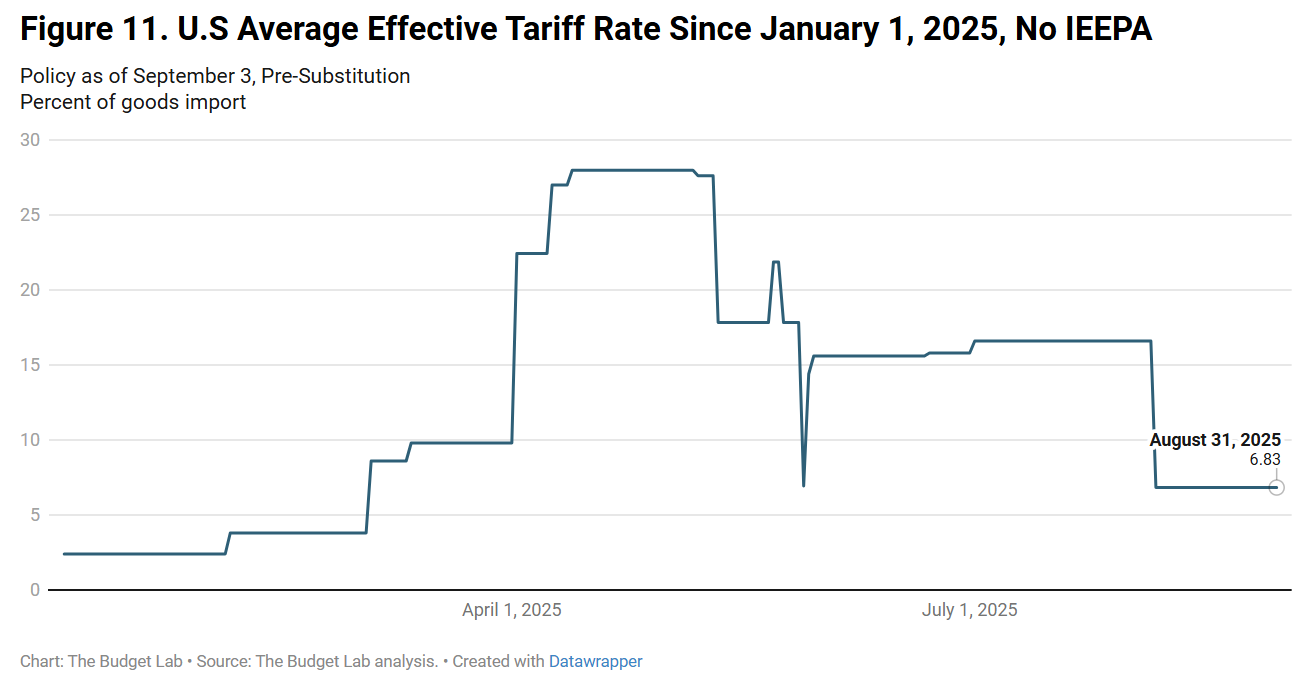

While the April 2, 2025 “Liberation Day” reciprocal tariff regime raised theoretical risks of inflation, in practice its inflationary blow has been far more muted than early commentators assumed. The effective U.S. tariff rate has risen sharply—from ~2-3% in 2024 to around 15-17% by mid-2025, driven by sweeping reciprocal tariffs and product-specific levies.

For many G7 trading partners, negotiated deals have reduced applicable rates (e.g. the U.S.–EU deal with most goods at ~15%) or excluded key categories, meaning the “headline” reciprocal rates overstate the inflation pressure in consumer baskets.

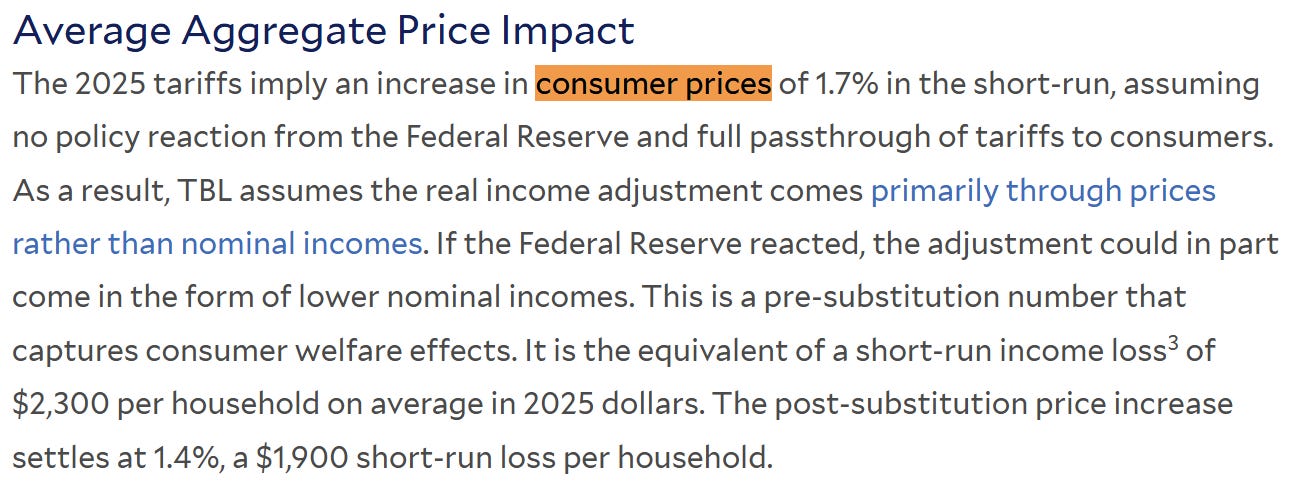

Moreover, modeling by the Yale Budget Lab suggests that all 2025 tariffs (including retaliation to date) raise consumer price levels by ~1.7% in the short-run (if fully passed through), which is meaningful but far from runaway inflation.

Historical precedent also tempers alarm. In the 2018-19 U.S.–China tariff war, studies estimate the direct contribution of tariffs to core PCE inflation was only 0.1-0.3% under most scenarios.

The steep “Smoot-Hawley” era (1930s) is a cautionary tale, because economists correlate tariffs to the Great Depression. I call that BS. When tariffs were massive and global retaliation widespread, global trade collapsed, but modern trade networks, supply chains, and import substitution reduce that risk today.

It is important to note that, OECD reports by mid-August 2025, the effective U.S. tariff rate is the highest since the 1930s, but also that many goods facing higher duties are non-core or have exemptions.

Central Banks in Rest of the World

It is important to note that the U.S. is not battling inflation in isolation; central banks across Europe, Canada, and Asia are wrestling with the same pressures of sticky services costs, wage growth, and residual supply distortions.

The Bank of England, the ECB, and the Bank of Japan all face credibility questions similar to the Fed’s, as their inflation targets remain elusive.

But there is a reflexive element here: once the U.S. convincingly “kills” the inflation story, global sentiment will follow. I believe inflation expectations are not built country by country, they are anchored by the Federal Reserve.

The Fed is the only central bank with true global reach, and history shows that when the Fed shifts decisively, the rest of the world falls into line. That reflexivity means the moment the U.S. steps off inflation-watch and onto easing, markets will quickly stop punishing other central banks for being behind, and the global policy narrative will reset in unison.

Preventing or mitigating stagflation

What if I’m wrong, and rate cuts reignite inflation instead of cushioning growth? That risk is real.

But remember: I didn’t even mention the arsenal of tools the Fed can deploy beyond the funds rate. The Fed has phenomenal power to crush demand if it wants to.

Open-mouth operations (forward guidance) alone can reset market expectations in hours. Quantitative tightening can be accelerated, draining liquidity at scale. Balance sheet composition can be adjusted; for example, selling MBS aggressively to hit housing directly. The standing repo facility and reverse repo facility can tighten collateral and funding conditions almost instantly. The Fed can also use countercyclical capital buffers and supervisory guidance to rein in credit creation at the banking level. And if it truly wanted to deliver a knockout punch, a couple of 75bp hikes layered with hawkish guidance could do it in one or two meetings.

My point is: if inflation flares, the Fed has overwhelming tools to kill it. The only reason they haven’t been used with maximum force is because the Fed has been managing trade-offs, but the ability is there. Paul Adolph Volcker Jr. did it, and there will be a Fed chairman who has the guts to do it too - if needed.

What is the trade?

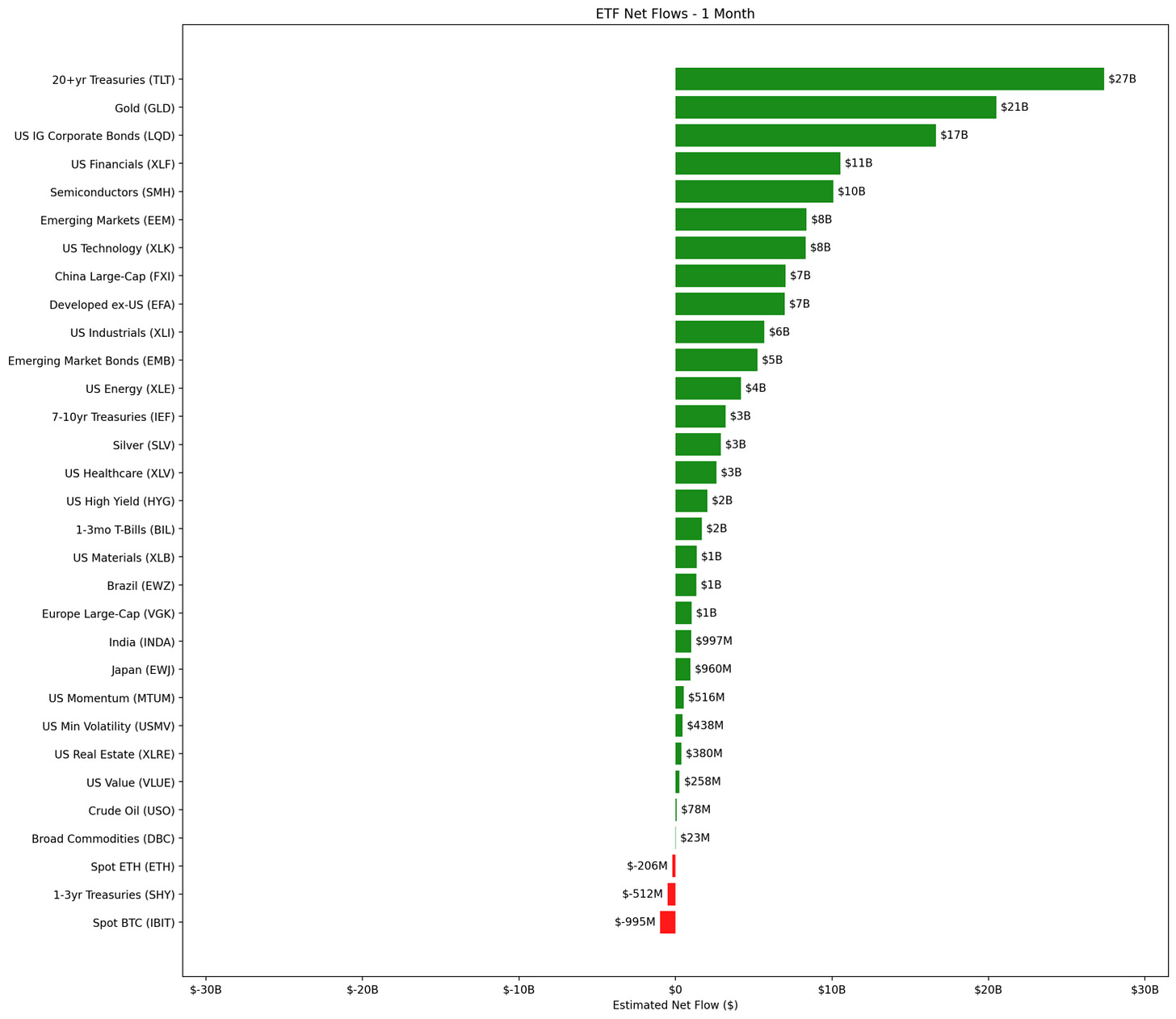

What do you see in the table below? The market is not stupid, and when a big wave is coming - market participants often see where to park their capital. I see big purchases in TLT 0.00%↑, GLD 0.00%↑, LQD 0.00%↑, and XLF 0.00%↑ / SMH 0.00%↑.

Investors are confident that the long end of the US treasury curve will stay tame despite what fearmongering economists say - I agree with this take. Gold is an obvious hedge, but I think that theme is tired. US IG corporate bonds make sense to me, since they are extremely high quality yielding strong coupons with a mark-to-market higher opportunity as FF rates drop.

In the equity land, you buy US financials and technology (semiconductors in this case). I would’ve come to the same conclusions had I done the work but a quick glance at what the market participants are doing, and you get the picture. The market is positioned right for the regime shift.

Final note: I believe, Jerome Powell is an American hero and a legend. He’s the best Fed chairman since Volcker.

Thanks, excellent breakdown, the track record sure speaks for Jerome